Rover Investor Update

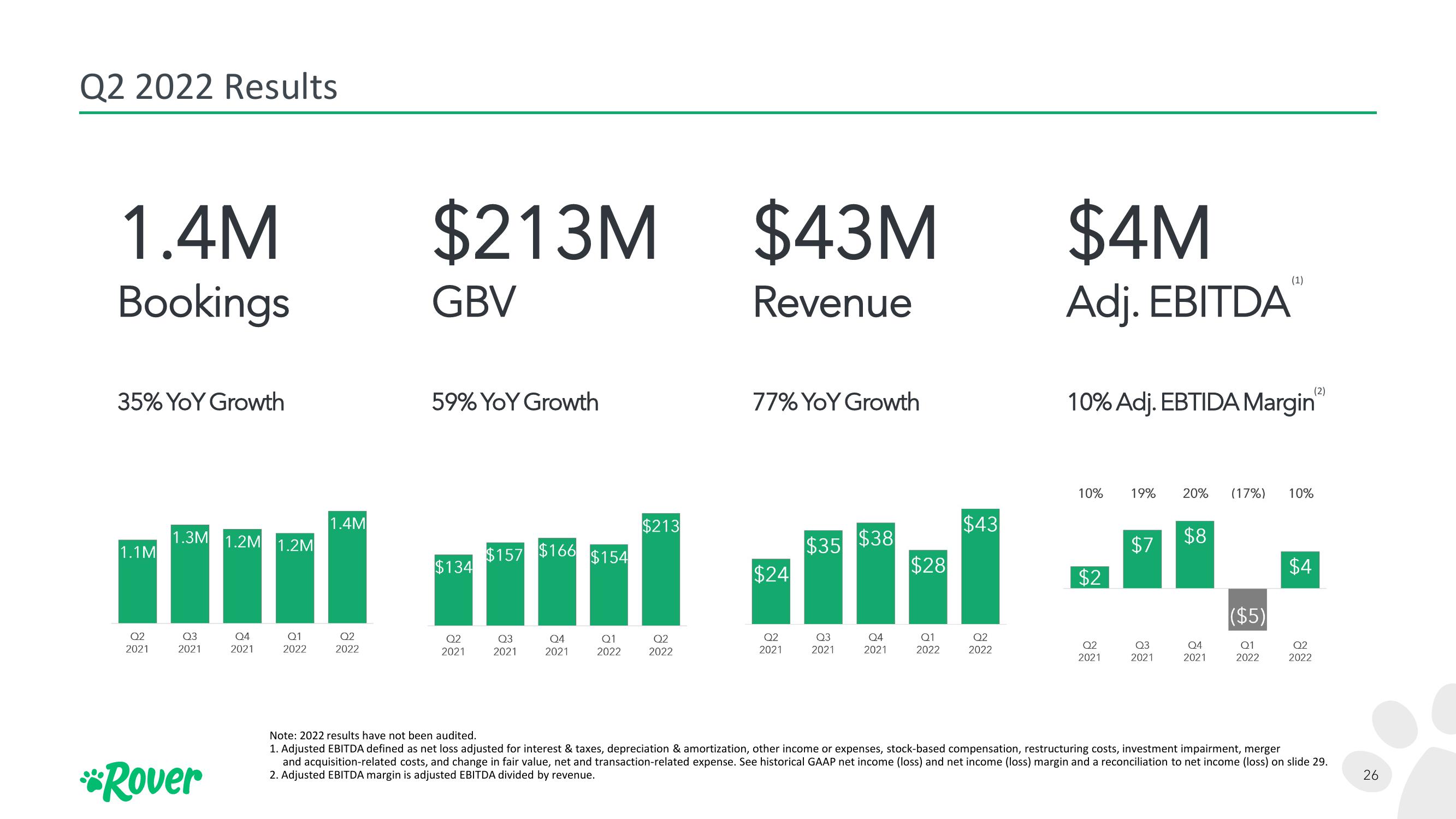

Q2 2022 Results

1.4M

Bookings

35% YoY Growth

1.1M

Q2

2021

1.3M 1.2M 1.2M

Q3

2021

*Rover

Q4

2021

Q1

2022

1.4M

Q2

2022

$213M

GBV

59% YoY Growth

$134

Q2

2021

$157 $166 $154

Q3

2021

Q4

2021

Q1

2022

$213

Q2

2022

$43M

Revenue

77% YoY Growth

$24

Q2

2021

$35 $38

Q3

2021

04

2021

$28

Q1

2022

$43

Q2

2022

$4M

Adj. EBITDA

10%

10% Adj. EBTIDA Margin

$2

Q2

2021

19% 20% (17%) 10%

$7

Q3

2021

$8

Q4

2021

(1)

($5)

Q1

2022

(2)

$4

Q2

2022

Note: 2022 results have not been audited.

1. Adjusted EBITDA defined as net loss adjusted for interest & taxes, depreciation & amortization, other income or expenses, stock-based compensation, restructuring costs, investment impairment, merger

and acquisition-related costs, and change in fair value, net and transaction-related expense. See historical GAAP net income (loss) and net income (loss) margin and a reconciliation to net income (loss) on slide 29.

2. Adjusted EBITDA margin is adjusted EBITDA divided by revenue.

26View entire presentation