Crocs Results Presentation Deck

Financial Outlook

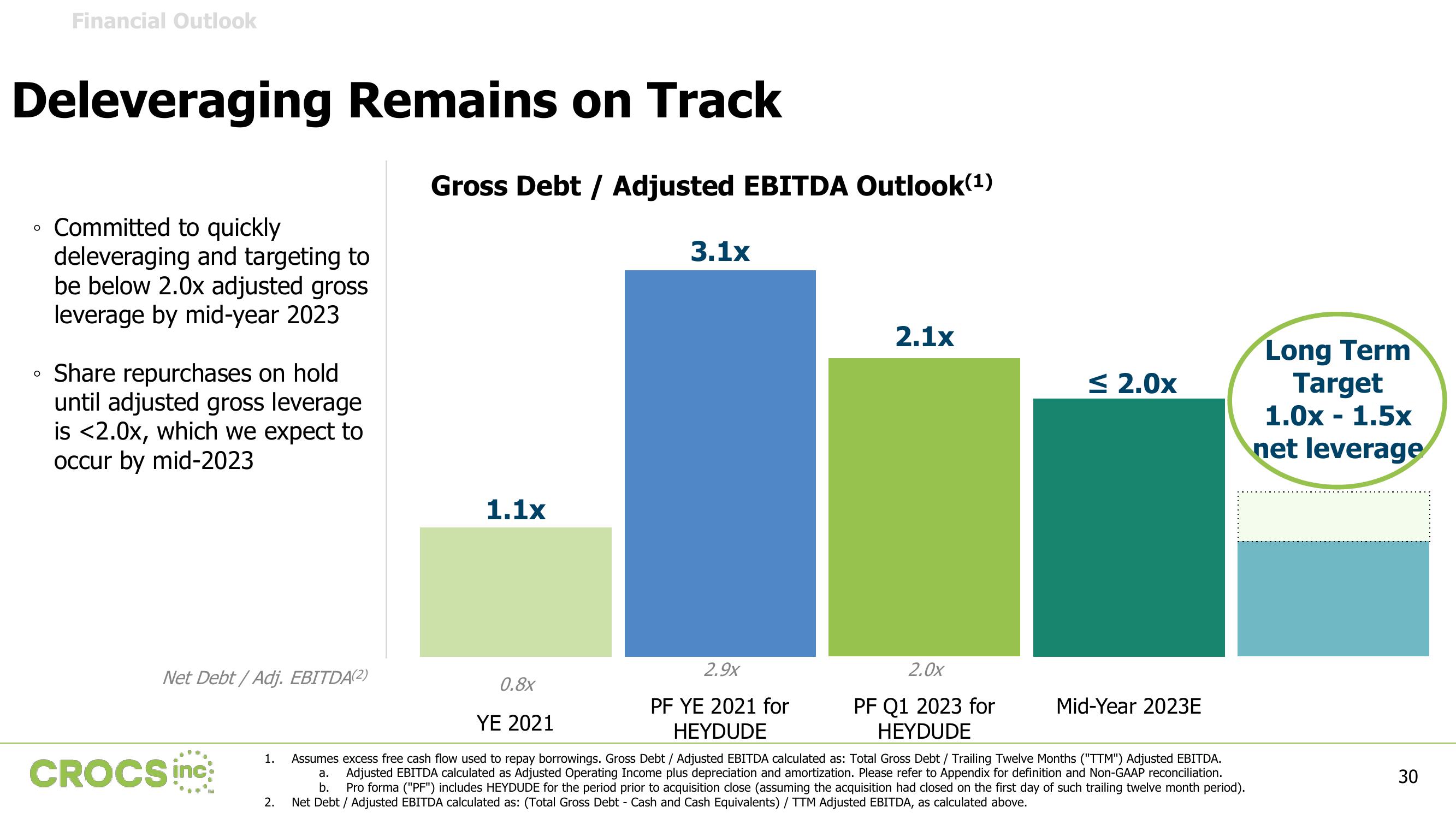

Deleveraging Remains on Track

O

• Committed to quickly

deleveraging and targeting to

be below 2.0x adjusted gross

leverage by mid-year 2023

O

Share repurchases on hold

until adjusted gross leverage

is <2.0x, which we expect to

occur by mid-2023

Net Debt/Adj. EBITDA(2)

CROCS inc

Gross Debt / Adjusted EBITDA Outlook(1)

1.1x

3.1x

2.9x

PF YE 2021 for

HEYDUDE

2.1x

2.0x

PF Q1 2023 for

HEYDUDE

≤ 2.0x

0.8x

YE 2021

1. Assumes excess free cash flow used to repay borrowings. Gross Debt / Adjusted EBITDA calculated as: Total Gross Debt / Trailing Twelve Months ("TTM") Adjusted EBITDA.

Adjusted EBITDA calculated as Adjusted Operating Income plus depreciation and amortization. Please refer to Appendix for definition and Non-GAAP reconciliation.

b. Pro forma ("PF") includes HEYDUDE for the period prior to acquisition close (assuming the acquisition had closed on the first day of such trailing twelve month period).

a.

2. Net Debt / Adjusted EBITDA calculated as: (Total Gross Debt - Cash and Cash Equivalents) / TTM Adjusted EBITDA, as calculated above.

Mid-Year 2023E

Long Term

Target

1.0x - 1.5x

net leverage

30View entire presentation