Hyzon SPAC Presentation Deck

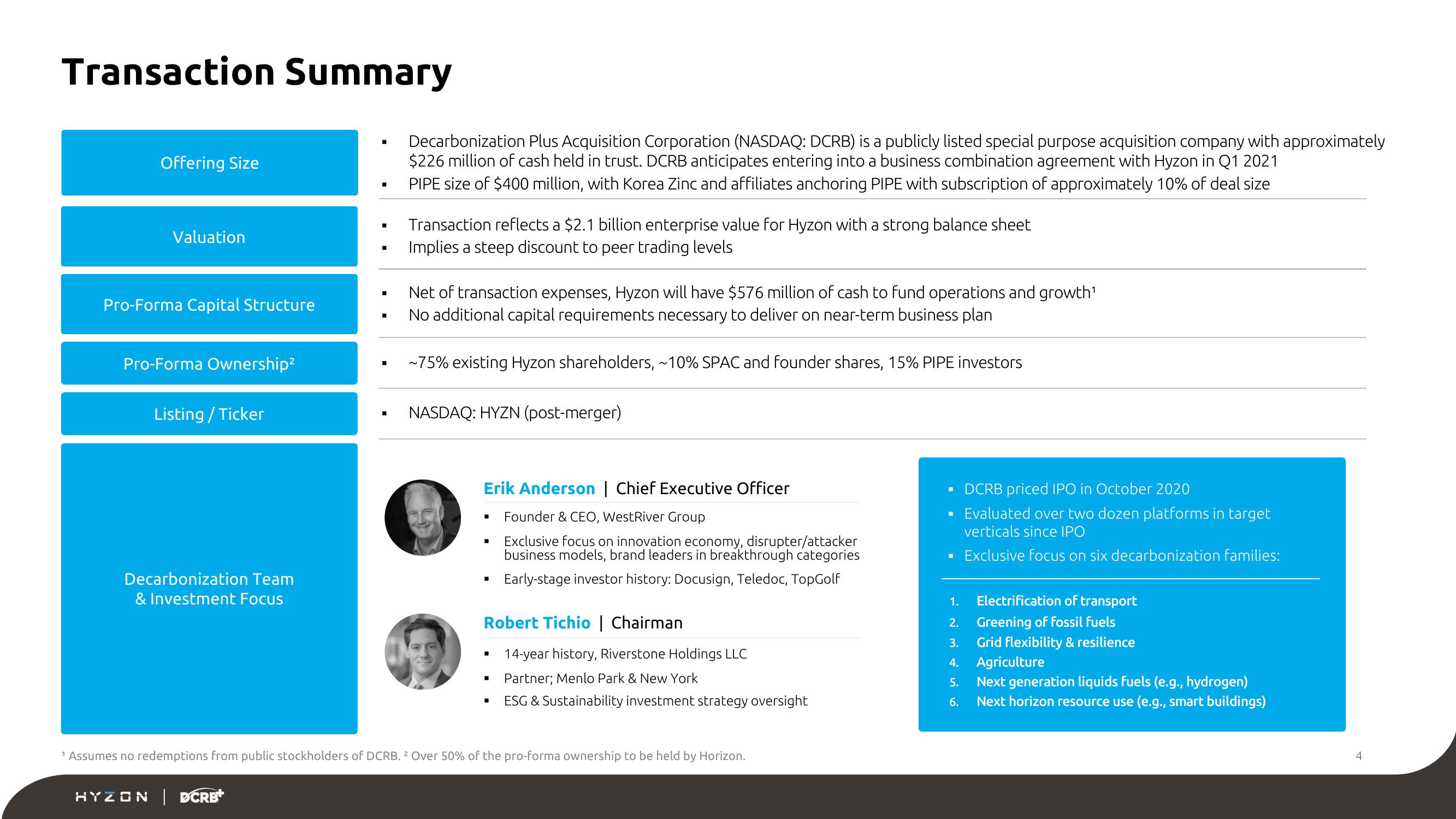

Transaction Summary

Offering Size

Valuation

Pro-Forma Capital Structure

Pro-Forma Ownership²

Listing/Ticker

Decarbonization Team

& Investment Focus

■

HYZON | DCRB+

■

■

■

■

■

Decarbonization Plus Acquisition Corporation (NASDAQ: DCRB) is a publicly listed special purpose acquisition company with approximately

$226 million of cash held in trust. DCRB anticipates entering into a business combination agreement with Hyzon in Q1 2021

PIPE size of $400 million, with Korea Zinc and affiliates anchoring PIPE with subscription of approximately 10% of deal size

Transaction reflects a $2.1 billion enterprise value for Hyzon with a strong balance sheet

Implies a steep discount to peer trading levels

Net of transaction expenses, Hyzon will have $576 million of cash to fund operations and growth¹

No additional capital requirements necessary to deliver on near-term business plan

~75% existing Hyzon shareholders, ~10% SPAC and founder shares, 15% PIPE investors

NASDAQ: HYZN (post-merger)

Erik Anderson | Chief Executive Officer

Founder & CEO, WestRiver Group

Exclusive focus on innovation economy, disrupter/attacker

business models, brand leaders in breakthrough categories

Early-stage investor history: Docusign, Teledoc, TopGolf

■

Robert Tichio | Chairman

14-year history, Riverstone Holdings LLC

Partner; Menlo Park & New York

ESG & Sustainability investment strategy oversight

■

¹ Assumes no redemptions from public stockholders of DCRB. 2 Over 50% of the pro-forma ownership to be held by Horizon.

M

DCRB priced IPO in October 2020

Evaluated over two dozen platforms in target

verticals since IPO

Exclusive focus on six decarbonization families:

1.

2.

3.

4.

Electrification of transport

Greening of fossil fuels

Grid flexibility & resilience

Agriculture

5. Next generation liquids fuels (e.g., hydrogen)

6.

Next horizon resource use (e.g., smart buildings)

4View entire presentation