Verint SPAC Presentation Deck

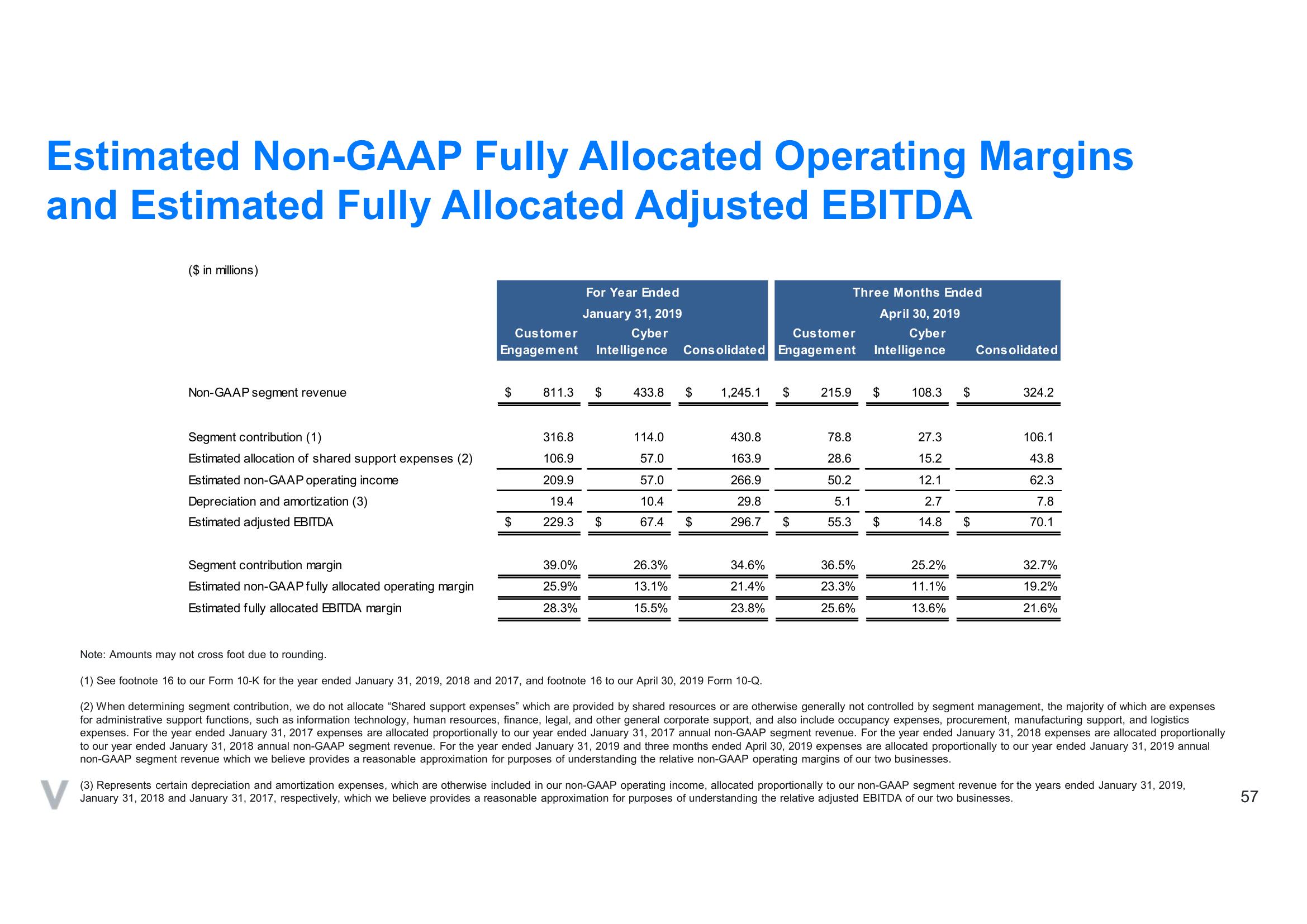

Estimated Non-GAAP Fully Allocated Operating Margins

and Estimated Fully Allocated Adjusted EBITDA

($ in millions)

Non-GAAP segment revenue

Segment contribution (1)

Estimated allocation of shared support expenses (2)

Estimated non-GAAP operating income

Depreciation and amortization (3)

Estimated adjusted EBITDA

Segment contribution margin

Estimated non-GAAP fully allocated operating margin

Estimated fully allocated EBITDA margin

$

Customer

Customer

Engagement Intelligence Consolidated Engagement

$

For Year Ended

January 31, 2019

Cyber

811.3 $ 433.8 $ 1,245.1 $ 215.9

316.8

106.9

209.9

19.4

229.3

39.0%

25.9%

28.3%

$

114.0

57.0

57.0

10.4

67.4 $

26.3%

13.1%

15.5%

430.8

163.9

266.9

29.8

296.7 $

34.6%

21.4%

23.8%

Three Months Ended

April 30, 2019

Cyber

Intelligence

78.8

28.6

50.2

5.1

55.3

36.5%

23.3%

25.6%

$

$

108.3 $

27.3

15.2

12.1

2.7

14.8 $

25.2%

11.1%

13.6%

Consolidated

324.2

106.1

43.8

62.3

7.8

70.1

32.7%

19.2%

21.6%

Note: Amounts may not cross foot due to rounding.

(1) See footnote 16 to our Form 10-K for the year ended January 31, 2019, 2018 and 2017, and footnote 16 to our April 30, 2019 Form 10-Q.

(2) When determining segment contribution, we do not allocate "Shared support expenses" which are provided by shared resources or are otherwise generally not controlled by segment management, the majority of which are expenses

for administrative support functions, such as information technology, human resources, finance, legal, and other general corporate support, and also include occupancy expenses, procurement, manufacturing support, and logistics

expenses. For the year ended January 31, 2017 expenses are allocated proportionally to our year ended January 31, 2017 annual non-GAAP segment revenue. For the year ended January 31, 2018 expenses are allocated proportionally

to our year ended January 31, 2018 annual non-GAAP segment revenue. For the year ended January 31, 2019 and three months ended April 30, 2019 expenses are allocated proportionally to our year ended January 31, 2019 annual

non-GAAP segment revenue which we believe provides a reasonable approximation for purposes of understanding the relative non-GAAP operating margins of our two businesses.

(3) Represents certain depreciation and amortization expenses, which are otherwise included in our non-GAAP operating income, allocated proportionally to our non-GAAP segment revenue for the years ended January 31, 2019,

January 31, 2018 and January 31, 2017, respectively, which we believe provides a reasonable approximation for purposes of understanding the relative adjusted EBITDA of our two businesses.

57View entire presentation