Blackwells Capital Activist Presentation Deck

BLACKWELLS APPROACH TO WPT

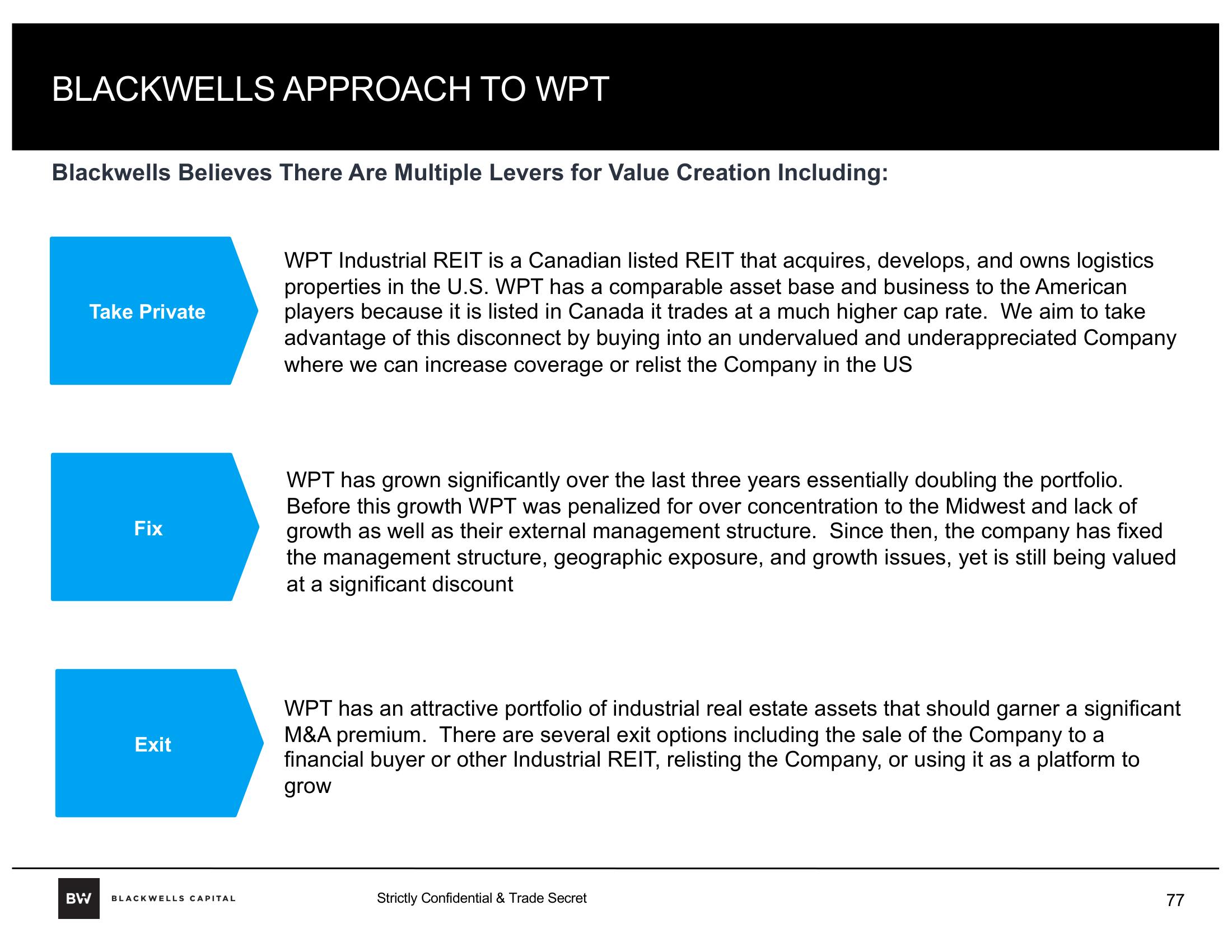

Blackwells Believes There Are Multiple Levers for Value Creation Including:

Take Private

BW

Fix

Exit

BLACKWELLS CAPITAL

WPT Industrial REIT is a Canadian listed REIT that acquires, develops, and owns logistics

properties in the U.S. WPT has a comparable asset base and business to the American

players because it is listed in Canada it trades at a much higher cap rate. We aim to take

advantage of this disconnect by buying into an undervalued and underappreciated Company

where we can increase coverage or relist the Company in the US

WPT has grown significantly over the last three years essentially doubling the portfolio.

Before this growth WPT was penalized for over concentration to the Midwest and lack of

growth as well as their external management structure. Since then, the company has fixed

the management structure, geographic exposure, and growth issues, yet is still being valued

at a significant discount

WPT has an attractive portfolio of industrial real estate assets that should garner a significant

M&A premium. There are several exit options including the sale of the Company to a

financial buyer or other Industrial REIT, relisting the Company, or using it as a platform to

grow

Strictly Confidential & Trade Secret

77View entire presentation