Ford Investor Conference Presentation Deck

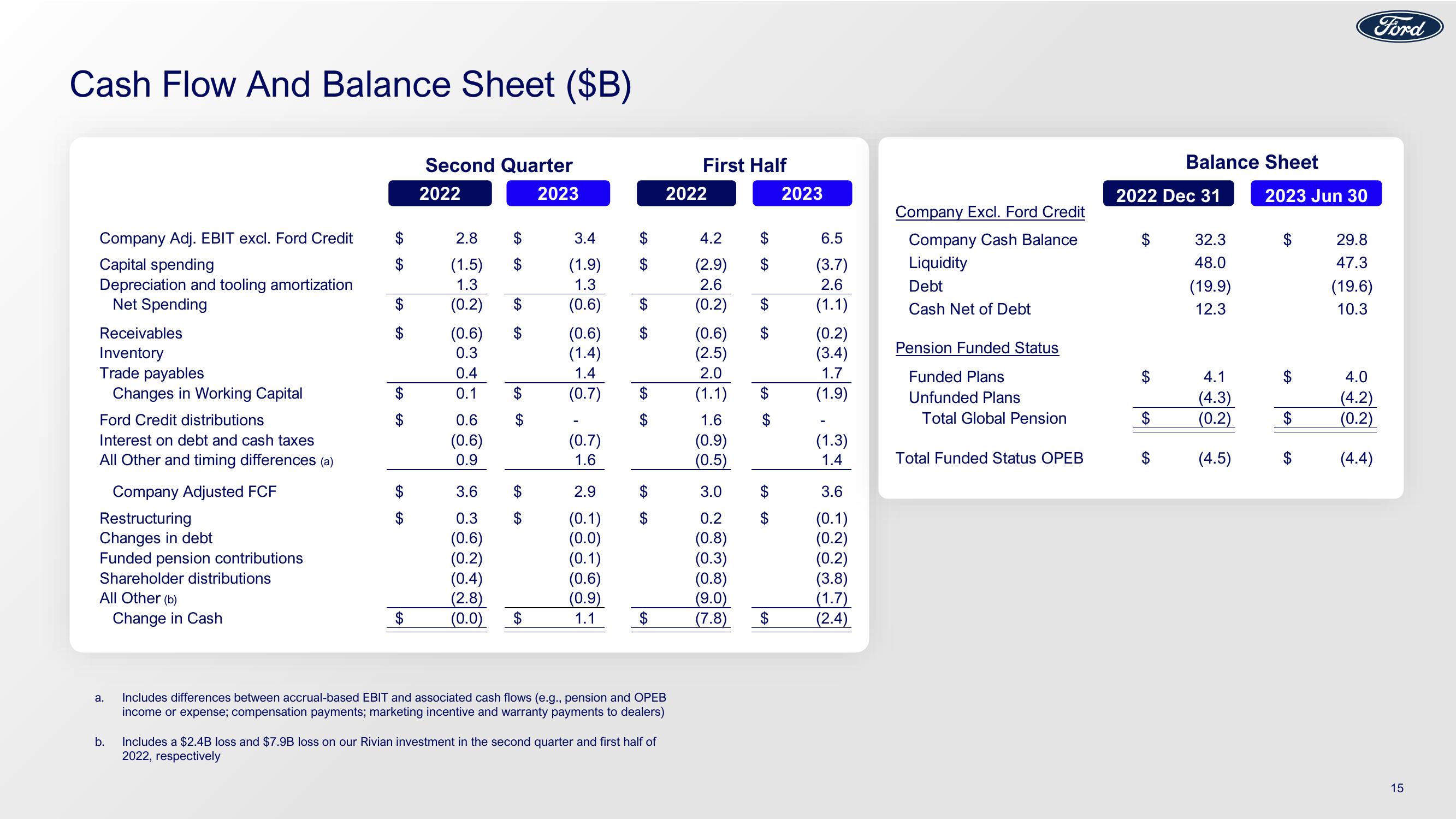

Cash Flow And Balance Sheet ($B)

Company Adj. EBIT excl. Ford Credit

Capital spending

Depreciation and tooling amortization

Net Spending

Receivables

Inventory

Trade payables

Changes in Working Capital

Ford Credit distributions

Interest on debt and cash taxes

All Other and timing differences (a)

Company Adjusted FCF

Restructuring

Changes in debt

Funded pension contributions

Shareholder distributions

All Other (b)

a.

b.

Change in Cash

6 6

SA

$

$

Second Quarter

2022

2023

2.8

(1.5)

1.3

(0.2)

(0.6)

0.3

0.4

0.1

0.6

(0.6)

0.9

$

$

3.6

$

0.3 $

(0.6)

(0.2)

(0.4)

(2.8)

(0.0)

$

3.4

(1.9)

1.3

(0.6)

(0.6)

(1.4)

1.4

(0.7)

(0.7)

1.6

2.9

(0.1)

(0.0)

(0.1)

(0.6)

(0.9)

1.1

LA GA

A

$

$

Includes differences between accrual-based EBIT and associated cash flows (e.g., pension and OPEB

income or expense; compensation payments; marketing incentive and warranty payments to dealers)

Includes a $2.4B loss and $7.9B loss on our Rivian investment in the second quarter and first half of

2022, respectively

First Half

2022

4.2

(2.9)

2.6

(0.2)

(0.6)

(2.5)

2.0

(1.1)

1.6

(0.9)

(0.5)

3.0

0.2

(0.8)

(0.3)

(0.8)

(9.0)

(7.8)

LA

2023

6.5

(3.7)

2.6

(1.1)

(0.2)

(3.4)

1.7

(1.9)

(1.3)

1.4

3.6

(0.1)

(0.2)

(0.2)

(3.8)

(1.7)

(2.4)

Company Excl. Ford Credit

Company Cash Balance

Liquidity

Debt

Cash Net of Debt

Pension Funded Status

Funded Plans

Unfunded Plans

Total Global Pension

Total Funded Status OPEB

Balance Sheet

2022 Dec 31

$

32.3

48.0

(19.9)

12.3

4.1

(4.3)

(0.2)

(4.5)

2023 Jun 30

$

29.8

47.3

(19.6)

10.3

4.0

(4.2)

(0.2)

(4.4)

Ford

15View entire presentation