Gorilla Technology Group SPAC Presentation Deck

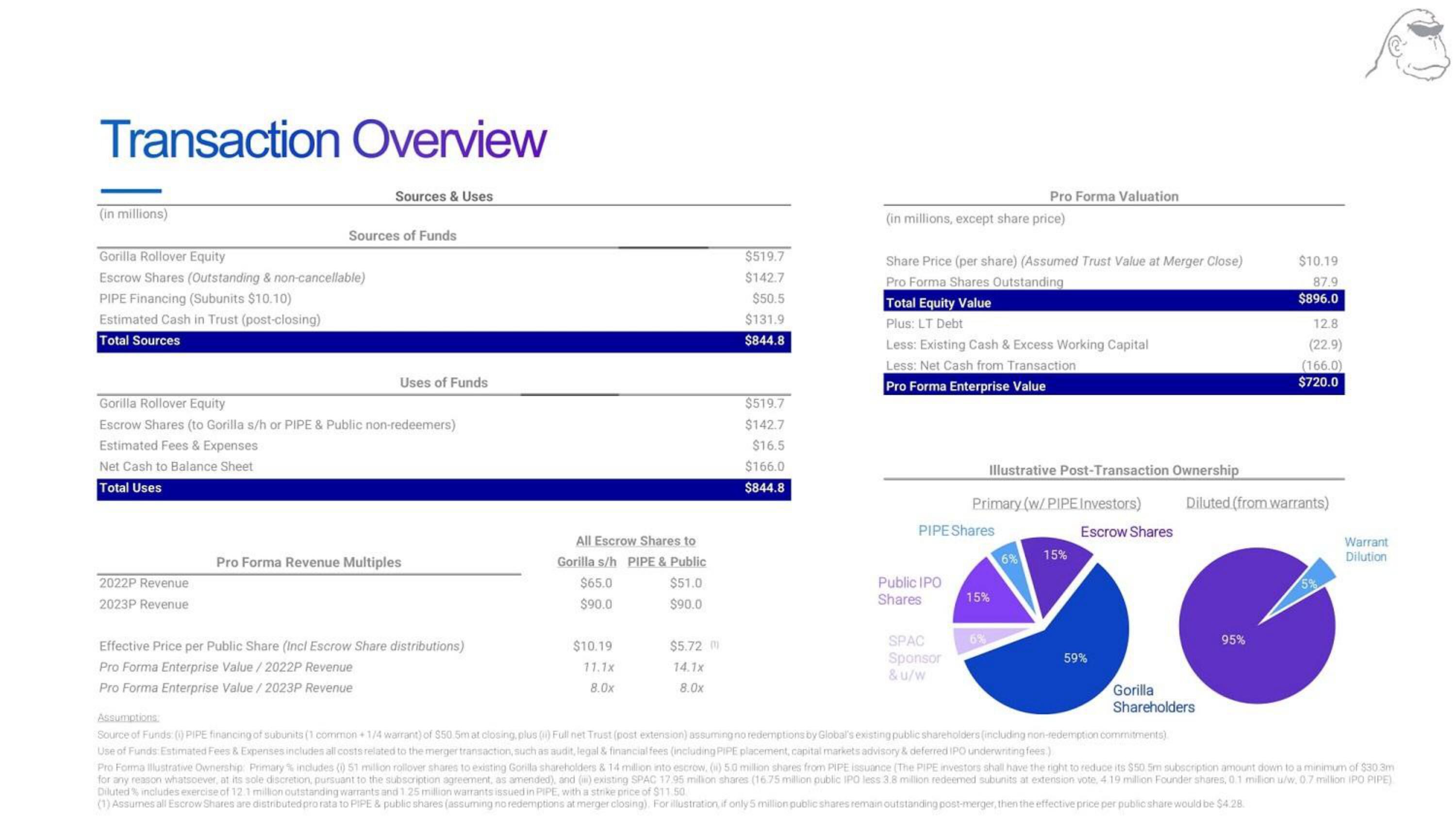

Transaction Overview

(in millions)

Gorilla Rollover Equity

Escrow Shares (Outstanding & non-cancellable)

PIPE Financing (Subunits $10.10)

Estimated Cash in Trust (post-closing)

Total Sources

Sources & Uses

Sources of Funds

2022P Revenue

2023P Revenue

Uses of Funds

Gorilla Rollover Equity

Escrow Shares (to Gorilla s/h or PIPE & Public non-redeemers)

Estimated Fees & Expenses

Net Cash to Balance Sheet

Total Uses

Pro Forma Revenue Multiples

Effective Price per Public Share (Incl Escrow Share distributions)

Pro Forma Enterprise Value/2022P Revenue

Pro Forma Enterprise Value/2023P Revenue

All Escrow Shares to

Gorilla s/h PIPE & Public

$51.0

$90.0

$65.0

$90.0

$10.19

11.1x

8.0x

$5.72 M

14.1x

8.0x

$519.7

$142.7

$50.5

$131.9

$844.8

$519.7

$142.7

$16.5

$166.0

$844.8

(in millions, except share price)

Share Price (per share) (Assumed Trust Value at Merger Close)

Pro Forma Shares Outstanding

Total Equity Value

Plus: LT Debt

Less: Existing Cash & Excess Working Capital

Less: Net Cash from Transaction

Pro Forma Enterprise Value

Pro Forma Valuation

PIPE Shares

Public IPO

Shares

SPAC

Sponsor

& U/W

Illustrative Post-Transaction Ownership

Primary (w/PIPE Investors) Diluted (from warrants)

Escrow Shares

15%

15%

6%

59%

Gorilla

Shareholders

$10.19

87.9

$896.0

12.8

(22.9)

(166.0)

$720.0

95%

5%

Warrant

Dilution

Assumptions

Source of Funds: (i) PIPE financing of subunits (1 common +1/4 warrant) of $50 5m at closing, plus (1) Full net Trust (post extension) assuming no redemptions by Global's existing public shareholders (including non-redemption commitments)

Use of Funds Estimated Fees & Expenses includes all costs related to the merger transaction, such as audit, legal & financial fees (including PIPE placement, capital markets advisory & deferred IPO underwriting fees.)

Pro Forma Illustrative Ownership: Primary % includes (i) 51 million rollover shares to existing Gorilla shareholders & 14 million into escrow, (ii) 5.0 million shares from PIPE issuance (The PIPE investors shall have the right to reduce its $50.5m subscription amount down to a minimum of $30.3m

for any reason whatsoever, at its sole discretion, pursuant to the subscription agreement, as amended), and (ii) existing SPAC 17.95 million shares (16.75 million public IPO less 3.8 million redeemed subunits at extension vote, 4.19 million Founder shares, 0.1 million u/w. 0.7 million IPO PIPE)

Diluted % includes exercise of 12.1 million outstanding warrants and 1.25 million warrants issued in PIPE, with a strike price of $11.50

(1) Assumes all Escrow Shares are distributed pro rata to PIPE & public shares (assuming no redemptions at merger closing). For illustration, if only 5 million public shares remain outstanding post-merger, then the effective price per public share would be $4.28.View entire presentation