Baird Investment Banking Pitch Book

Confidential

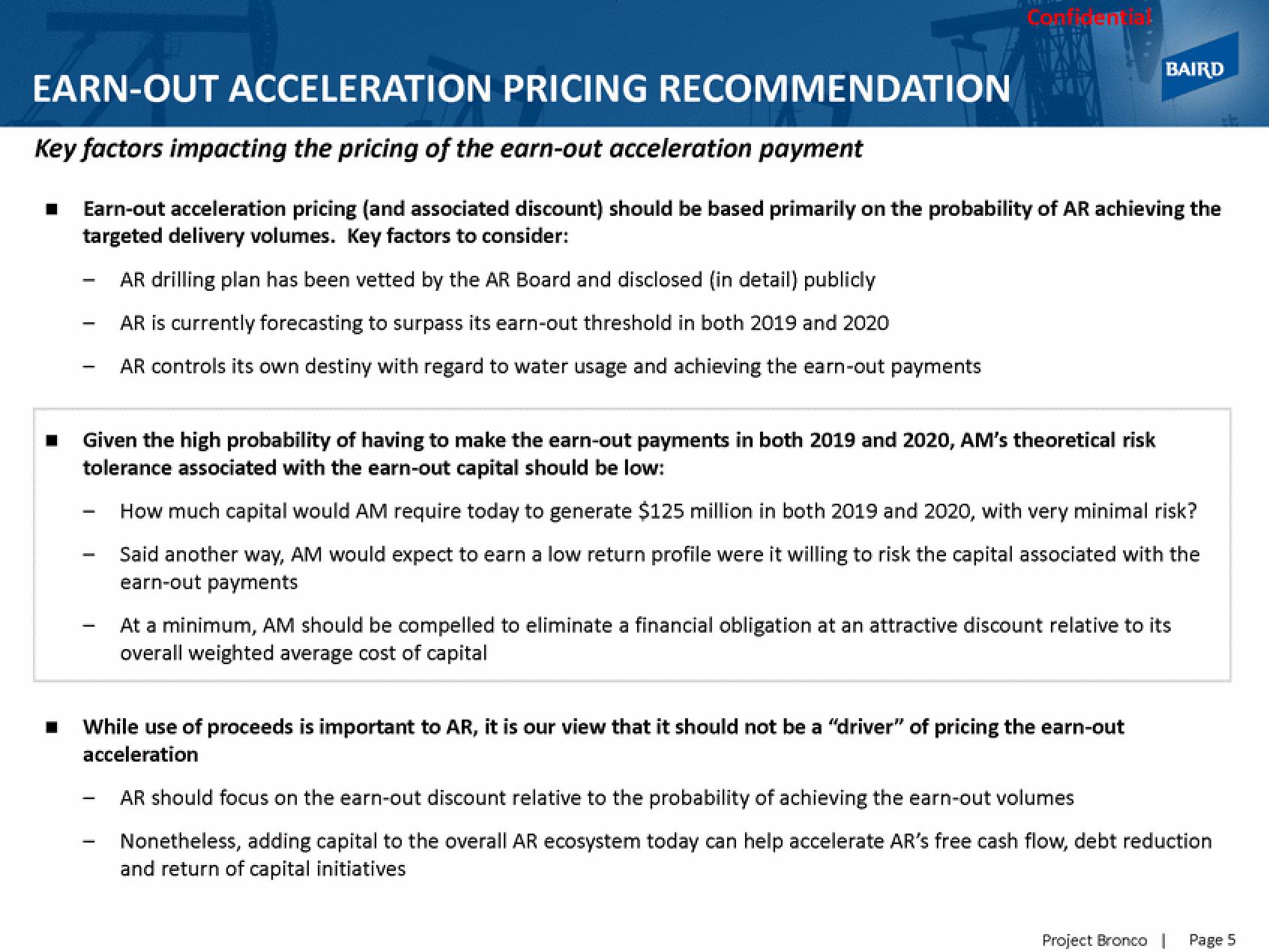

EARN-OUT ACCELERATION PRICING RECOMMENDATION

Key factors impacting the pricing of the earn-out acceleration payment

Earn-out acceleration pricing (and associated discount) should be based primarily on the probability of AR achieving the

targeted delivery volumes. Key factors to consider:

AR drilling plan has been vetted by the AR Board and disclosed (in detail) publicly

AR is currently forecasting to surpass its earn-out threshold in both 2019 and 2020

AR controls its own destiny with regard to water usage and achieving the earn-out payments

BAIRD

Given the high probability of having to make the earn-out payments in both 2019 and 2020, AM's theoretical risk

tolerance associated with the earn-out capital should be low:

How much capital would AM require today to generate $125 million in both 2019 and 2020, with very minimal risk?

Said another way, AM would expect to earn a low return profile were it willing to risk the capital associated with the

earn-out payments

At a minimum, AM should be compelled to eliminate a financial obligation at an attractive discount relative to its

overall weighted average cost of capital

While use of proceeds is important to AR, it is our view that it should not be a "driver" of pricing the earn-out

acceleration

AR should focus on the earn-out discount relative to the probability of achieving the earn-out volumes

Nonetheless, adding capital to the overall AR ecosystem today can help accelerate AR's free cash flow, debt reduction

and return of capital initiatives

Project Bronco

Page 5View entire presentation