Pershing Square Activist Presentation Deck

Pershing Square SPARC Holdings ("SPARC")

Square

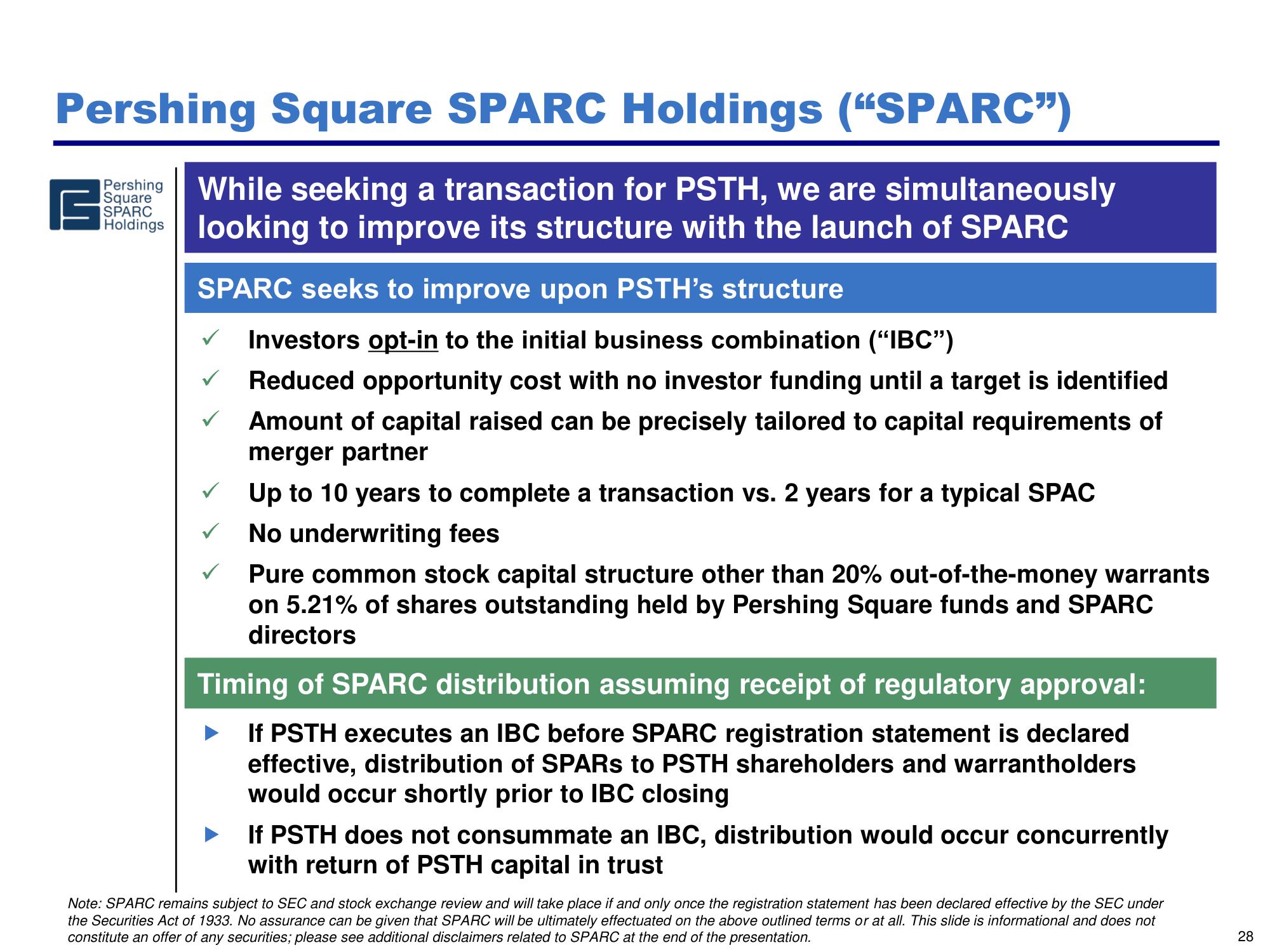

Pershing While seeking a transaction for PSTH, we are simultaneously

looking to improve its structure with the launch of SPARC

SPARC

Holdings

SPARC seeks to improve upon PSTH's structure

Investors opt-in to the initial business combination ("IBC”")

Reduced opportunity cost with no investor funding until a target is identified

Amount of capital raised can be precisely tailored to capital requirements of

merger partner

✓

Up to 10 years to complete a transaction vs. 2 years for a typical SPAC

No underwriting fees

Pure common stock capital structure other than 20% out-of-the-money warrants

on 5.21% of shares outstanding held by Pershing Square funds and SPARC

directors

Timing of SPARC distribution assuming receipt of regulatory approval:

► If PSTH executes an IBC before SPARC registration statement is declared

effective, distribution of SPARS to PSTH shareholders and warrantholders

would occur shortly prior to IBC closing

If PSTH does not consummate an IBC, distribution would occur concurrently

with return of PSTH capital in trust

Note: SPARC remains subject to SEC and stock exchange review and will take place if and only once the registration statement has been declared effective by the SEC under

the Securities Act of 1933. No assurance can be given that SPARC will be ultimately effectuated on the above outlined terms or at all. This slide is informational and does not

constitute an offer of any securities; please see additional disclaimers related to SPARC at the end of the presentation.

28View entire presentation