Dave SPAC Presentation Deck

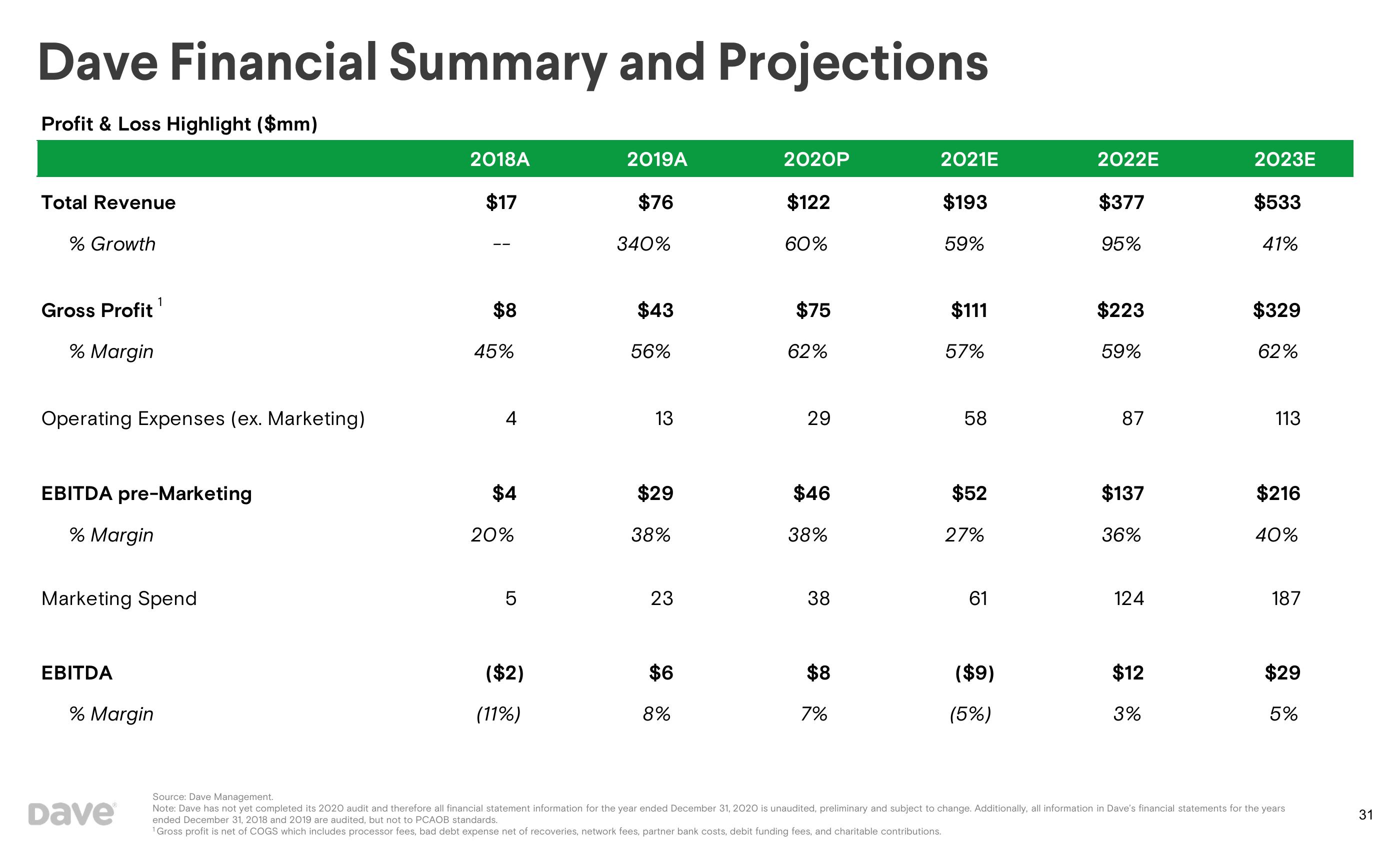

Dave Financial Summary and Projections

Profit & Loss Highlight ($mm)

Total Revenue

% Growth

1

Gross Profit¹

% Margin

Operating Expenses (ex. Marketing)

EBITDA pre-Marketing

% Margin

Marketing Spend

EBITDA

% Margin

Dave

2018A

$17

$8

45%

4

$4

20%

5

($2)

(11%)

2019A

$76

340%

$43

56%

13

$29

38%

23

$6

8%

2020P

$122

60%

$75

62%

29

$46

38%

38

$8

7%

2021E

$193

59%

$111

57%

58

$52

27%

61

($9)

(5%)

2022E

$377

95%

$223

59%

87

$137

36%

124

$12

3%

2023E

$533

41%

$329

62%

113

$216

40%

187

$29

5%

Source: Dave Management.

Note: Dave has not yet completed its 2020 audit and therefore all financial statement information for the year ended December 31, 2020 is unaudited, preliminary and subject to change. Additionally, all information in Dave's financial statements for the years

ended December 31, 2018 and 2019 are audited, but not to PCAOB standards.

¹ Gross profit is net of COGS which includes processor fees, bad debt expense net of recoveries, network fees, partner bank costs, debit funding fees, and charitable contributions.

31View entire presentation