PJT Partners Investment Banking Pitch Book

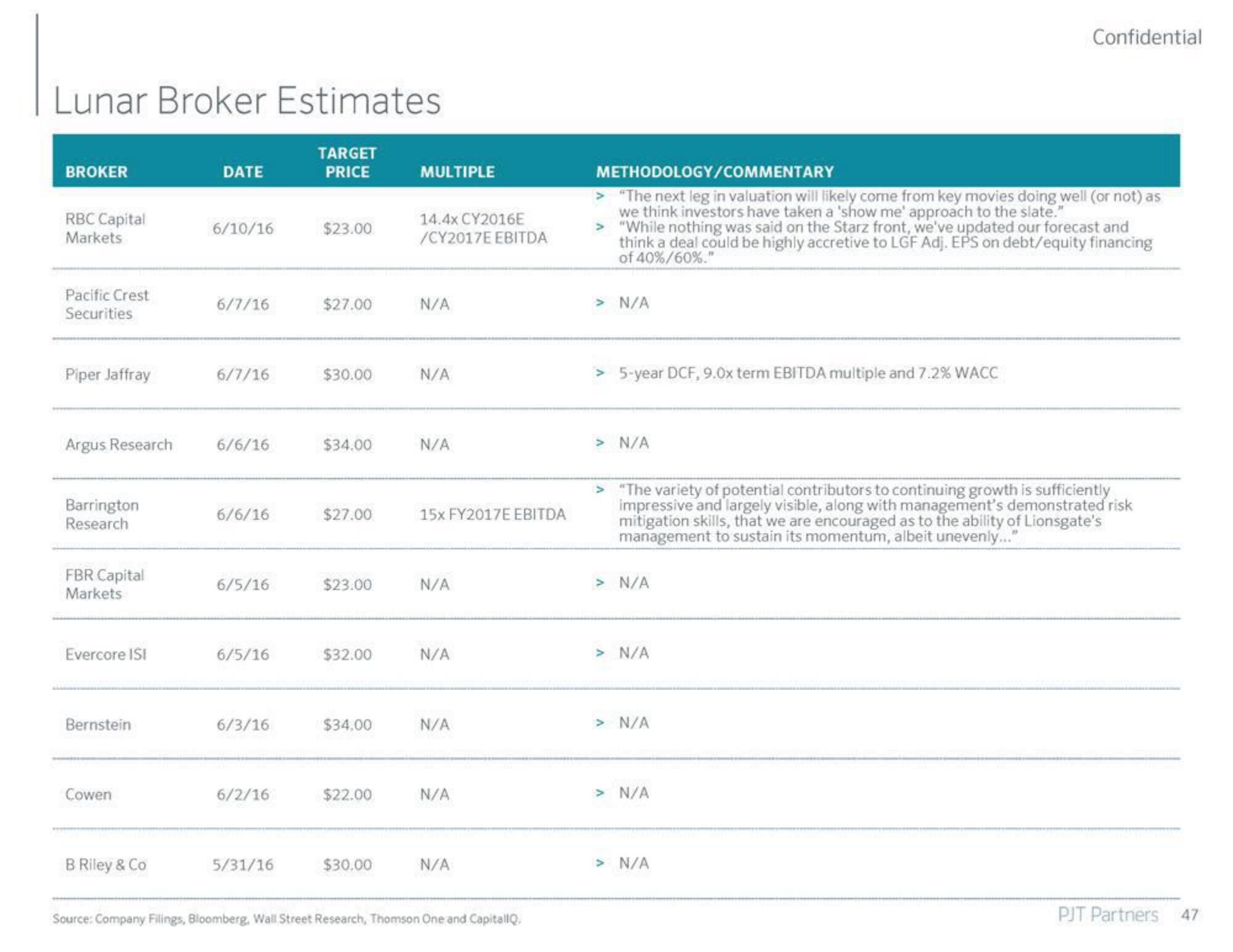

Lunar Broker Estimates

TARGET

PRICE

BROKER

RBC Capital

Markets

Pacific Crest

Securities

Piper Jaffray

Argus Research

Barrington

Research

FBR Capital

Markets

Evercore ISI

Bernstein

Cowen

B Riley & Co

DATE

6/10/16

6/7/16

6/7/16

6/6/16

6/6/16

6/5/16

6/5/16

6/3/16

6/2/16

5/31/16

$23.00

$27.00

$30.00

$34.00

$27.00

$23.00

$32.00

$34.00

$22.00

$30.00

MULTIPLE

14.4x CY2016E

/CY2017E EBITDA

N/A

N/A

N/A

15x FY2017E EBITDA

N/A

N/A

N/A

N/A

N/A

Source: Company Filings, Bloomberg, Wall Street Research, Thomson One and CapitallQ.

METHODOLOGY/COMMENTARY

> "The next leg in valuation will likely come from key movies doing well (or not) as

we think investors have taken a 'show me' approach to the slate."

"While nothing was said on the Starz front, we've updated our forecast and

think a deal could be highly accretive to LGF Adj. EPS on debt/equity financing

of 40%/60%."

> N/A

> 5-year DCF, 9.0x term EBITDA multiple and 7.2% WACC

> N/A

"The variety of potential contributors to continuing growth is sufficiently

impressive and largely visible, along with management's demonstrated risk

mitigation skills, that we are encouraged as to the ability of Lionsgate's

management to sustain its momentum, albeit unevenly..."

> N/A

> N/A

> N/A

Confidential

> N/A

> N/A

PJT Partners

47View entire presentation