Kinnevik Results Presentation Deck

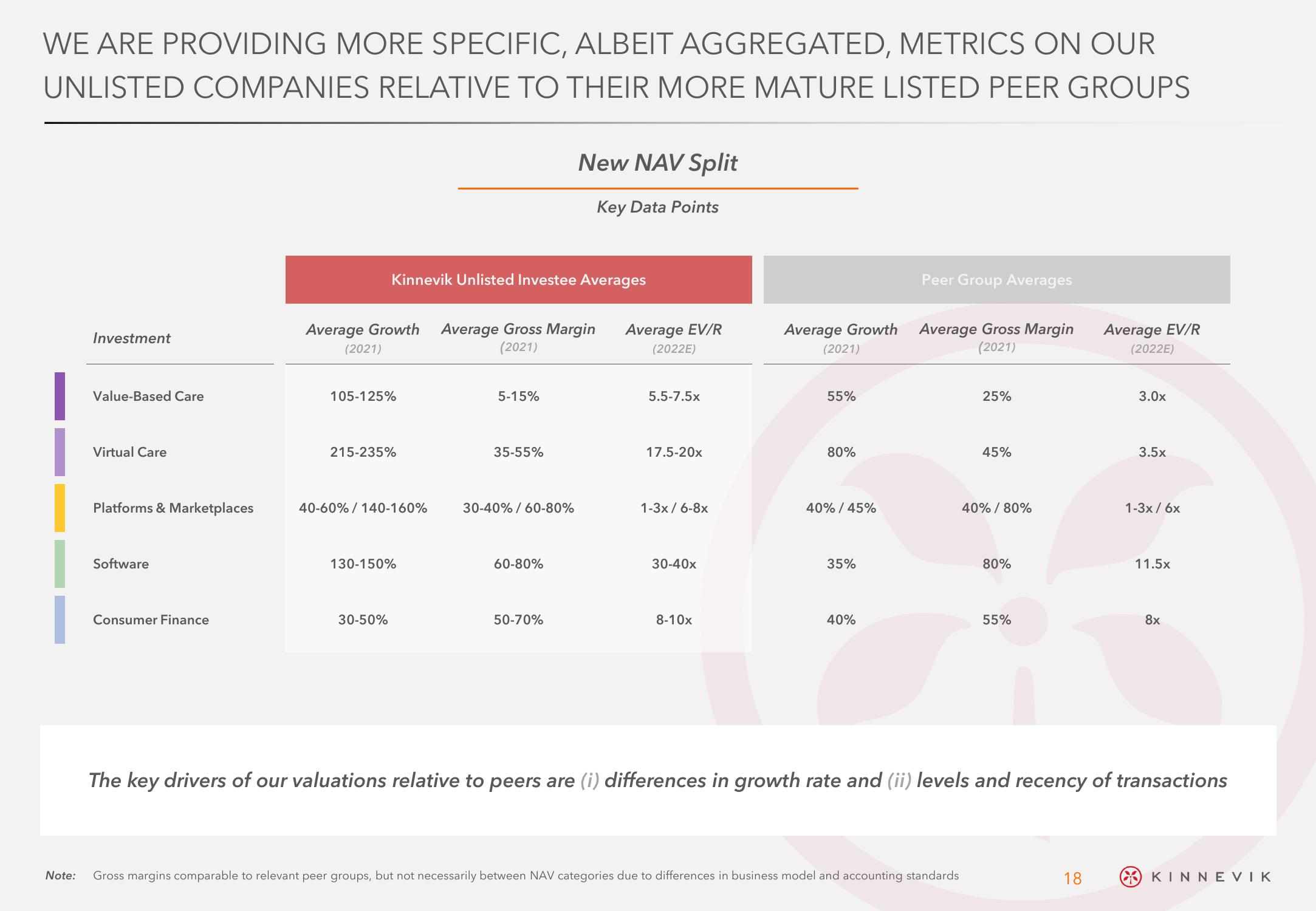

WE ARE PROVIDING MORE SPECIFIC, ALBEIT AGGREGATED, METRICS ON OUR

UNLISTED COMPANIES RELATIVE TO THEIR MORE MATURE LISTED PEER GROUPS

Note:

Investment

Value-Based Care

Virtual Care

Platforms & Marketplaces

Software

Consumer Finance

Average Growth

(2021)

Kinnevik Unlisted Investee Averages

105-125%

215-235%

40-60% / 140-160%

130-150%

30-50%

Average Gross Margin

(2021)

5-15%

35-55%

30-40% / 60-80%

New NAV Split

Key Data Points

60-80%

50-70%

Average EV/R

(2022E)

5.5-7.5x

17.5-20x

1-3x/6-8x

30-40x

8-10x

Average Growth

(2021)

55%

80%

40% / 45%

35%

40%

Peer Group Averages

Average Gross Margin

(2021)

25%

Gross margins comparable to relevant peer groups, but not necessarily between NAV categories due to differences in business model and accounting standards

45%

40% / 80%

80%

55%

Average EV/R

(2022E)

18

3.0x

3.5x

1-3x/6x

11.5x

The key drivers of our valuations relative to peers are (i) differences in growth rate and (ii) levels and recency of transactions

8x

KINNEVIKView entire presentation