Energy Vault SPAC Presentation Deck

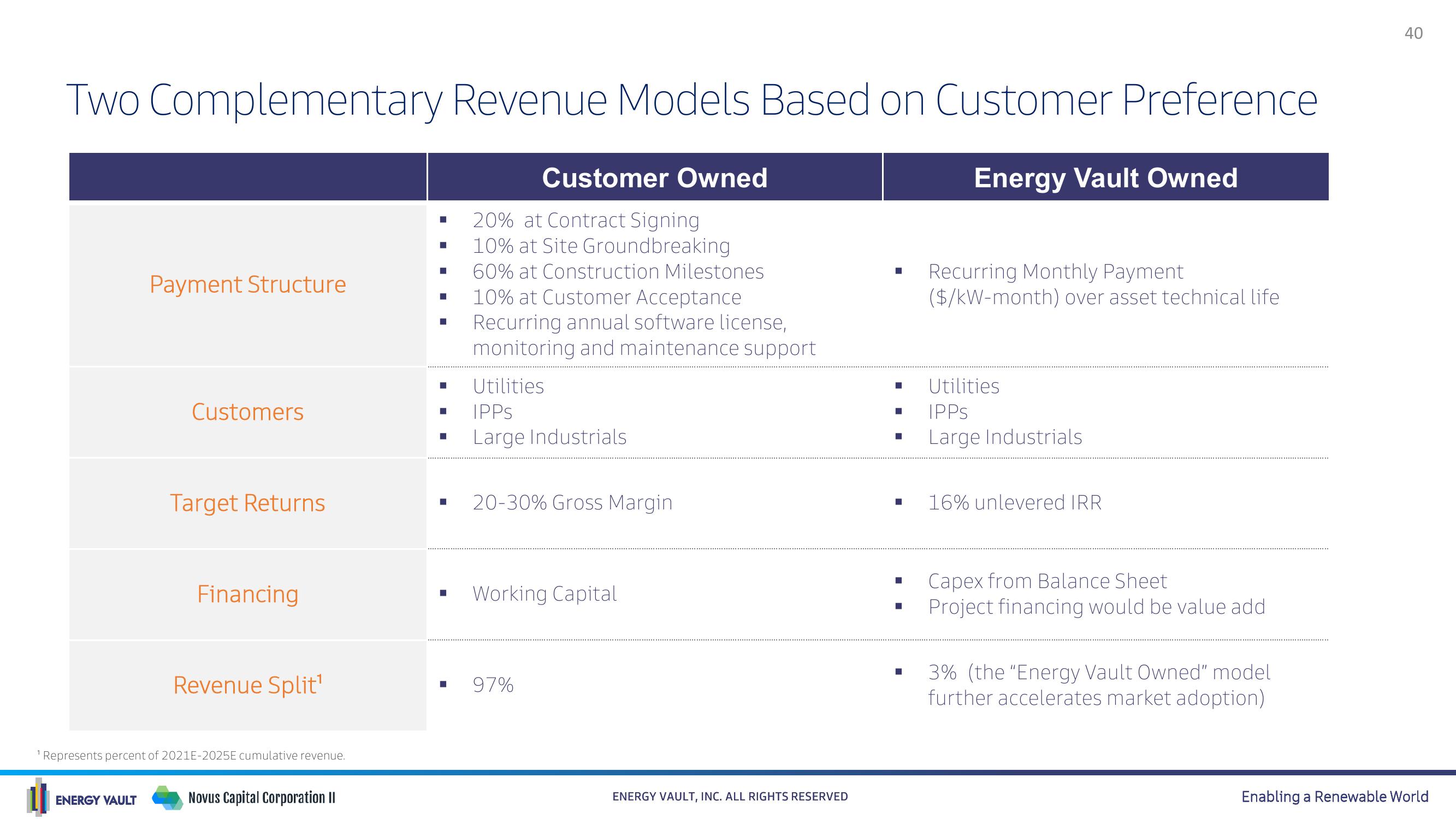

Two Complementary Revenue Models Based on Customer Preference

Energy Vault Owned

Payment Structure

ENERGY VAULT

Customers

Target Returns

Financing

Revenue Split¹

1 Represents percent of 2021E-2025E cumulative revenue.

Novus Capital Corporation II

■

■

■

■

■

■

■

■

Customer Owned

20% at Contract Signing

10% at Site Groundbreaking

60% at Construction Milestones

10% at Customer Acceptance

Recurring annual software license,

monitoring and maintenance support

Utilities

IPPs

Large Industrials

20-30% Gross Margin

Working Capital

■ 97%

ENERGY VAULT, INC. ALL RIGHTS RESERVED

■

Recurring Monthly Payment

($/kW-month) over asset technical life

Utilities

IPPS

Large Industrials

16% unlevered IRR

Capex from Balance Sheet

Project financing would be value add.

3% (the "Energy Vault Owned" model

further accelerates market adoption)

40

Enabling a Renewable WorldView entire presentation