GMS Investor Conference Presentation Deck

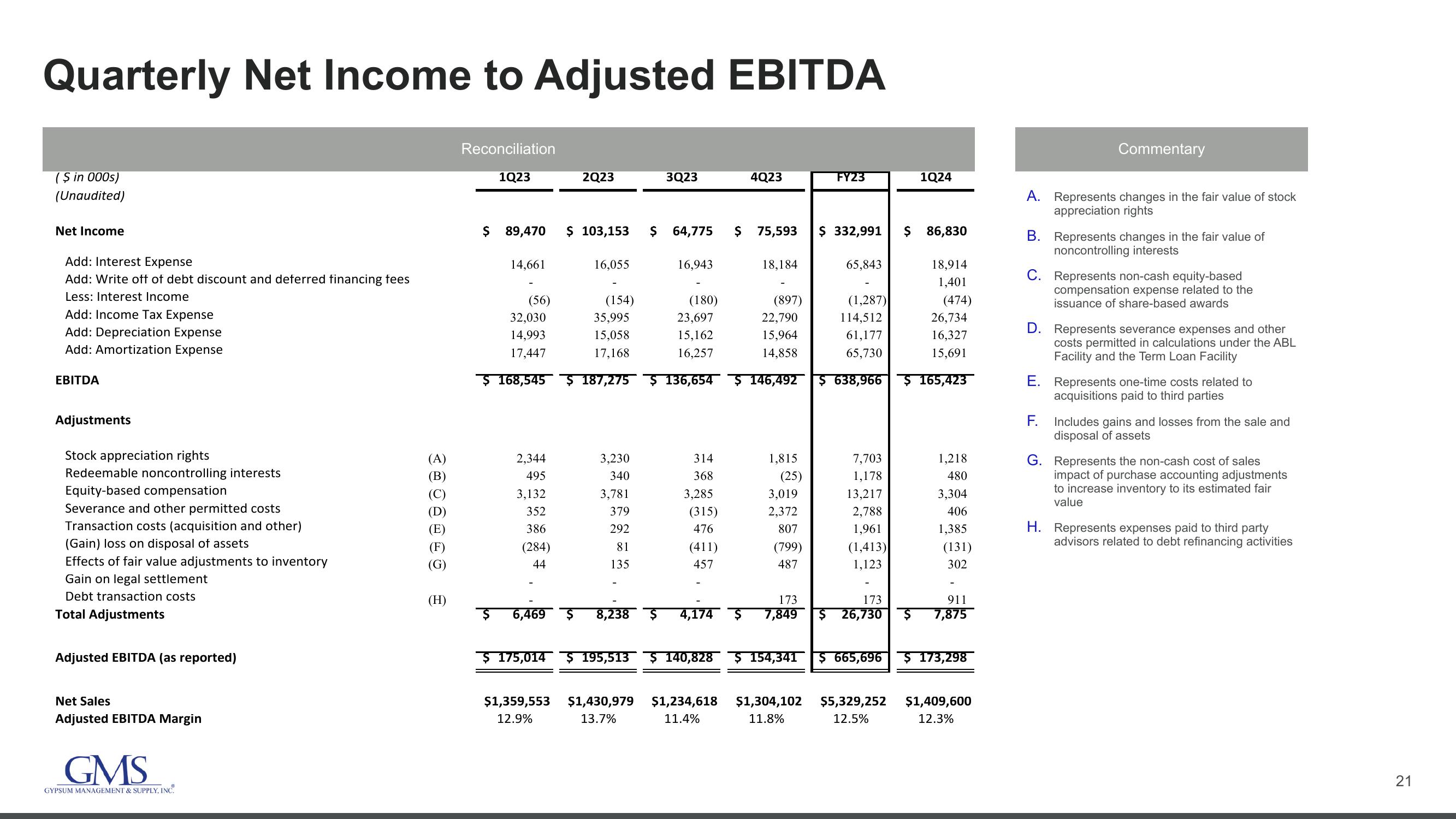

Quarterly Net Income to Adjusted EBITDA

(Ş in 000s)

(Unaudited)

Net Income

Add: Interest Expense

Add: Write off of debt discount and deferred financing fees

Less: Interest Income

Add: Income Tax Expense

Add: Depreciation Expense

Add: Amortization Expense

EBITDA

Adjustments

Stock appreciation rights

Redeemable noncontrolling interests

Equity-based compensation

Severance and other permitted costs

Transaction costs (acquisition and other)

(Gain) loss on disposal of assets

Effects of fair value adjustments to inventory

Gain on legal settlement

Debt transaction costs

Total Adjustments

Adjusted EBITDA (as reported)

Net Sales

Adjusted EBITDA Margin

GMS

GYPSUM MANAGEMENT & SUPPLY, INC.

(A)

(B)

(F)

(G)

(H)

Reconciliation

1Q23

$

14,661

89,470 $ 103,153 $ 64,775

(56)

2Q23

2,344

495

3,132

352

386

(284)

44

6,469

16,055

(180)

23,697

32,030

35,995

14,993

15,058

15,162

17,447

17,168

16,257

168,545 $ 187,275 Ș 136,654

(154)

3,230

340

3Q23

3,781

379

292

81

135

8,238

16,943

314

368

3,285

(315)

476

(411)

457

4,174

4Q23

$1,359,553 $1,430,979 $1,234,618

12.9%

13.7%

11.4%

$ 75,593

18,184

(897)

22,790

15,964

14,858

1,815

(25)

3,019

2,372

807

(799)

487

173

7,849

FY23

(1,287)

114,512

61,177

65,730

146,492 $ 638,966 $ 165,423

$1,304,102

11.8%

$ 332,991 $ 86,830

65,843

7,703

1,178

13,217

2,788

1,961

1Q24

(1,413)

1,123

18,914

1,401

$5,329,252

12.5%

(474)

26,734

16,327

15,691

1,218

480

3,304

406

1,385

$ 175,014 Ș 195,513 $ 140,828 $ 154,341 $ 665,696 $ 173,298

(131)

302

173

911

$ 26,730 $ 7,875

$1,409,600

12.3%

Commentary

A. Represents changes in the fair value of stock

appreciation rights

B. Represents changes in the fair value of

noncontrolling interests

C. Represents non-cash equity-based

compensation expense related to the

issuance of share-based awards

D. Represents severance expenses and other

costs permitted in calculations under the ABL

Facility and the Term Loan Facility

E. Represents one-time costs related to

acquisitions paid to third parties

F. Includes gains and losses from the sale and

disposal of assets

G. Represents the non-cash cost of sales

impact of purchase accounting adjustments

to increase inventory to its estimated fair

value

H. Represents expenses paid to third party

advisors related to debt refinancing activities

21View entire presentation