Melrose Mergers and Acquisitions Presentation Deck

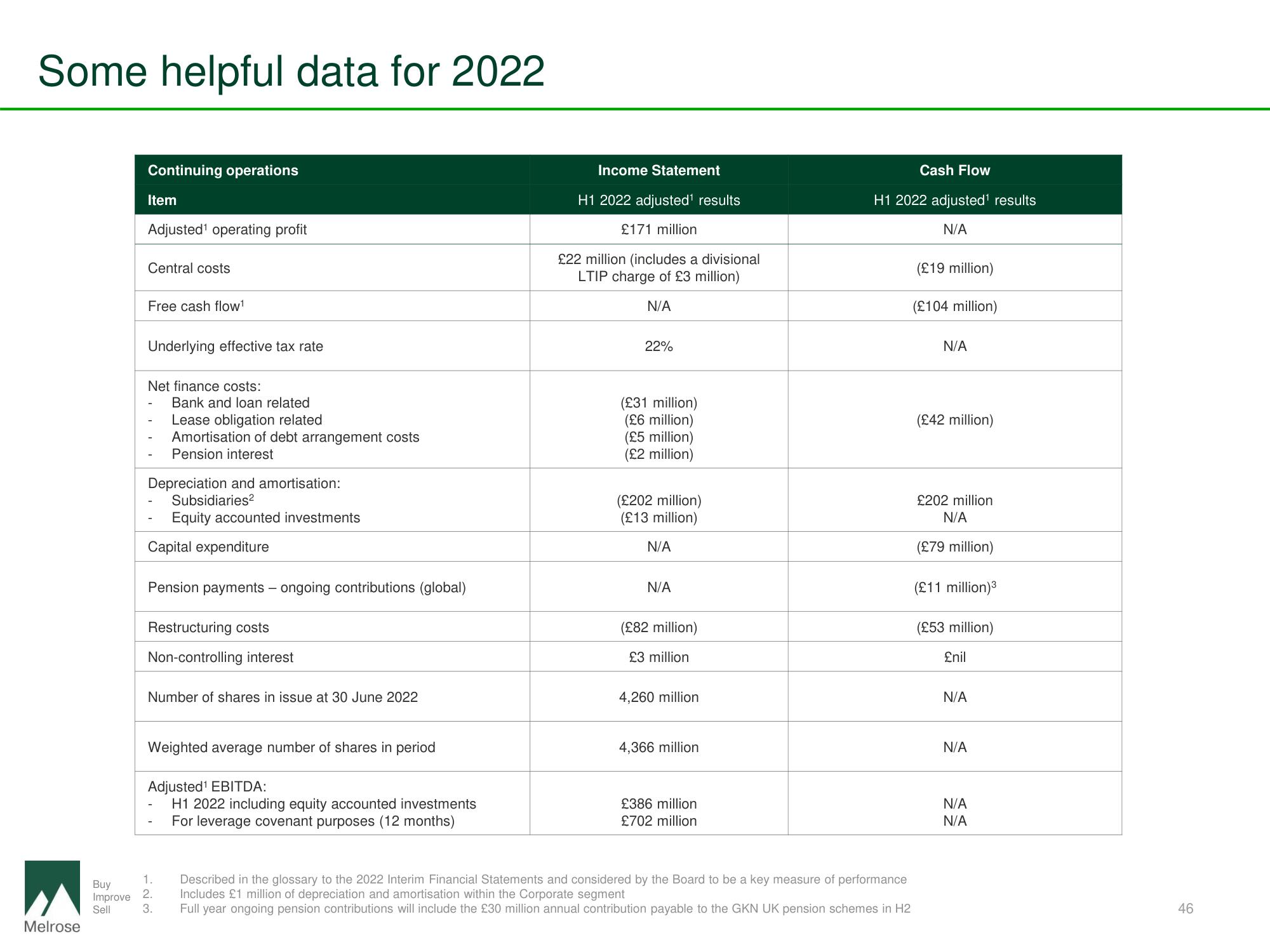

Some helpful data for 2022

Melrose

Continuing operations

Item

Adjusted¹ operating profit

Central costs

Free cash flow¹

Underlying effective tax rate

Net finance costs:

Bank and loan related

Lease obligation related

Amortisation of debt arrangement costs

Pension interest

Depreciation and amortisation:

Subsidiaries²

Equity accounted investments

Capital expenditure

Pension payments - ongoing contributions (global)

Restructuring costs

Non-controlling interest

Number of shares in issue at 30 June 2022

Weighted average number of shares in period

Adjusted¹ EBITDA:

H1 2022 including equity accounted investments

For leverage covenant purposes (12 months)

1.

Buy

Improve 2.

Sell

3.

Income Statement

H1 2022 adjusted¹ results

£171 million

£22 million (includes a divisional

LTIP charge of £3 million)

N/A

22%

(£31 million)

(£6 million)

(£5 million)

(£2 million)

(£202 million)

(£13 million)

N/A

N/A

(£82 million)

£3 million

4,260 million

4,366 million

£386 million

£702 million

Cash Flow

H1 2022 adjusted¹ results

N/A

Described in the glossary to the 2022 Interim Financial Statements and considered by the Board to be a key measure of performance

Includes £1 million of depreciation and amortisation within the Corporate segment

Full year ongoing pension contributions will include the £30 million annual contribution payable to the GKN UK pension schemes in H2

(£19 million)

(£104 million)

N/A

(£42 million)

£202 million

N/A

(£79 million)

(£11 million) ³

(£53 million)

£nil

N/A

N/A

N/A

N/A

46View entire presentation