HireRight Results Presentation Deck

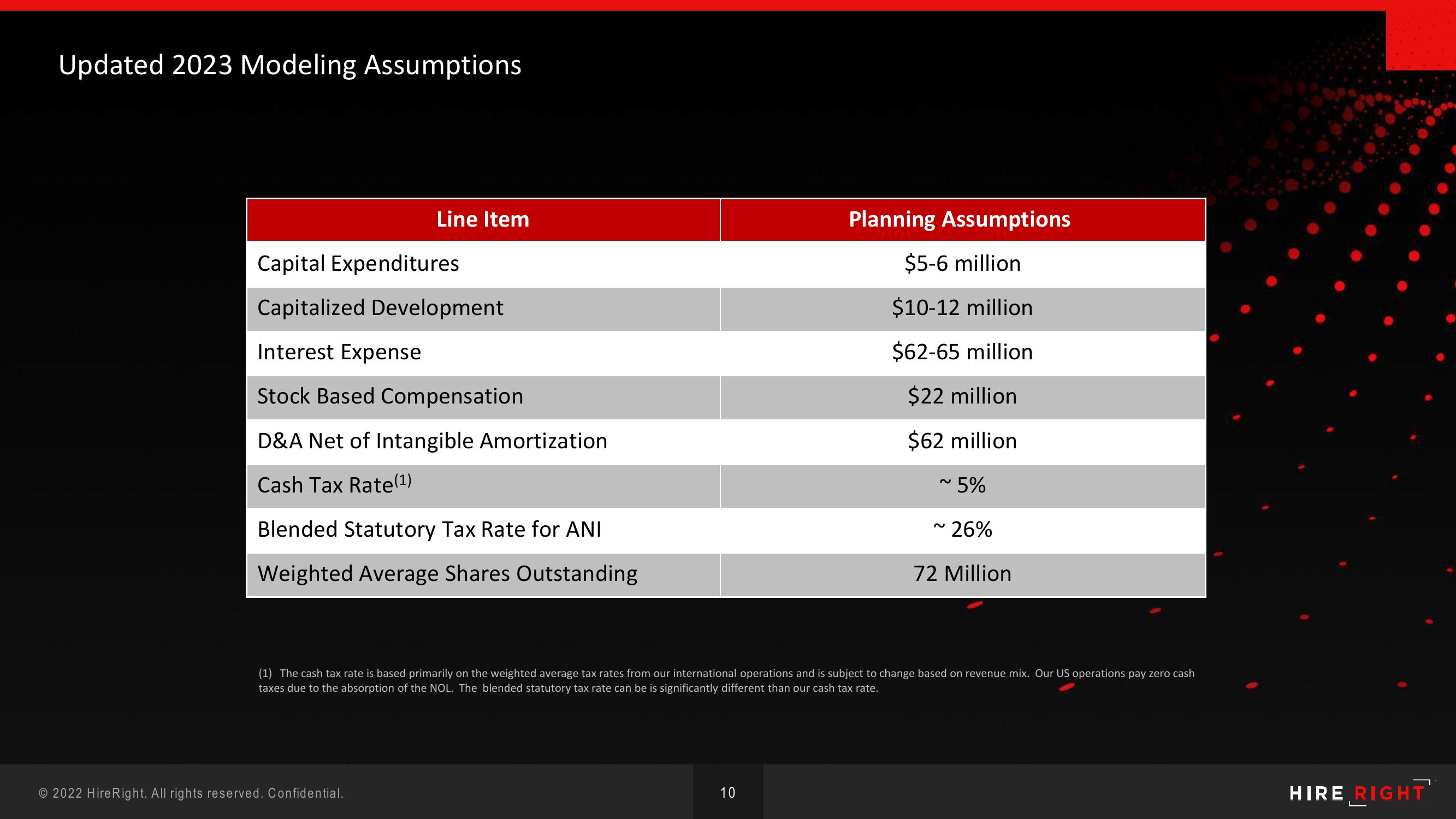

Updated 2023 Modeling Assumptions

Line Item

Capital Expenditures

Capitalized Development

Interest Expense

Stock Based Compensation

D&A Net of Intangible Amortization

Cash Tax Rate(1)

Blended Statutory Tax Rate for ANI

Weighted Average Shares Outstanding

© 2022 HireRight. All rights reserved. Confidential.

Planning Assumptions

$5-6 million

$10-12 million

$62-65 million

$22 million

$62 million

~ 5%

' 26%

72 Million

(1) The cash tax rate is based primarily on the weighted average tax rates from our international operations and is subject to change based on revenue mix. Our US operations pay zero cash

taxes due to the absorption of the NOL. The blended statutory tax rate can be is significantly different than our cash tax rate.

10

2

HIRE RIGHTView entire presentation