Spirit Mergers and Acquisitions Presentation Deck

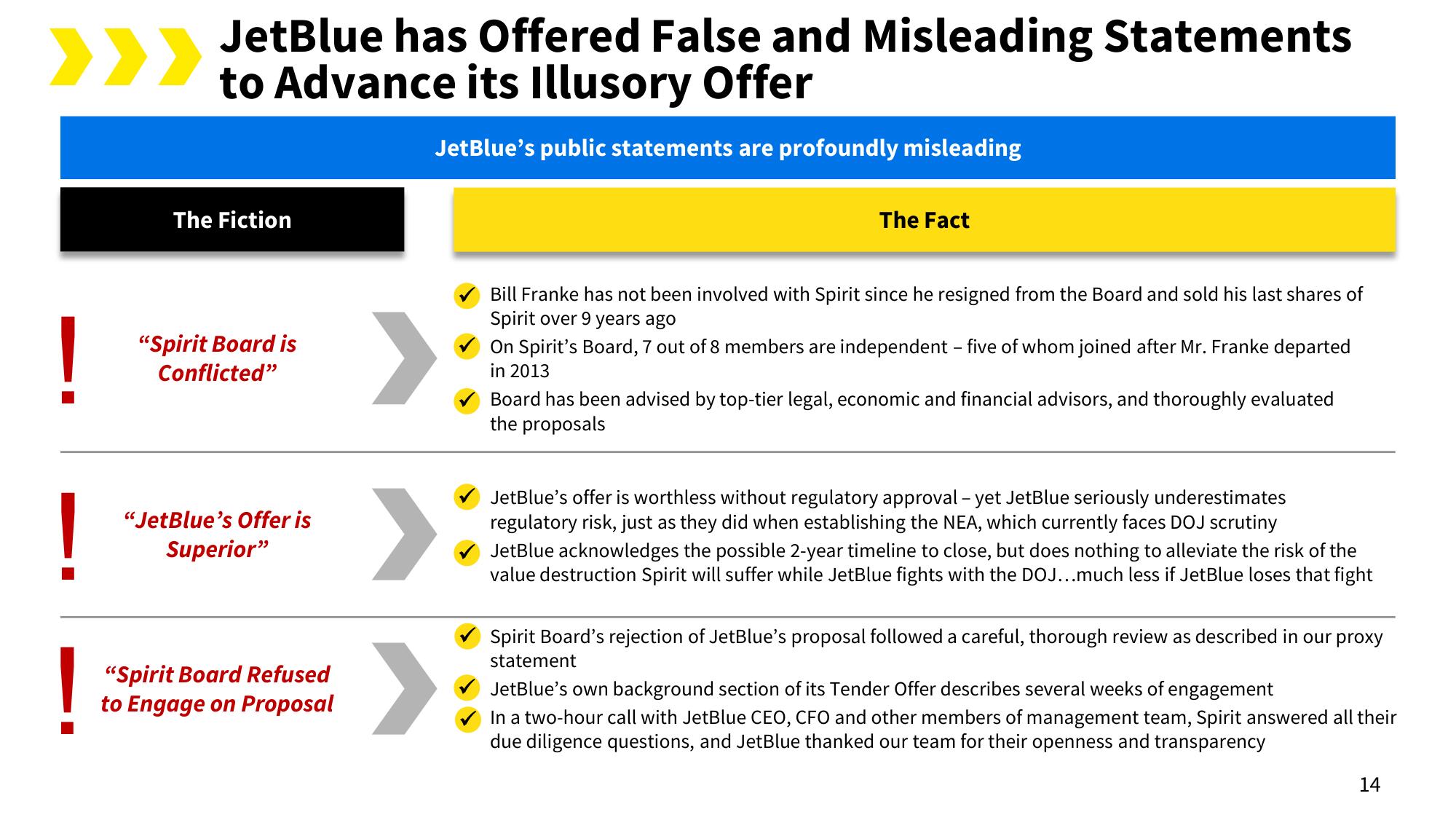

》》》 JetBlue has Offered False and Misleading Statements

to Advance its Illusory Offer

!

The Fiction

"Spirit Board is

Conflicted"

"JetBlue's Offer is

Superior"

"Spirit Board Refused

to Engage on Proposal

JetBlue's public statements are profoundly misleading

>

The Fact

Bill Franke has not been involved with Spirit since he resigned from the Board and sold his last shares of

Spirit over 9 years ago

On Spirit's Board, 7 out of 8 members are independent - five of whom joined after Mr. Franke departed

in 2013

Board has been advised by top-tier legal, economic and financial advisors, and thoroughly evaluated

the proposals

JetBlue's offer is worthless without regulatory approval - yet JetBlue seriously underestimates

regulatory risk, just as they did when establishing the NEA, which currently faces DOJ scrutiny

JetBlue acknowledges the possible 2-year timeline to close, but does nothing to alleviate the risk of the

value destruction Spirit will suffer while JetBlue fights with the DOJ... much less if JetBlue loses that fight

Spirit Board's rejection of JetBlue's proposal followed a careful, thorough review as described in our proxy

statement

JetBlue's own background section of its Tender Offer describes several weeks of engagement

In a two-hour call with JetBlue CEO, CFO and other members of management team, Spirit answered all their

due diligence questions, and JetBlue thanked our team for their openness and transparency

14View entire presentation