Goldman Sachs Industrials & Materials Conference

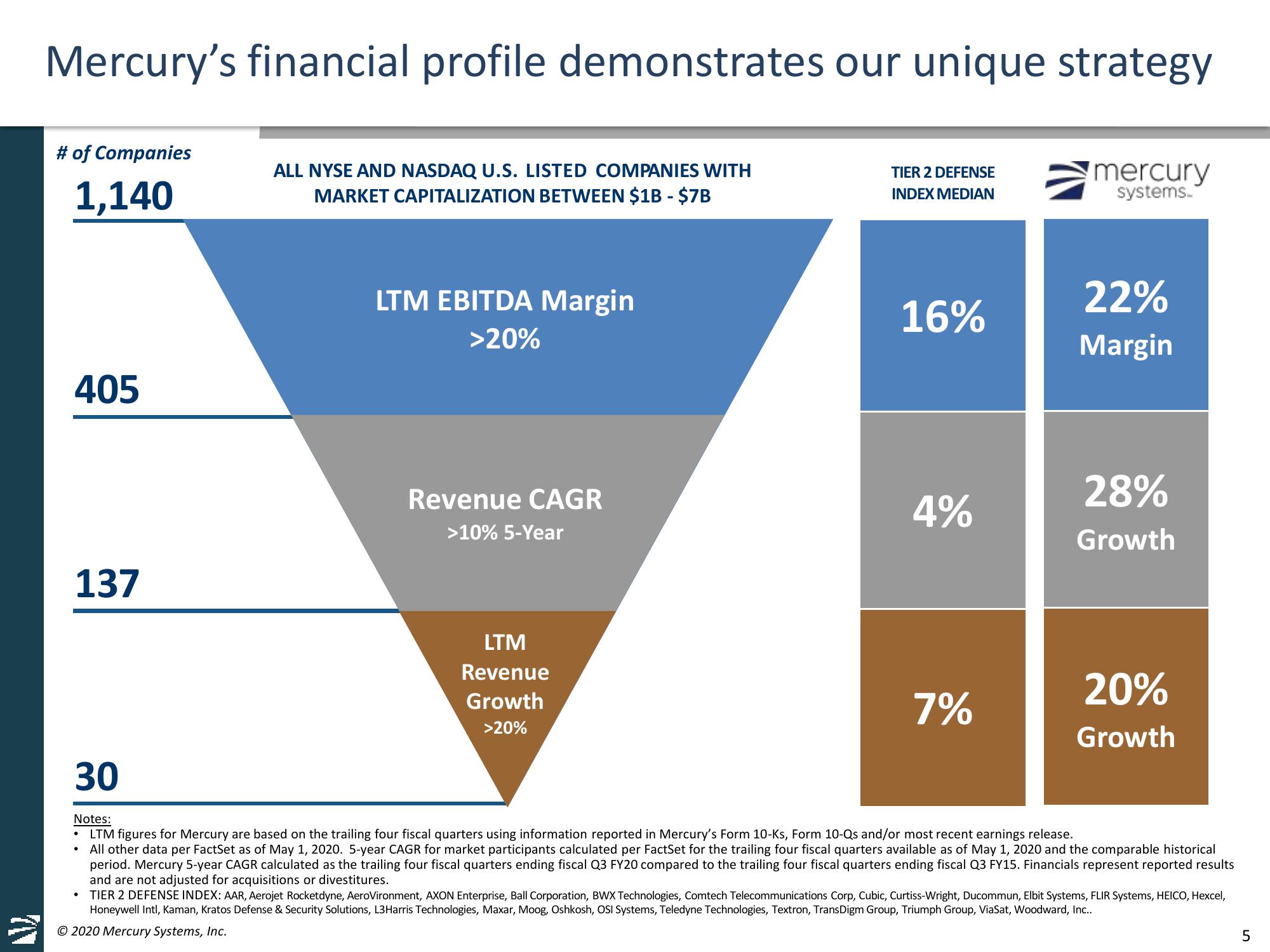

Mercury's financial profile demonstrates our unique strategy

# of Companies

1,140

405

137

30

●

ALL NYSE AND NASDAQ U.S. LISTED COMPANIES WITH

MARKET CAPITALIZATION BETWEEN $1B - $7B

●

LTM EBITDA Margin

>20%

Revenue CAGR

>10% 5-Year

LTM

Revenue

Growth

>20%

TIER 2 DEFENSE

INDEX MEDIAN

16%

4%

7%

mercury

systems.

22%

Margin

28%

Growth

Notes:

LTM figures for Mercury are based on the trailing four fiscal quarters using information reported in Mercury's Form 10-Ks, Form 10-Qs and/or most recent earnings release.

All other data per FactSet as of May 1, 2020. 5-year CAGR for market participants calculated per FactSet for the trailing four fiscal quarters available as of May 1, 2020 and the comparable historical

period. Mercury 5-year CAGR calculated as the trailing four fiscal quarters ending fiscal Q3 FY20 compared to the trailing four fiscal quarters ending fiscal Q3 FY15. Financials represent reported results

and are not adjusted for acquisitions or divestitures.

TIER 2 DEFENSE INDEX: AAR, Aerojet Rocketdyne, AeroVironment, AXON Enterprise, Ball Corporation, BWX Technologies, Comtech Telecommunications Corp, Cubic, Curtiss-Wright, Ducommun, Elbit Systems, FLIR Systems, HEICO, Hexcel,

Honeywell Intl, Kaman, Kratos Defense & Security Solutions, L3Harris Technologies, Maxar, Moog, Oshkosh, OSI Systems, Teledyne Technologies, Textron, TransDigm Group, Triumph Group, ViaSat, Woodward, Inc..

© 2020 Mercury Systems, Inc.

20%

Growth

LO

5View entire presentation