Paysafe SPAC Presentation Deck

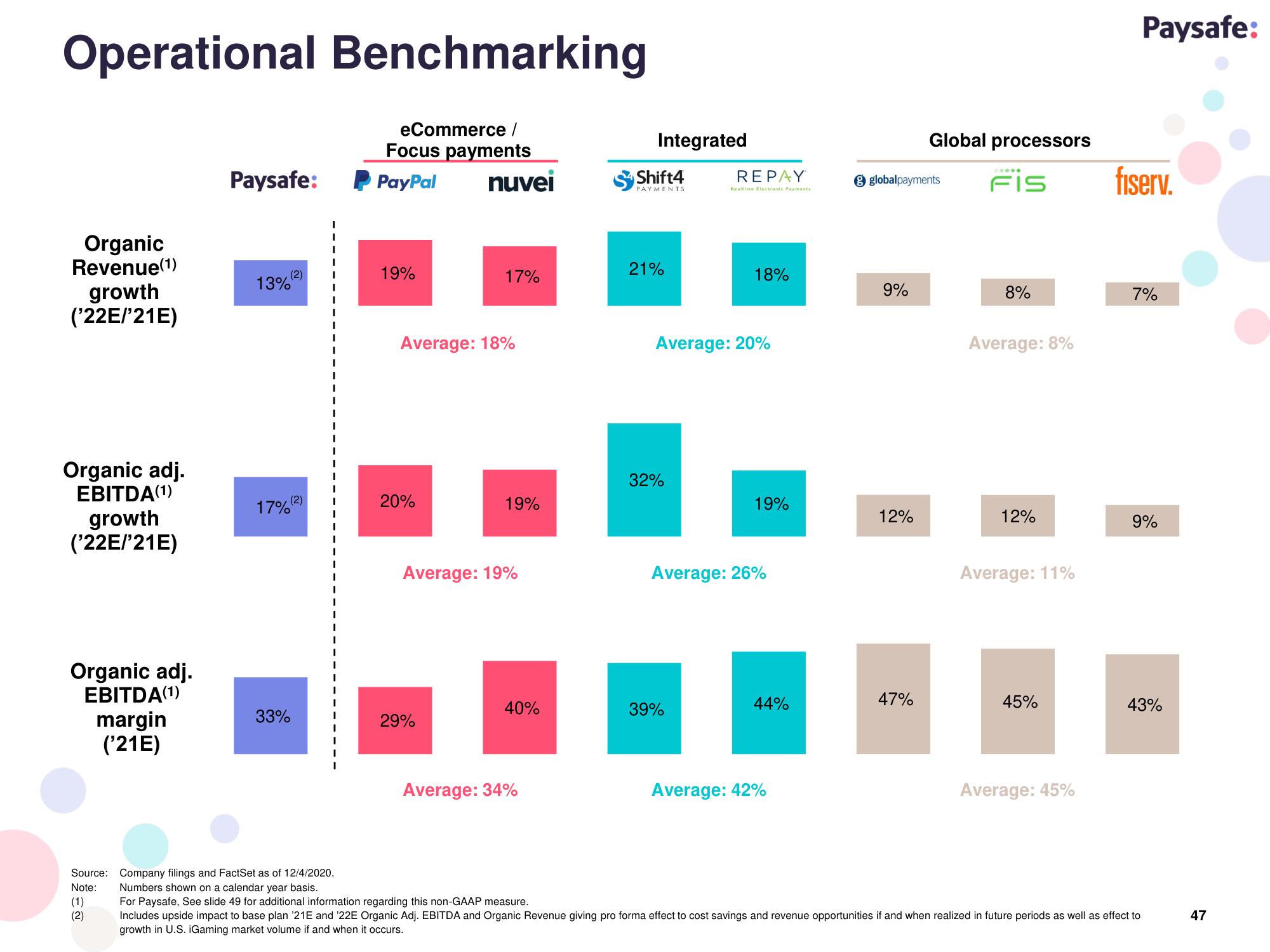

Operational Benchmarking

eCommerce /

Focus payments

PayPal

Organic

Revenue(1)

('22E/'21E)

Organic adj.

EBITDA(¹)

growth

('22E/'21E)

Organic adj.

EBITDA(1)

margin

('21E)

Paysafe:

(1)

(2)

13%

17%

33%

(2)

(2)

I

I

I

I

I

1

1

1

I

I

1

I

I

I

I

I

I

I

I

I

Source: Company filings and FactSet as of 12/4/2020.

Note: Numbers shown on a calendar year basis.

19%

20%

nuvei

Average: 18%

17%

29%

19%

Average: 19%

40%

Average: 34%

Integrated

Shift4

21%

32%

REPAY

Realtime Electronic Payments

Average: 20%

18%

39%

19%

Average: 26%

44%

Average: 42%

globalpayments

9%

12%

Global processors

Fis

47%

8%

Average: 8%

12%

Average: 11%

45%

Average: 45%

Paysafe:

fiserv.

7%

9%

43%

For Paysafe, See slide 49 for additional information regarding this non-GAAP measure.

Includes upside impact to base plan '21E and '22E Organic Adj. EBITDA and Organic Revenue giving pro forma effect to cost savings and revenue opportunities if and when realized in future periods as well as effect to

growth in U.S. iGaming market volume if and when it occurs.

47View entire presentation