Certara Investor Day Presentation Deck

2022 Outlook

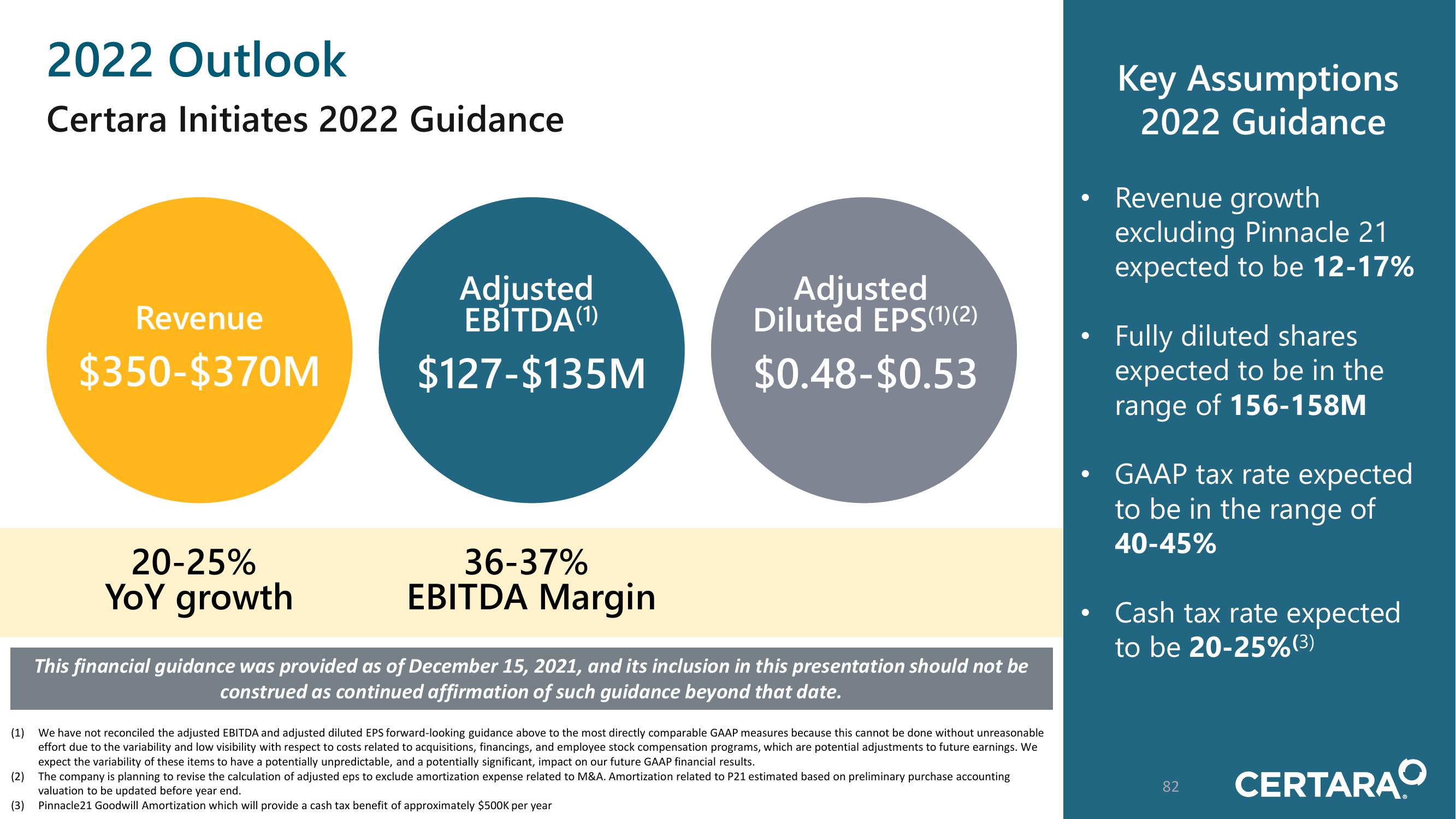

Certara Initiates 2022 Guidance

Revenue

$350-$370M

20-25%

YoY growth

Adjusted

EBITDA (¹)

$127-$135M

36-37%

EBITDA Margin

Adjusted

Diluted EPS(1)(2)

$0.48-$0.53

This financial guidance was provided as of December 15, 2021, and its inclusion in this presentation should not be

construed as continued affirmation of such guidance beyond that date.

(1)

We have not reconciled the adjusted EBITDA and adjusted diluted EPS forward-looking guidance above to the most directly comparable GAAP measures because this cannot be done without unreasonable

effort due to the variability and low visibility with respect to costs related to acquisitions, financings, and employee stock compensation programs, which are potential adjustments to future earnings. We

expect the variability of these items to have a potentially unpredictable, and a potentially significant, impact on our future GAAP financial results.

(2)

The company is planning to revise the calculation of adjusted eps to exclude amortization expense related to M&A. Amortization related to P21 estimated based on preliminary purchase accounting

valuation to be updated before year end.

(3) Pinnacle21 Goodwill Amortization which will provide a cash tax benefit of approximately $500K per year

Key Assumptions

2022 Guidance

Revenue growth

excluding Pinnacle 21

expected to be 12-17%

Fully diluted shares

expected to be in the

range of 156-158M

GAAP tax rate expected

to be in the range of

40-45%

Cash tax rate expected

to be 20-25%(3)

82

CERTARAOView entire presentation