Kinnevik Results Presentation Deck

WE DEPLOYED SEK 1.9BN IN FOLLOW-ONS IN Q2 EXECUTING ON OUR MAIN

2023 PRIORITY TO INCREASE THE IMPACT OF OUR HIGH-CONVICTION BUSINESSES

■

Main strategic priority in 2023 is to use the market conditions to

double-down in our high-conviction businesses by increasing our

committed capital and accreting ownership

In the quarter we deployed SEK 1.7bn into portfolio winners such as

Spring Health, TravelPerk, Instabee, Recursion and HungryPanda

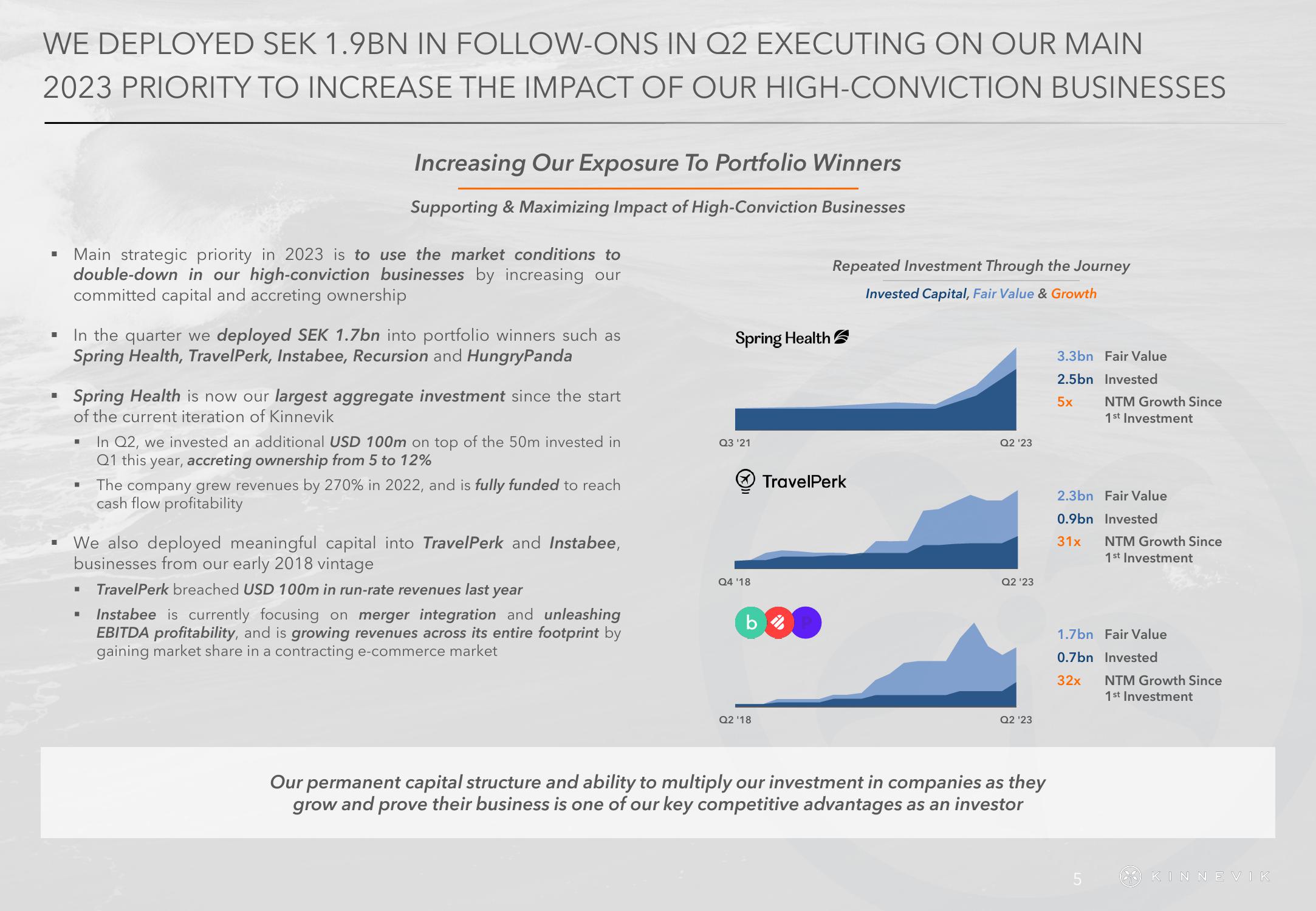

Increasing Our Exposure To Portfolio Winners

Supporting & Maximizing Impact of High-Conviction Businesses

Spring Health is now our largest aggregate investment since the start

of the current iteration of Kinnevik

■

■

■

In Q2, we invested an additional USD 100m on top of the 50m invested in

Q1 this year, accreting ownership from 5 to 12%

The company grew revenues by 270% in 2022, and is fully funded to reach

cash flow profitability

We also deployed meaningful capital into TravelPerk and Instabee,

businesses from our early 2018 vintage

TravelPerk breached USD 100m in run-rate revenues last year

Instabee is currently focusing on merger integration and unleashing

EBITDA profitability, and is growing revenues across its entire footprint by

gaining market share in a contracting e-commerce market

Spring Health

Q3 '21

Q4 '18

b

Q2 '18

Repeated Investment Through the Journey

Invested Capital, Fair Value & Growth

TravelPerk

Q2 '23

Q2 '23

Q2 '23

Our permanent capital structure and ability to multiply our investment in companies as they

grow and prove their business is one of our key competitive advantages as an investor

3.3bn Fair Value

2.5bn Invested

5x

NTM Growth Since

1st Investment

2.3bn Fair Value

0.9bn Invested

31x

1.7bn

0.7bn

32x

NTM Growth Since

1st Investment

Fair Value

Invested

NTM Growth Since

1st Investment

KINNEVIKView entire presentation