Adtheorent SPAC Presentation Deck

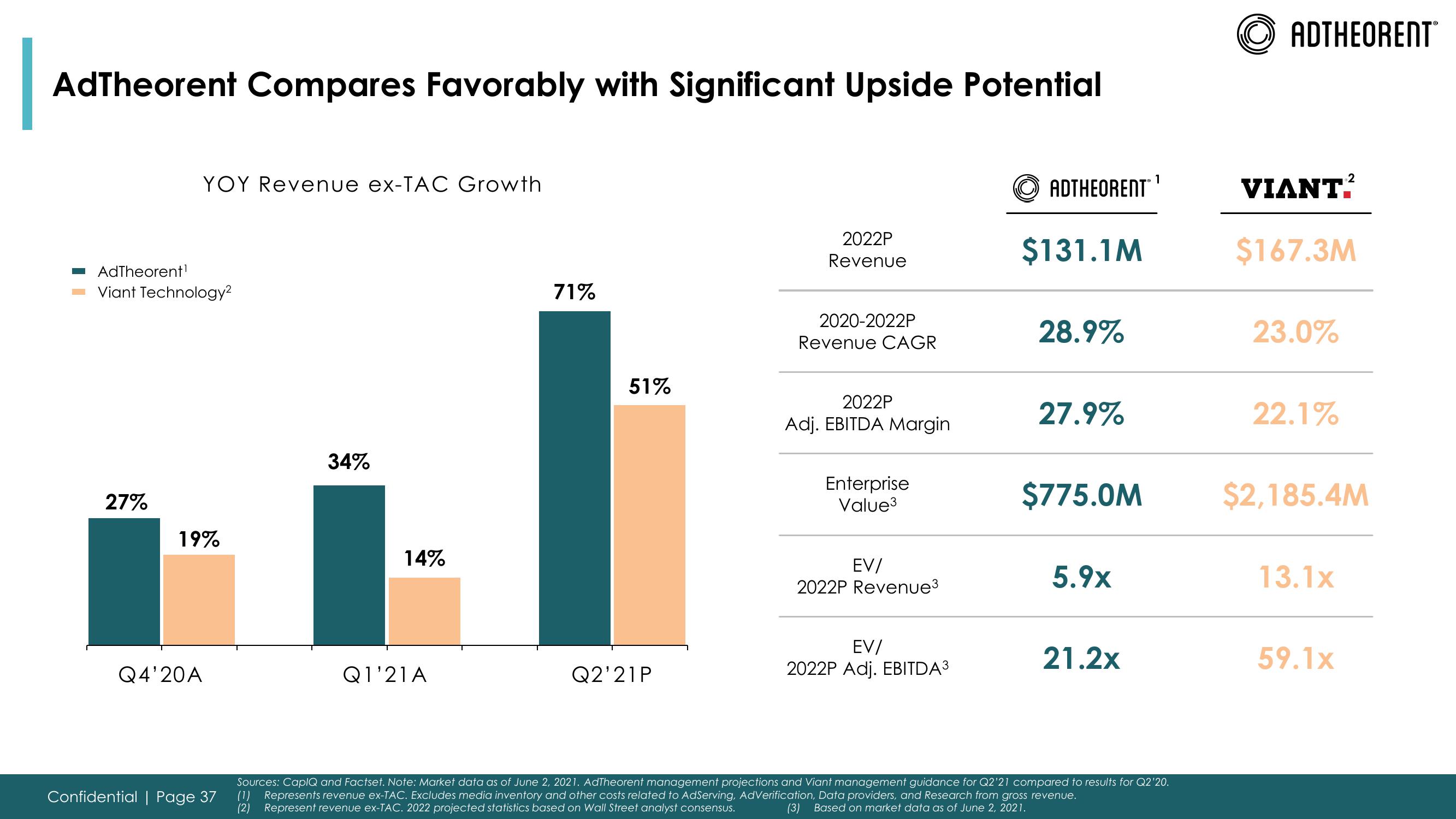

AdTheorent Compares Favorably with Significant Upside Potential

YOY Revenue ex-TAC Growth

AdTheorent¹

Viant Technology²

27%

19%

Q4'20A

Confidential | Page 37

34%

14%

Q1'21A

71%

51%

Q2'21P

2022P

Revenue

2020-2022P

Revenue CAGR

2022P

Adj. EBITDA Margin

Enterprise

Value³

EV/

2022P Revenue³

EV/

2022P Adj. EBITDA ³

ADTHEORENT

$131.1M

28.9%

27.9%

$775.0M

5.9x

21.2x

1

Sources: CapIQ and Factset. Note: Market data as of June 2, 2021. AdTheorent management projections and Viant management guidance for Q2'21 compared to results for Q2'20.

(1) Represents revenue ex-TAC. Excludes media inventory and other costs related to AdServing, AdVerification, Data providers, and Research from gross revenue.

(2) Represent revenue ex-TAC. 2022 projected statistics based on Wall Street analyst consensus.

(3) Based on market data as of June 2, 2021.

ADTHEORENT

VIANT.

$167.3M

23.0%

22.1%

$2,185.4M

13.1x

59.1xView entire presentation