Tempo SPAC Presentation Deck

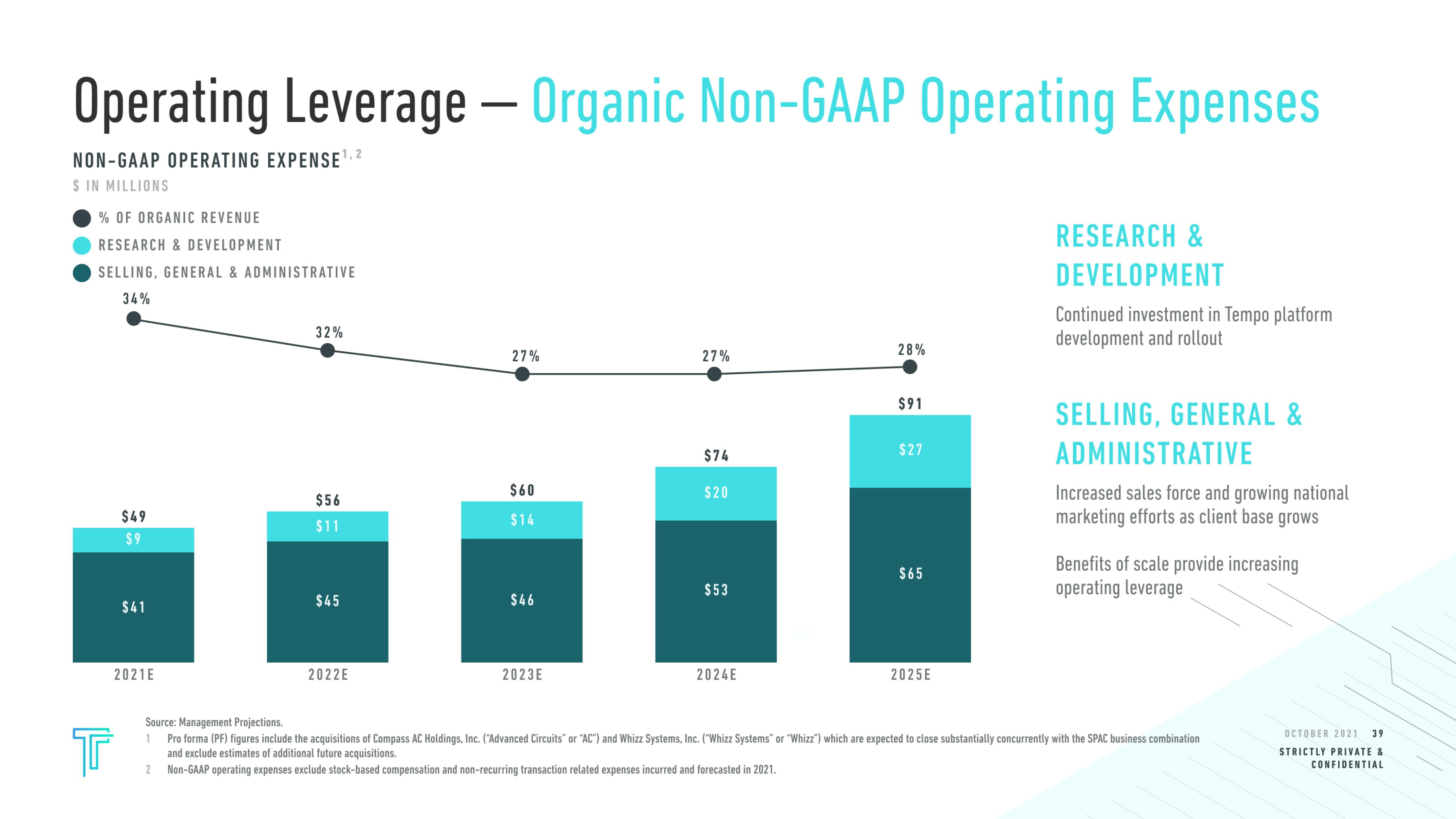

Operating Leverage - Organic Non-GAAP Operating Expenses

NON-GAAP OPERATING EXPENSE ¹,2

$ IN MILLIONS

% OF ORGANIC REVENUE

RESEARCH & DEVELOPMENT

SELLING, GENERAL & ADMINISTRATIVE

34%

$49

$9

$41

2021E

32%

$56

$11

$45

2022E

27%

$60

$14

$46

2023E

27%

$74

$20

$53

2024E

28%

$91

$27

$65

2025E

RESEARCH &

DEVELOPMENT

Continued investment in Tempo platform

development and rollout

SELLING, GENERAL &

ADMINISTRATIVE

Increased sales force and growing national

marketing efforts as client base grows

Benefits of scale provide increasing

operating leverage

Source: Management Projections.

Tr

1 Pro forma (PF) figures include the acquisitions of Compass AC Holdings, Inc. ("Advanced Circuits" or "AC") and Whizz Systems, Inc. ("Whizz Systems" or "Whizz") which are expected to close substantially concurrently with the SPAC business combination

and exclude estimates of additional future acquisitions.

2 Non-GAAP operating expenses exclude stock-based compensation and non-recurring transaction related expenses incurred and forecasted in 2021.

OCTOBER 2021 39

STRICTLY PRIVATE &

CONFIDENTIALView entire presentation