Credit Suisse Investment Banking Pitch Book

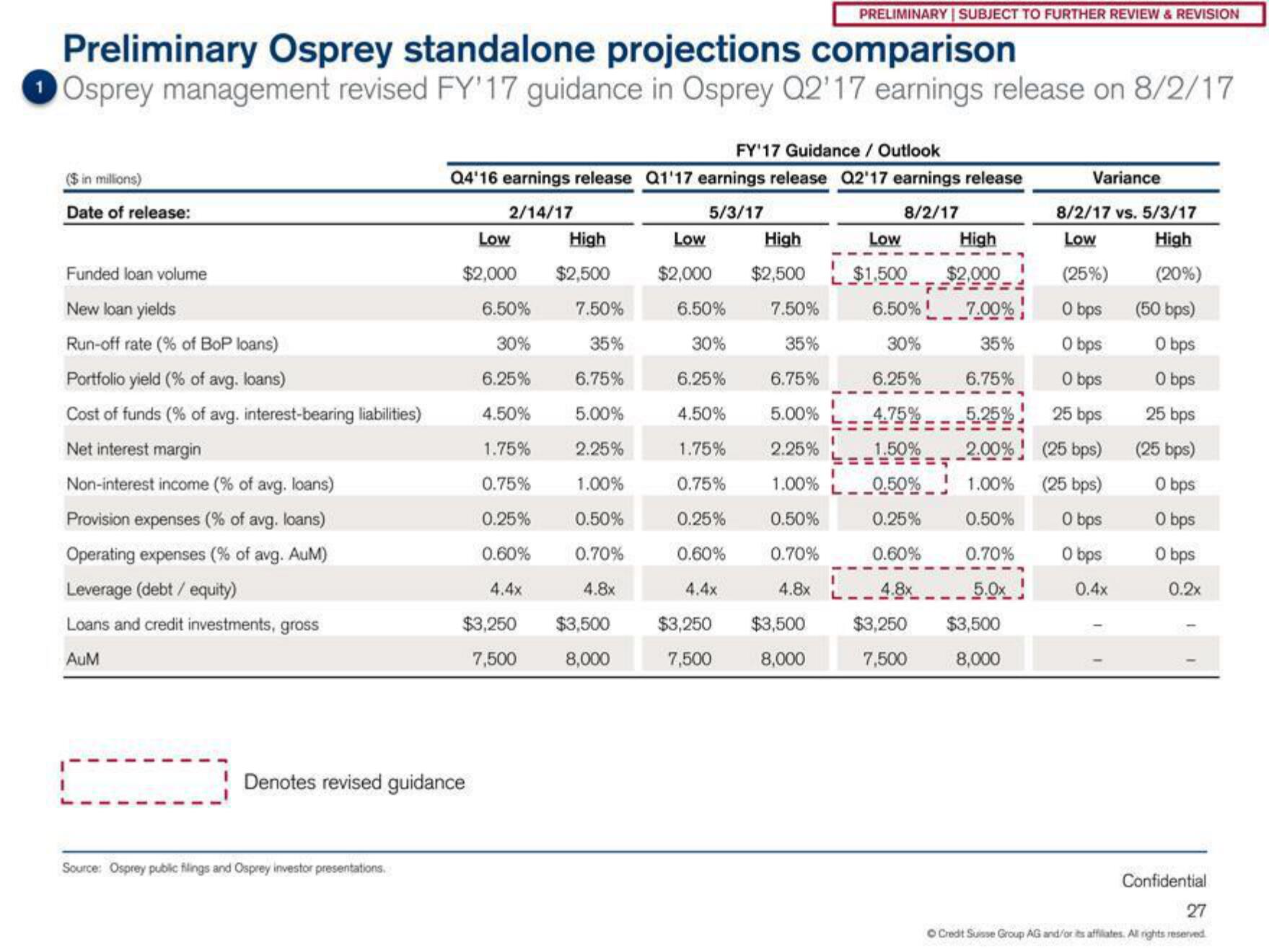

Preliminary Osprey standalone projections comparison

Osprey management revised FY'17 guidance in Osprey Q2'17 earnings release on 8/2/17

($ in millions)

Date of release:

Funded loan volume

New loan yields

Run-off rate (% of BoP loans)

Portfolio yield (% of avg. loans)

Cost of funds (% of avg. interest-bearing liabilities)

Net interest margin

Non-interest income (% of avg. loans)

Provision expenses (% of avg. loans)

Operating expenses (% of avg. AuM)

Leverage (debt / equity)

Loans and credit investments, gross

AUM

Source: Osprey public filings and Osprey investor presentations.

FY'17 Guidance / Outlook

Q4'16 earnings release Q1'17 earnings release Q2'17 earnings release

2/14/17

5/3/17

8/2/17

Low

$2,000

Denotes revised guidance

6.50%

30%

6.25%

4.50%

1.75%

0.75%

0.25%

0.60%

4.4x

$3,250

7,500

Low

High

$2,500 $2,000

7.50%

6.50%

35%

30%

6.75%

6.25%

5.00%

4.50%

2.25%

1.75%

1.00%

0.75%

0.50%

0.25%

0.70%

0.60%

4.8x

4.4x

$3,250 $3,500

7,500

8,000

PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

$3,500

8,000

High

$2,500

7.50%

35%

6.75%

5.00%

2.25%

1.00%

L__0.50%

0.50%

0.25%

0.70%

0.60%

4.8× L-4.8x_

1

Low

High

$1,500 $2,000

6.50%!

7.00%

30%

35%

6.25% 6.75%

4.75%

5.25%

1.50%

2.00%

1.00%

0.50%

0.70%

5.0x

$3,250 $3,500

7,500

8,000

F

Variance

8/2/17 vs. 5/3/17

Low

High

(25%)

0 bps

0 bps

0 bps

25 bps

(25 bps)

(25 bps)

0 bps

0 bps

0.4x

(20%)

(50 bps)

0 bps

0 bps

25 bps

(25 bps)

0 bps

0 bps

0 bps

0.2x

Confidential

27

Ⓒ Credit Suisse Group AG and/or its affiliates. All rights reserved.View entire presentation