Ready Capital Investor Presentation Deck

Loan Portfolio - Risk Rating

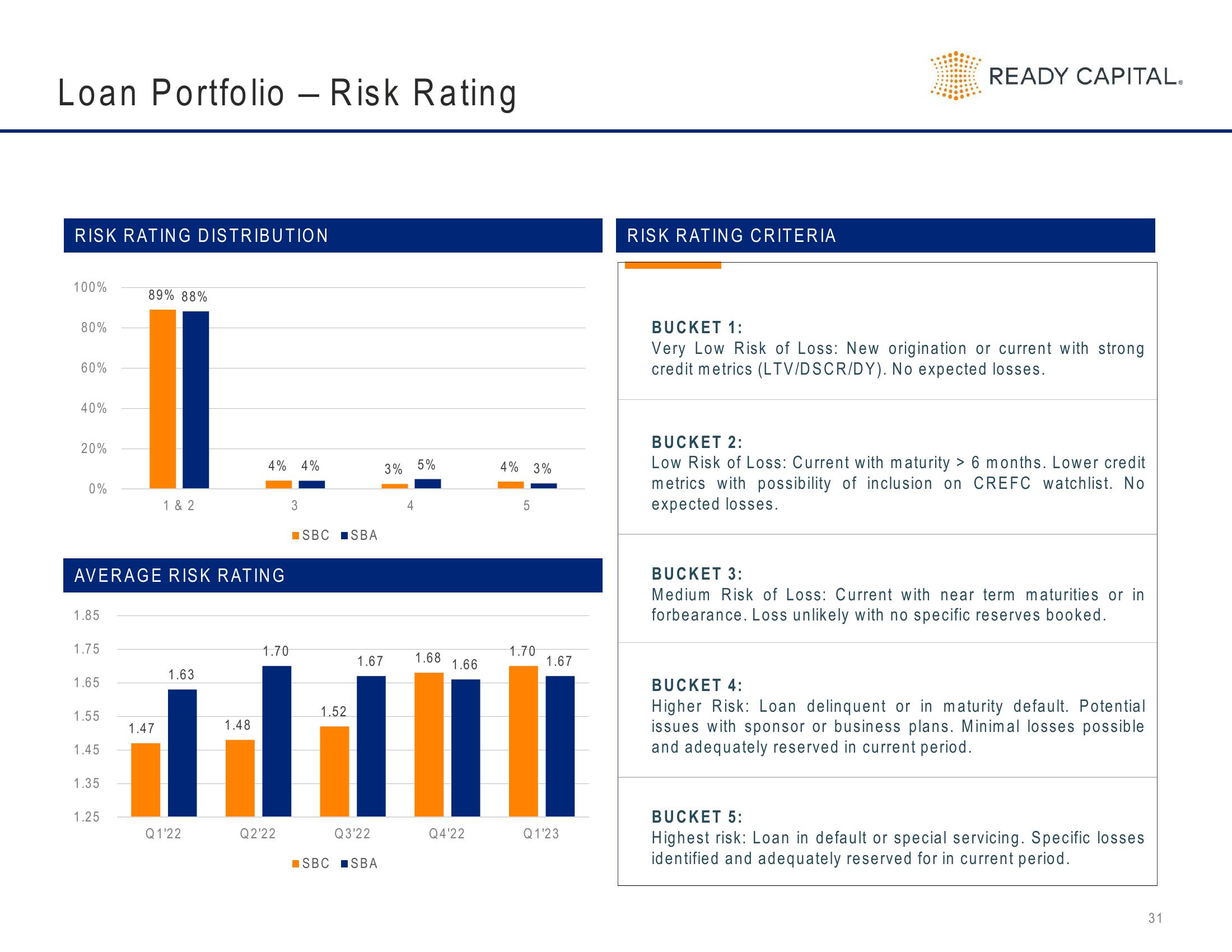

RISK RATING DISTRIBUTION

100%

80%

60%

40%

20%

0%

1.85

1.75

AVERAGE RISK RATING

1.65

1.55

1.45

1.35

89% 88%

1.25

1 & 2

1.47

1.63

Q1'22

4% 4%

1.48

1.70

Q2'22

3

SBC SBA

1.52

Q3'22

3% 5%

1.67 1.68

SBC SBA

4

1.66

Q4'22

4% 3%

5

1.70

1.67

Q1'23

RISK RATING CRITERIA

READY CAPITAL.

BUCKET 1:

Very Low Risk of Loss: New origination or current with strong

credit metrics (LTV/DSCR/DY). No expected losses.

BUCKET 2:

Low Risk of Loss: Current with maturity > 6 months. Lower credit

metrics with possibility of inclusion on CREFC watchlist. No

expected losses.

BUCKET 3:

Medium Risk of Loss: Current with near term maturities or in

forbearance. Loss unlikely with no specific reserves booked.

BUCKET 4:

Higher Risk: Loan delinquent or in maturity default. Potential

issues with sponsor or business plans. Minimal losses possible

and adequately reserved in current period.

BUCKET 5:

Highest risk: Loan in default or special servicing. Specific losses

identified and adequately reserved for in current period.

31View entire presentation