Barclays Credit Presentation Deck

STRATEGY, TARGETS

& GUIDANCE

Reg min

3.775%

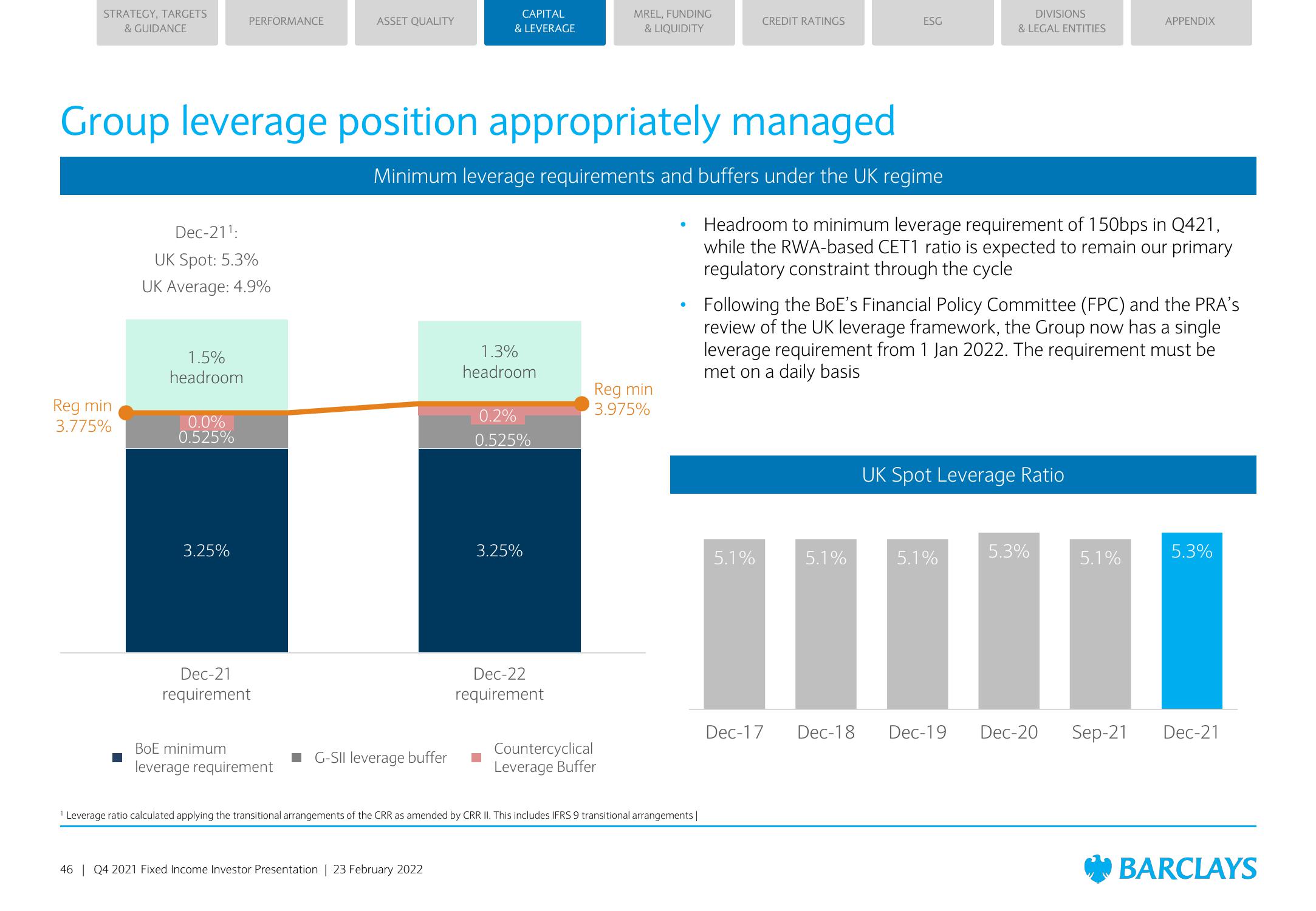

Dec-21¹:

UK Spot: 5.3%

UK Average: 4.9%

1.5%

headroom

PERFORMANCE

0.0%

0.525%

3.25%

Group leverage position appropriately managed

Minimum leverage requirements and buffers under the UK regime

Dec-21

requirement

ASSET QUALITY

BoE minimum

leverage requirement

G-SII leverage buffer

CAPITAL

& LEVERAGE

46 | Q4 2021 Fixed Income Investor Presentation | 23 February 2022

1.3%

headroom

0.2%

0.525%

3.25%

Dec-22

requirement

MREL, FUNDING

& LIQUIDITY

Reg min

3.975%

Countercyclical

Leverage Buffer

●

¹ Leverage ratio calculated applying the transitional arrangements of the CRR as amended by CRR II. This includes IFRS 9 transitional arrangements |

CREDIT RATINGS

ESG

5.1%

Headroom to minimum leverage requirement of 150bps in Q421,

while the RWA-based CET1 ratio is expected to remain our primary

regulatory constraint through the cycle

5.1%

DIVISIONS

& LEGAL ENTITIES

Following the BoE's Financial Policy Committee (FPC) and the PRA's

review of the UK leverage framework, the Group now has a single

leverage requirement from 1 Jan 2022. The requirement must be

met on a daily basis

UK Spot Leverage Ratio

5.1%

5.3%

APPENDIX

5.1%

Dec-17 Dec-18 Dec-19 Dec-20 Sep-21

5.3%

Dec-21

BARCLAYSView entire presentation