XP Inc Results Presentation Deck

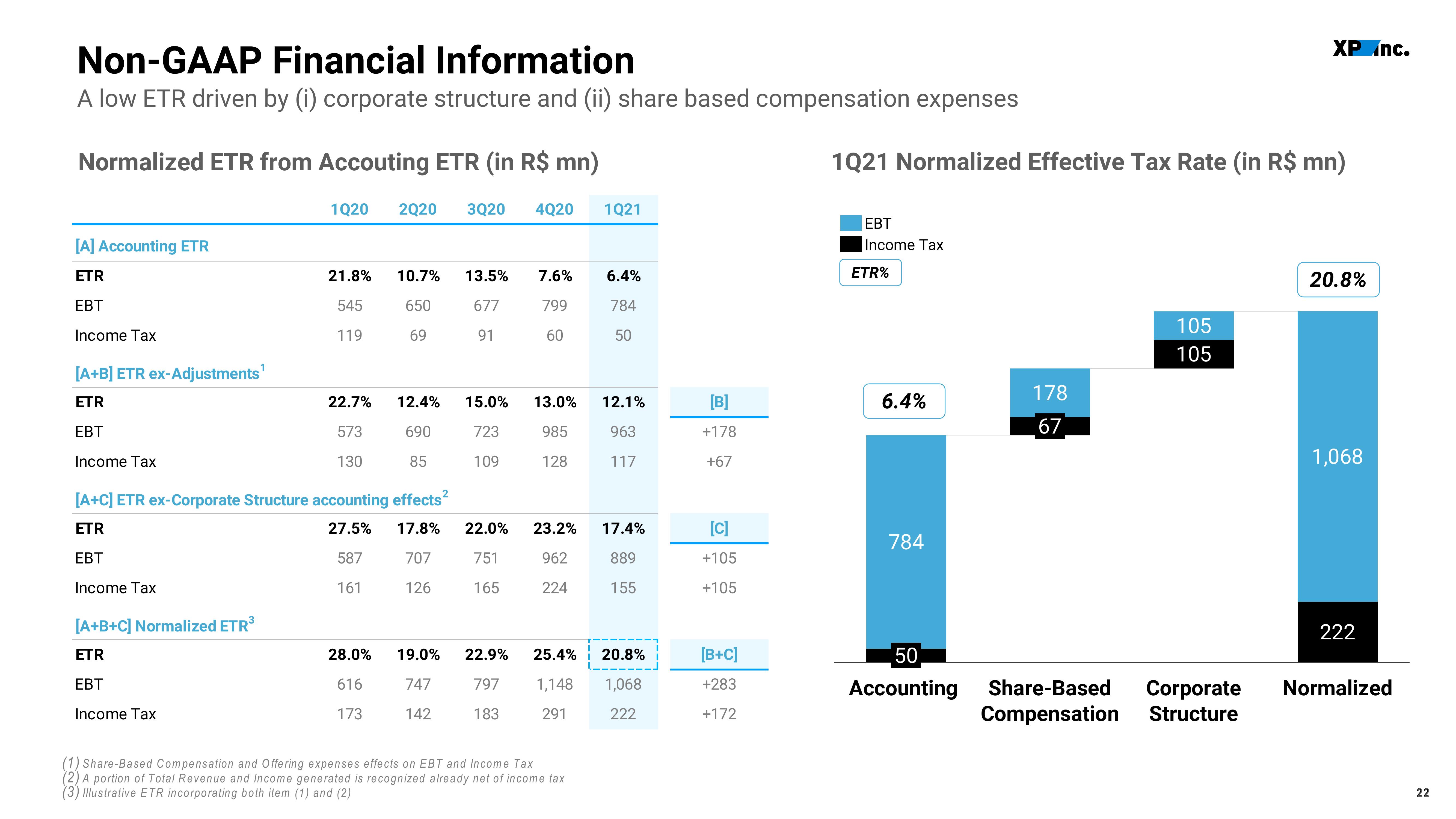

Non-GAAP Financial Information

A low ETR driven by (i) corporate structure and (ii) share based compensation expenses

Normalized ETR from Accouting ETR (in R$ mn)

[A] Accounting ETR

ETR

EBT

Income Tax

[A+B] ETR ex-Adjustments¹

ETR

EBT

Income Tax

1Q20

[A+B+C] Normalized ETR³

ETR

EBT

Income Tax

21.8%

545

119

22.7%

573

130

2Q20 3Q20 4Q20 1Q21

28.0%

616

173

10.7%

650

69

2

[A+C] ETR ex-Corporate Structure accounting effects²

ETR

27.5%

EBT

587

Income Tax

161

12.4%

690

85

13.5% 7.6% 6.4%

677

799

784

91

60

50

15.0% 13.0% 12.1%

723

985

963

109

128

117

17.8% 22.0% 23.2% 17.4%

707

751

962

889

126

165

224

155

19.0% 22.9%

747

797

142

183

20.8%

25.4%

1,148 1,068

291

222

(1) Share-Based Compensation and Offering expenses effects on EBT and Income Tax

(2) A portion of Total Revenue and Income generated is recognized already net of income tax

(3) Illustrative ETR incorporating both item (1) and (2)

[B]

+178

+67

[C]

+105

+105

[B+C]

+283

+172

1Q21 Normalized Effective Tax Rate (in R$ mn)

EBT

Income Tax

ETR%

6.4%

784

178

67

105

105

XP nc.

50

Accounting Share-Based Corporate

Compensation Structure

20.8%

1,068

222

Normalized

22View entire presentation