First Busey Results Presentation Deck

4Q23 Earnings Investor Presentation

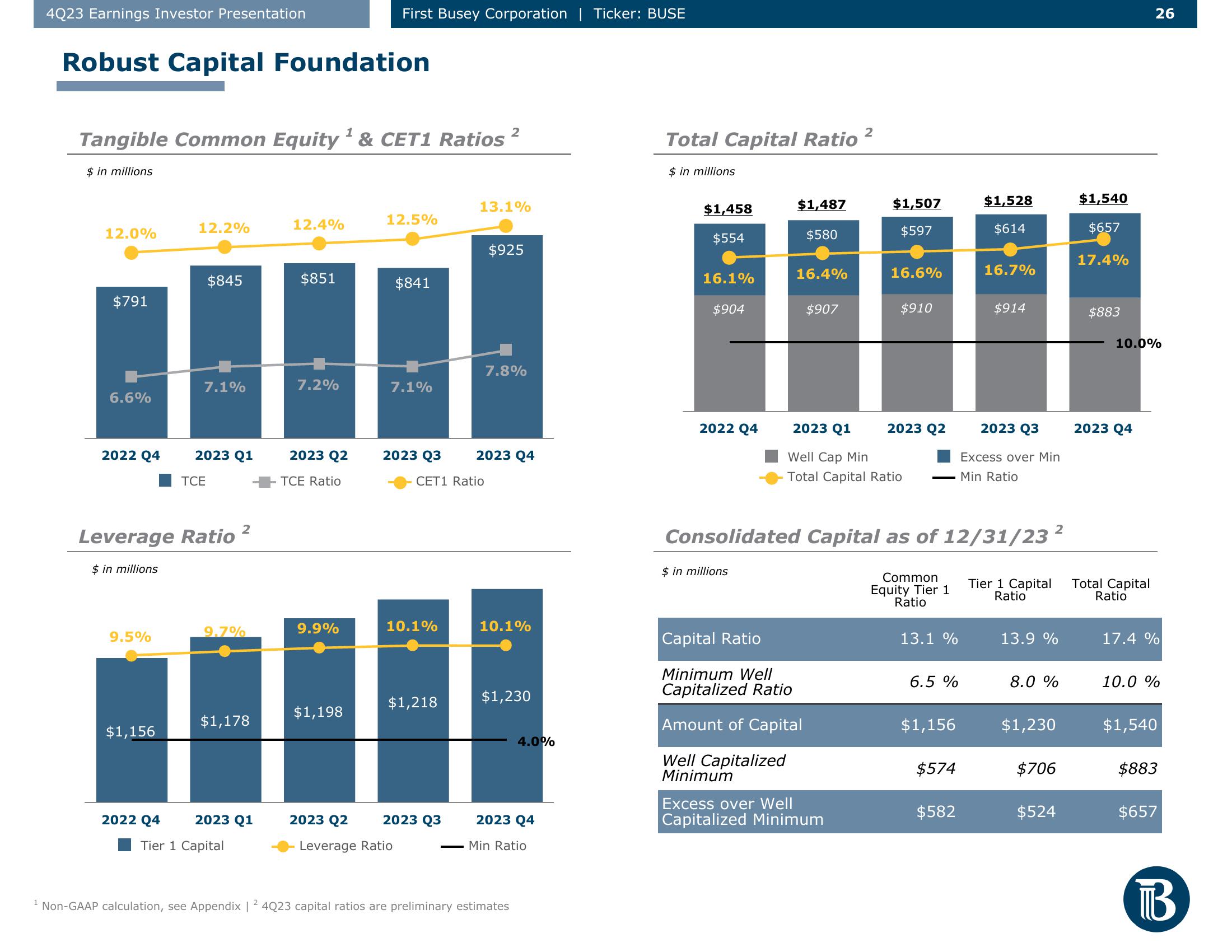

Robust Capital Foundation

1

Tangible Common Equity ¹ & CET1 Ratios

$ in millions

12.0%

$791

6.6%

2022 Q4

$ in millions

9.5%

$1,156

12.2%

2022 Q4

Leverage Ratio

$845

7.1%

2023 Q1

TCE

9.7%

2

$1,178

2023 Q1

Tier 1 Capital

12.4%

$851

7.2%

2023 Q2

TCE Ratio

9.9%

First Busey Corporation | Ticker: BUSE

$1,198

12.5%

$841

7.1%

2023 Q3

2023 Q2

Leverage Ratio

10.1%

$1,218

CET1 Ratio

2023 Q3

13.1%

2

$925

7.8%

2023 Q4

10.1%

$1,230

4.0%

2023 Q4

Non-GAAP calculation, see Appendix | 2 4Q23 capital ratios are preliminary estimates

Min Ratio

Total Capital Ratio

$ in millions

$1,458

$554

16.1%

$904

2022 Q4

$1,487

$580

$ in millions

16.4%

$907

Capital Ratio

Minimum Well

Capitalized Ratio

Amount of Capital

Well Capitalized

Minimum

2

$1,507

$597

Excess over Well

Capitalized Minimum

16.6%

2023 Q1

Well Cap Min

Total Capital Ratio

$910

2023 Q2

13.1 %

Consolidated Capital as of 12/31/23²

Common

Equity Tier 1

Ratio

6.5 %

$1,156

$574

$1,528

$614

$582

16.7%

$914

2023 Q3

Excess over Min

Min Ratio

Tier 1 Capital

Ratio

13.9 %

8.0 %

$1,230

$706

$524

$1,540

$657

17.4%

$883

10.0%

2023 Q4

26

Total Capital

Ratio

17.4 %

10.0 %

$1,540

$883

$657

BView entire presentation