Forge Results Presentation Deck

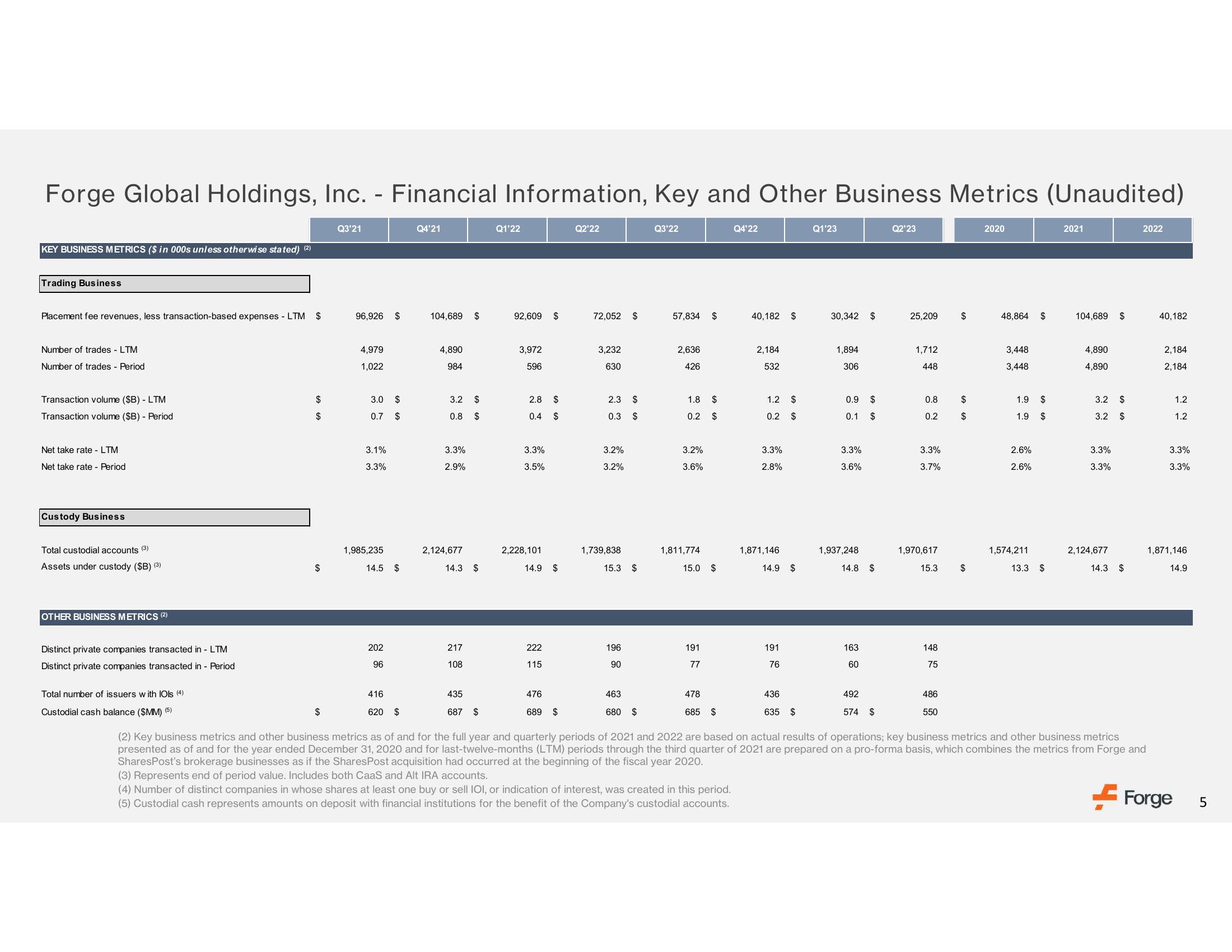

Forge Global Holdings, Inc. - Financial Information, Key and Other Business Metrics (Unaudited)

KEY BUSINESS METRICS ($ in 000s unless otherwise stated) (2)

Trading Business

Placement fee revenues, less transaction-based expenses - LTM

$

Number of trades - LTM

Number of trades - Period

Transaction volume ($B) - LTM

Transaction volume ($B) - Period

Net take rate - LTM

Net take rate - Period

Custody Business

Total custodial accounts (3)

Assets under custody ($B) (3)

OTHER BUSINESS METRICS (2)

Distinct private companies transacted in - LTM

Distinct private companies transacted in Period

$

$

$

Q3'21

$

96,926 $

4,979

1,022

3.0 $

0.7 $

3.1%

3.3%

1,985,235

14.5 $

202

96

416

620 $

Q4'21

104,689

4,890

984

3.2 $

0.8 $

3.3%

2.9%

2,124,677

14.3 $

217

108

435

687 $

Q1'22

92,609 $

3,972

596

2.8 $

0.4 $

3.3%

3.5%

2,228, 101

14.9 $

222

115

476

689 $

Q2'22

72,052 $

3,232

630

2.3 $

0.3 $

3.2%

3.2%

1,739,838

15.3 $

196

90

463

680 $

Q3'22

57,834 $

2,636

426

1.8 $

0.2 $

3.2%

3.6%

1,811,774

15.0 $

191

77

478

685 $

Q4'22

40,182 $

2,184

532

1.2

$

0.2 $

3.3%

2.8%

1,871,146

14.9 $

191

76

436

635 $

Q1'23

30,342 $

1,894

306

0.9

$

0.1 $

3.3%

3.6%

1,937,248

14.8 $

163

60

492

574 $

Q2'23

25,209

1,712

448

0.8

0.2

3.3%

3.7%

1,970,617

15.3

148

75

486

550

$

$

$

$

2020

48,864 $

3,448

3,448

1.9

1.9

2.6%

2.6%

$

$

1,574,211

13.3 $

2021

104,689 $

4,890

4,890

3.2

3.2

3.3%

3.3%

2,124,677

LA GA

Total number of issuers with IOIs (4)

Custodial cash balance ($MM) (5)

(2) Key business metrics and other business metrics as of and for the full year and quarterly periods of 2021 and 2022 are based on actual results of operations; key business metrics and other business metrics

presented as of and for the year ended December 31, 2020 and for last-twelve-months (LTM) periods through the third quarter of 2021 are prepared on a pro-forma basis, which combines the metrics from Forge and

SharesPost's brokerage businesses as if the Shares Post acquisition had occurred at the beginning of the fiscal year 2020.

(3) Represents end of period value. Includes both CaaS and Alt IRA accounts.

(4) Number of distinct companies in whose shares at least one buy or sell IOI, or indication of interest, was created in this period.

(5) Custodial cash represents amounts on deposit with financial institutions for the benefit of the Company's custodial accounts.

$

$

14.3 $

2022

40,182

2,184

2,184

1.2

1.2

3.3%

3.3%

1,871,146

14.9

Forge

5View entire presentation