Rippling Start Up Pitch Deck

Illustrative numbers shown, not actuals

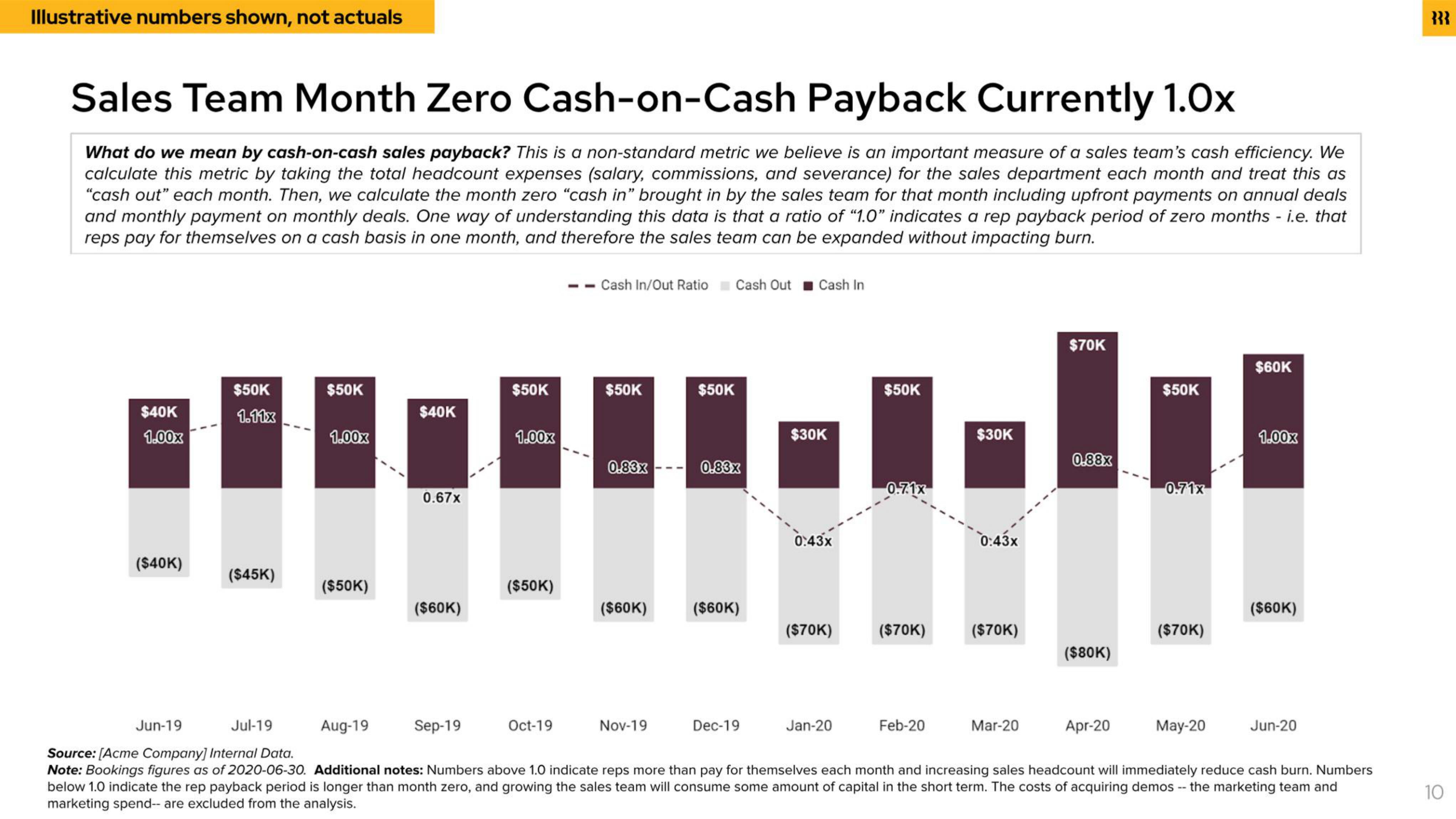

Sales Team Month Zero Cash-on-Cash Payback Currently 1.0x

What do we mean by cash-on-cash sales payback? This is a non-standard metric we believe is an important measure of a sales team's cash efficiency. We

calculate this metric by taking the total headcount expenses (salary, commissions, and severance) for the sales department each month and treat this as

"cash out" each month. Then, we calculate the month zero "cash in" brought in by the sales team for that month including upfront payments on annual deals

and monthly payment on monthly deals. One way of understanding this data is that a ratio of "1.0" indicates a rep payback period of zero months - i.e. that

reps pay for themselves on a cash basis in one month, and therefore the sales team can be expanded without impacting burn.

$40K

1.00x

($40K)

$50K

1.11x

($45K)

Jul-19

$50K

1.00x

($50K)

Aug-19

$40K

0.67x

($60K)

Sep-19

$50K

1.00x

($50K)

Oct-19

- Cash In/Out Ratio Cash Out Cash In

$50K

0.83x

$50K

Nov-19

0.83x

($60K) ($60K)

Dec-19

$30K

0:43x

($70K)

Jan-20

$50K

0.7.1x

($70K)

Feb-20

$30K

0:43x

($70K)

Mar-20

$70K

0.88x

($80K)

Apr-20

$50K

0.71x

($70K)

Jun-19

Source: [Acme Company] Internal Data.

Note: Bookings figures as of 2020-06-30. Additional notes: Numbers above 1.0 indicate reps more than pay for themselves each month and increasing sales headcount will immediately reduce cash burn. Numbers

below 1.0 indicate the rep payback period is longer than month zero, and growing the sales team will consume some amount of capital in the short term. The costs of acquiring demos -- the marketing team and

marketing spend-- are excluded from the analysis.

May-20

$60K

1.00x

($60K)

Jun-20

}}}

10View entire presentation