Pershing Square Activist Presentation Deck

III. Pershing's Proposal to McDonald's:

McOpCo IPO

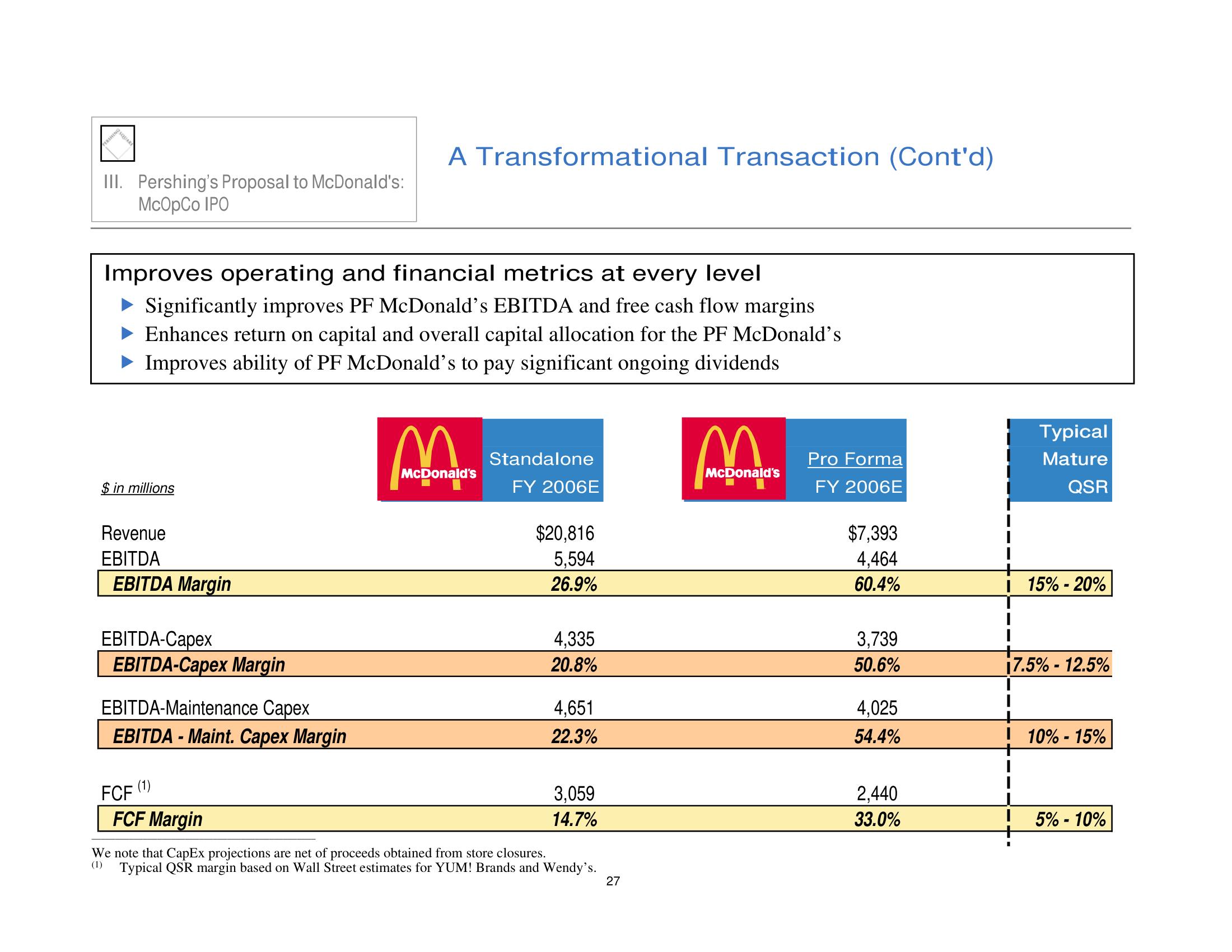

Improves operating and financial metrics at every level

Significantly improves PF McDonald's EBITDA and free cash flow margins

Enhances return on capital and overall capital allocation for the PF McDonald's

► Improves ability of PF McDonald's to pay significant ongoing dividends

$ in millions

Revenue

EBITDA

EBITDA Margin

EBITDA-Capex

EBITDA-Capex Margin

EBITDA-Maintenance Capex

EBITDA - Maint. Capex Margin

FCF

(1)

A Transformational Transaction (Cont'd)

FCF Margin

McDonald's

Standalone

FY 2006E

$20,816

5,594

26.9%

4,335

20.8%

4,651

22.3%

3,059

14.7%

We note that CapEx projections are net of proceeds obtained from store closures.

(1) Typical QSR margin based on Wall Street estimates for YUM! Brands and Wendy's.

27

M

McDonald's

Pro Forma

FY 2006E

$7,393

4,464

60.4%

3,739

50.6%

4,025

54.4%

2,440

33.0%

Typical

Mature

QSR

15% - 20%

¡7.5% -12.5%

10%-15%

5% - 10%View entire presentation