Kinnevik Results Presentation Deck

Intro

SEK m

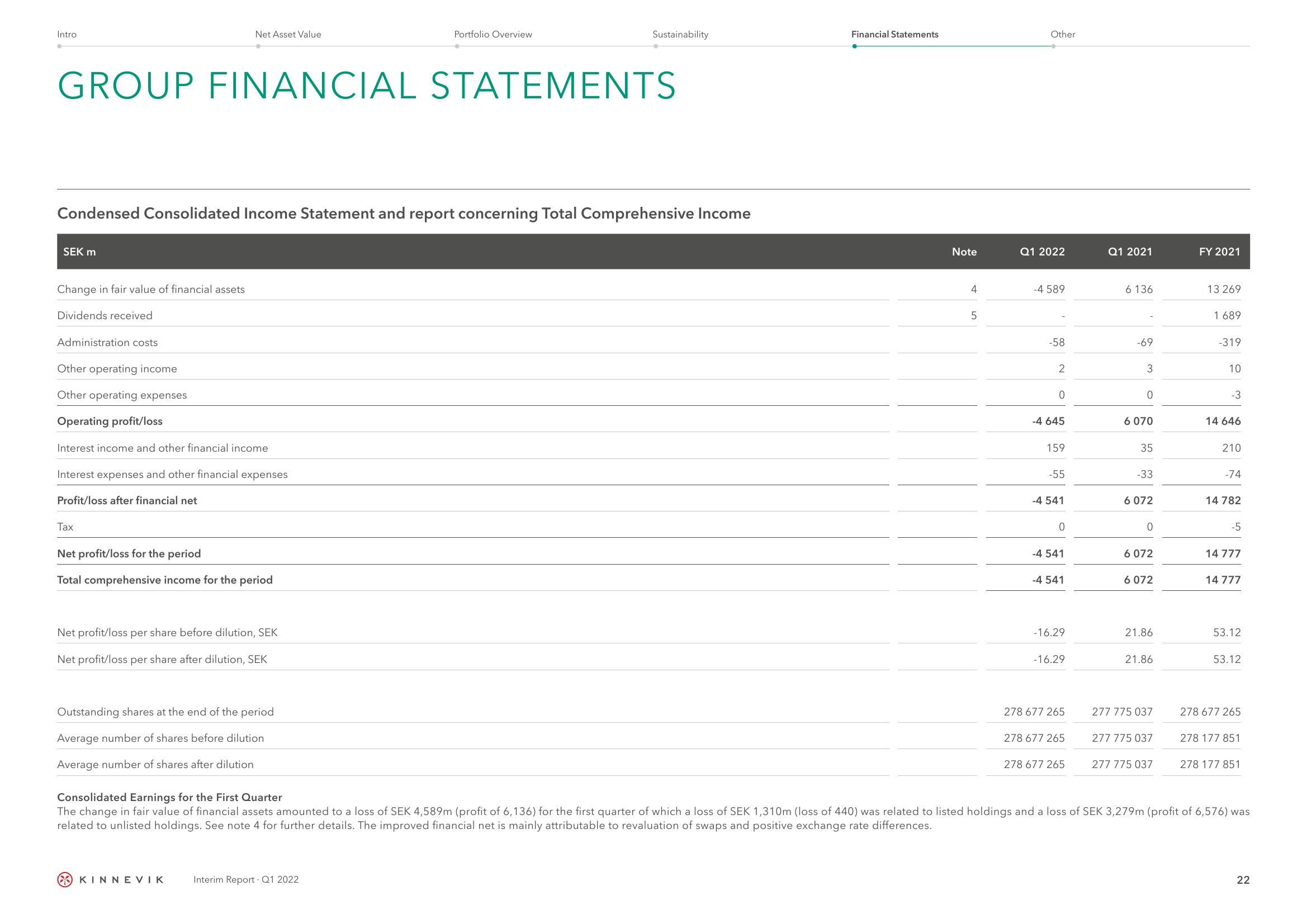

GROUP FINANCIAL STATEMENTS

Change in fair value of financial assets

Dividends received

Condensed Consolidated Income Statement and report concerning Total Comprehensive Income

Administration costs

Other operating income

Other operating expenses

Operating profit/loss

Net Asset Value

Interest income and other financial income

Interest expenses and other financial expenses

Profit/loss after financial net

Tax

Net profit/loss for the period

Total comprehensive income for the period

Net profit/loss per share before dilution, SEK

Net profit/loss per share after dilution, SEK

Outstanding shares at the end of the period

Average number of shares before dilution

Average number of shares after dilution

Portfolio Overview

KINNEVIK

Sustainability

Interim Report Q1 2022

Financial Statements

Note

4

5

Other

Q1 2022

-4 589

-58

2

0

-4 645

159

-55

-4541

0

-4541

-4 541

-16.29

-16.29

278 677 265

278 677 265

278 677 265

Q1 2021

6 136

-69

3

0

6 070

35

-33

6 072

0

6 072

6 072

21.86

21.86

277 775 037

277 775 037

277 775 037

FY 2021

13 269

1 689

-319

10

-3

14 646

210

-74

14 782

-5

14 777

14 777

53.12

53.12

278 677 265

278 177 851

Consolidated Earnings for the First Quarter

The change in fair value of financial assets amounted to a loss of SEK 4,589m (profit of 6,136) for the first quarter of which a loss of SEK 1,310m (loss of 440) was related to listed holdings and a loss of SEK 3,279m (profit of 6,576) was

related to unlisted holdings. See note 4 for further details. The improved financial net is mainly attributable to revaluation of swaps and positive exchange rate differences.

278 177 851

22View entire presentation