Moelis & Company Investment Banking Pitch Book

Weighted Average Cost of Capital Analysis (cont'd)

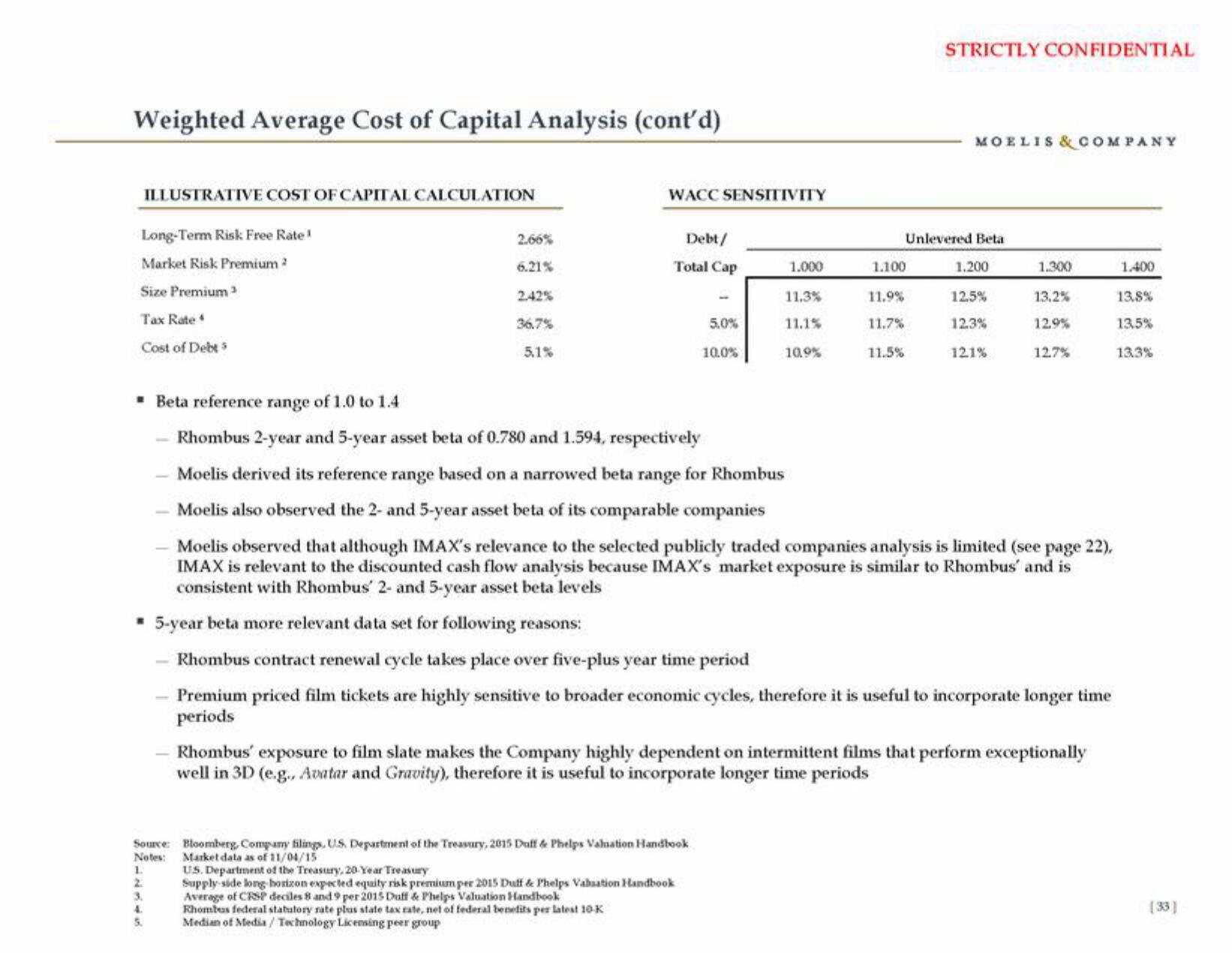

ILLUSTRATIVE COST OF CAPITAL CALCULATION

Long-Term Risk Free Rate ¹

Market Risk Premium 2

Size Premium ³

Tax Rate

Cost of Debt

2.66%

6.21%

1.

2

2.42%

3.

4.

5.

36.7%

51%

WACC SENSITIVITY

Debt/

Total Cap

Source: Bloomberg, Company filings, US Department of the Treasury, 2015 Duff & Phelps Valuation Handbook

Notes:

Market data as of 11/04/15

5.0%

10.0%

US. Department of the Treasury, 20-Year Treasury

Supply-side long horizon expected equity risk premium per 2015 Duff & Phelps Valuation Handbook

Average of CRSP deciles 8 and 9 per 2015 Duff & Phelps Valuation Handbook

Rhombus federal statutory rate plus state tax rate, net of federal benefits per latest 10-K

Median of Media / Technology Licensing peer group

1.000

11.3%

11.1%

10.9%

1.100

STRICTLY CONFIDENTIAL

Unlevered Beta

11.9%

11.7%

11.5%

MOELIS & COMPANY

▪ Beta reference range of 1.0 to 1.4

Rhombus 2-year and 5-year asset beta of 0.780 and 1.594, respectively

Moelis derived its reference range based on a narrowed beta range for Rhombus

Moelis also observed the 2- and 5-year asset beta of its comparable companies

Moelis observed that although IMAX's relevance to the selected publicly traded companies analysis is limited (see page 22),

IMAX is relevant to the discounted cash flow analysis because IMAX's market exposure is similar to Rhombus' and is

consistent with Rhombus' 2- and 5-year asset beta levels

▪ 5-year beta more relevant data set for following reasons:

Rhombus contract renewal cycle takes place over five-plus year time period

Premium priced film tickets are highly sensitive to broader economic cycles, therefore it is useful to incorporate longer time

periods

1.200

12.5%

12.3%

12.1%

1.300

13.2%

12.9%

127%

- Rhombus' exposure to film slate makes the Company highly dependent on intermittent films that perform exceptionally

well in 3D (e.g., Avatar and Gravity), therefore it is useful to incorporate longer time periods

1.400

13,8%

13,5%

13.3%

[33]View entire presentation