NuStar Energy Investor Conference Presentation Deck

NuStar

★

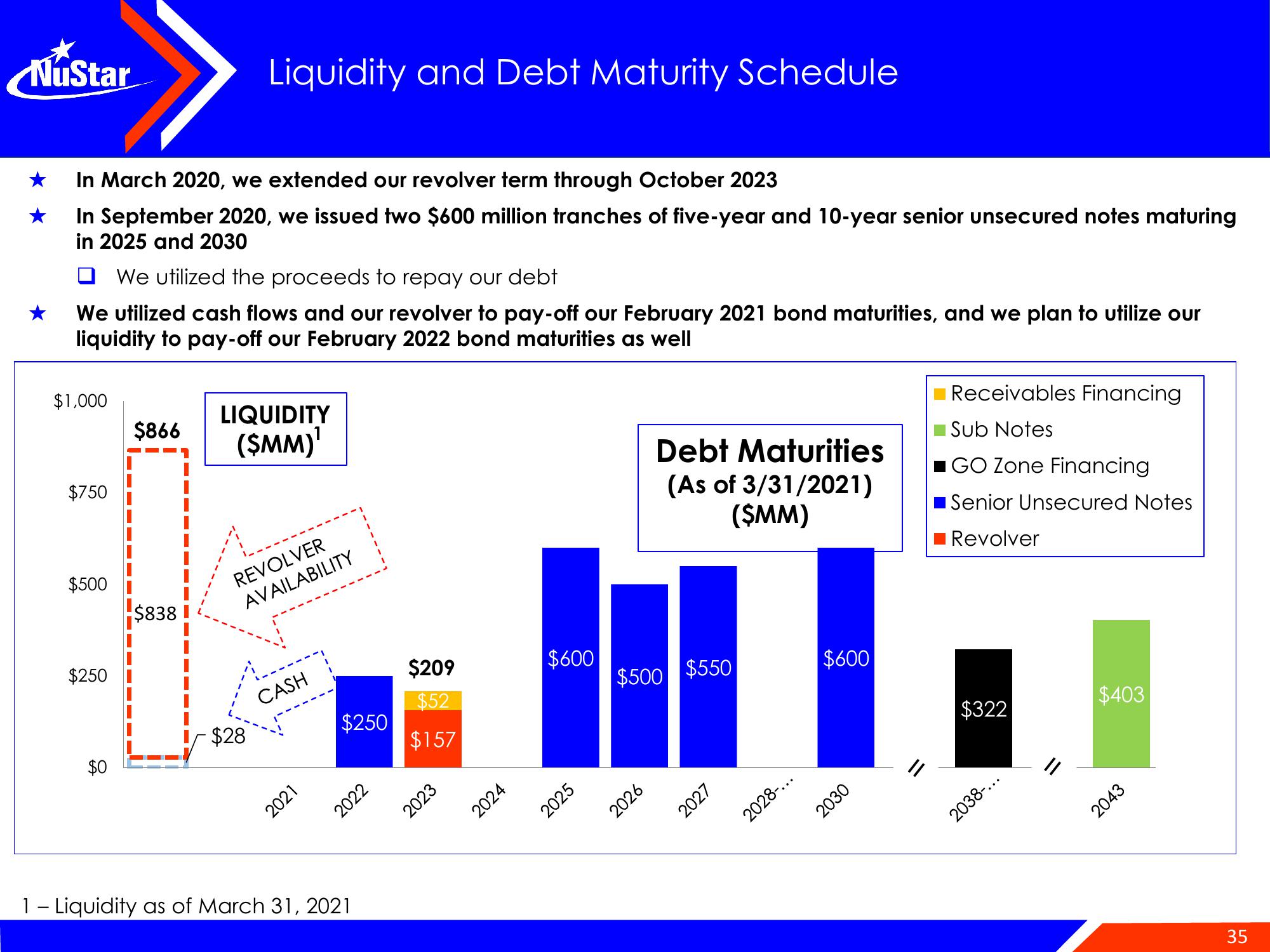

In March 2020, we extended our revolver term through October 2023

In September 2020, we issued two $600 million tranches of five-year and 10-year senior unsecured notes maturing

in 2025 and 2030

We utilized the proceeds to repay our debt

We utilized cash flows and our revolver to pay-off our February 2021 bond maturities, and we plan to utilize our

liquidity to pay-off our February 2022 bond maturities as well

$1,000

$750

$500

$250

$0

$866

Liquidity and Debt Maturity Schedule

$838

LIQUIDITY

($MM)¹

REVOLVER

AVAILABILITY

$28

CASH

2021

$250

2022

1 - Liquidity as of March 31, 2021

$209

$52

$157

2023

2024

$600

2025

Debt Maturities

(As of 3/31/2021)

($MM)

$500 $550

2026

2027

2028-...

$600

2030

Receivables Financing

Sub Notes

■GO Zone Financing

■Senior Unsecured Notes

Revolver

$322

2038-...

$403

2043

35View entire presentation