Cerberus Global NPL Fund, L.P.

Main Target Geographies

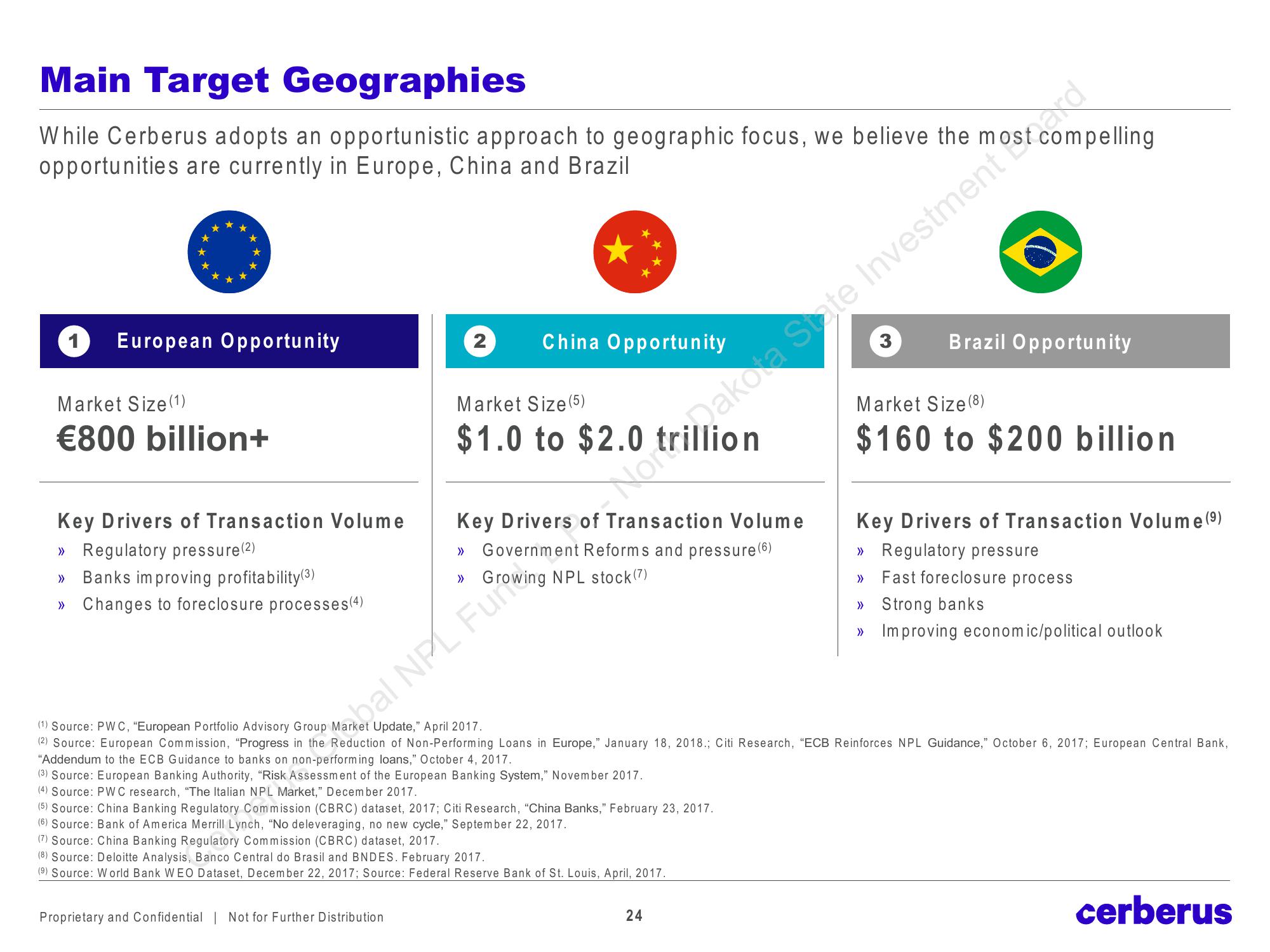

While Cerberus adopts an opportunistic approach to geographic focus, we believe the

opportunities are currently in Europe, China and Brazil

1 European Opportunity

Market Size (1)

€800 billion+

Key Drivers of Transaction Volume

>> Regulatory pressure (2)

>> Banks improving profitability (3)

>> Changes to foreclosure processes(4)

2 China Opportunity

Market Size (5)

$1.0 to $2.0

Proprietary and Confidential | Not for Further Distribution

Key Drivers of Transaction Volume

» Government Reforms and pressure (6)

>>

bal NPL FOwing NPL stock (7)

of Norimakota State Investment alling

ad

(5) Source: China Banking Regulatory Commission (CBRC) dataset, 2017; Citi Research, "China Banks," February 23, 2017.

(6) Source: Bank of America Merrill Lynch, "No deleveraging, no new cycle," September 22, 2017.

(7) Source: China Banking Regulatory Commission (CBRC) dataset, 2017.

(8) Source: Deloitte Analysis, Banco Central do Brasil and BNDES. February 2017.

(9) Source: World Bank WEO Dataset, December 22, 2017; Source: Federal Reserve Bank of St. Louis, April, 2017.

3

Brazil Opportunity

24

Market Size (8)

$160 to $200 billion

(1) Source: PWC, "European Portfolio Advisory Group Market Update," April 2017.

(2) Source: European Commission, "Progress in the Reduction of Non-Performing Loans in Europe," January 18, 2018.; Citi Research, "ECB Reinforces NPL Guidance," October 6, 2017; European Central Bank,

"Addendum to the ECB Guidance to banks on non-performing loans," October 4, 2017.

(3) Source: European Banking Authority, "Risk Assessment of the European Banking System," November 2017.

(4) Source: PWC research, "The Italian NPL Market," December 2017.

Key Drivers of Transaction Volume (⁹)

>> Regulatory pressure

>>>

>> Strong banks

» Improving economic/political outlook

Fast foreclosure process

cerberusView entire presentation