KKR Real Estate Finance Trust Investor Presentation Deck

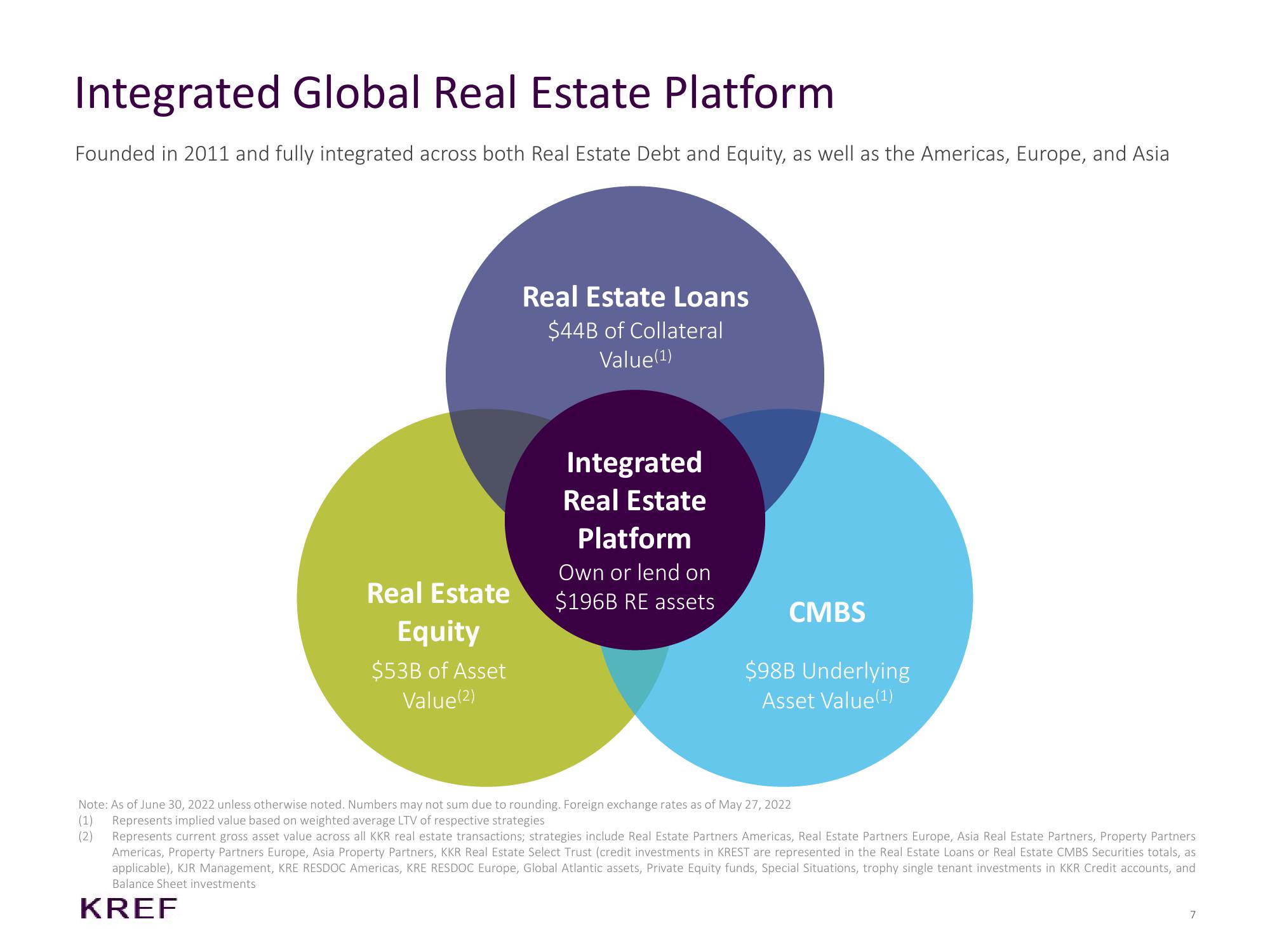

Integrated Global Real Estate Platform

Founded in 2011 and fully integrated across both Real Estate Debt and Equity, as well as the Americas, Europe, and Asia

Real Estate

Equity

$53B of Asset

Value (2)

Real Estate Loans

$44B of Collateral

Value(¹)

Integrated

Real Estate

Platform

Own or lend on

$196B RE assets

CMBS

$98B Underlying

Asset Value (¹)

Note: As of June 30, 2022 unless otherwise noted. Numbers may not sum due to rounding. Foreign exchange rates as of May 27, 2022

(1) Represents implied value based on weighted average LTV of respective strategies

(2)

Represents current gross asset value across all KKR real estate transactions; strategies include Real Estate Partners Americas, Real Estate Partners Europe, Asia Real Estate Partners, Property Partners

Americas, Property Partners Europe, Asia Property Partners, KKR Real Estate Select Trust (credit investments in KREST are represented in the Real Estate Loans or Real Estate CMBS Securities totals, as

applicable), KJR Management, KRE RESDOC Americas, KRE RESDOC Europe, Global Atlantic assets, Private Equity funds, Special Situations, trophy single tenant investments in KKR Credit accounts, and

Balance Sheet investments

KREF

7View entire presentation