OppFi SPAC Presentation Deck

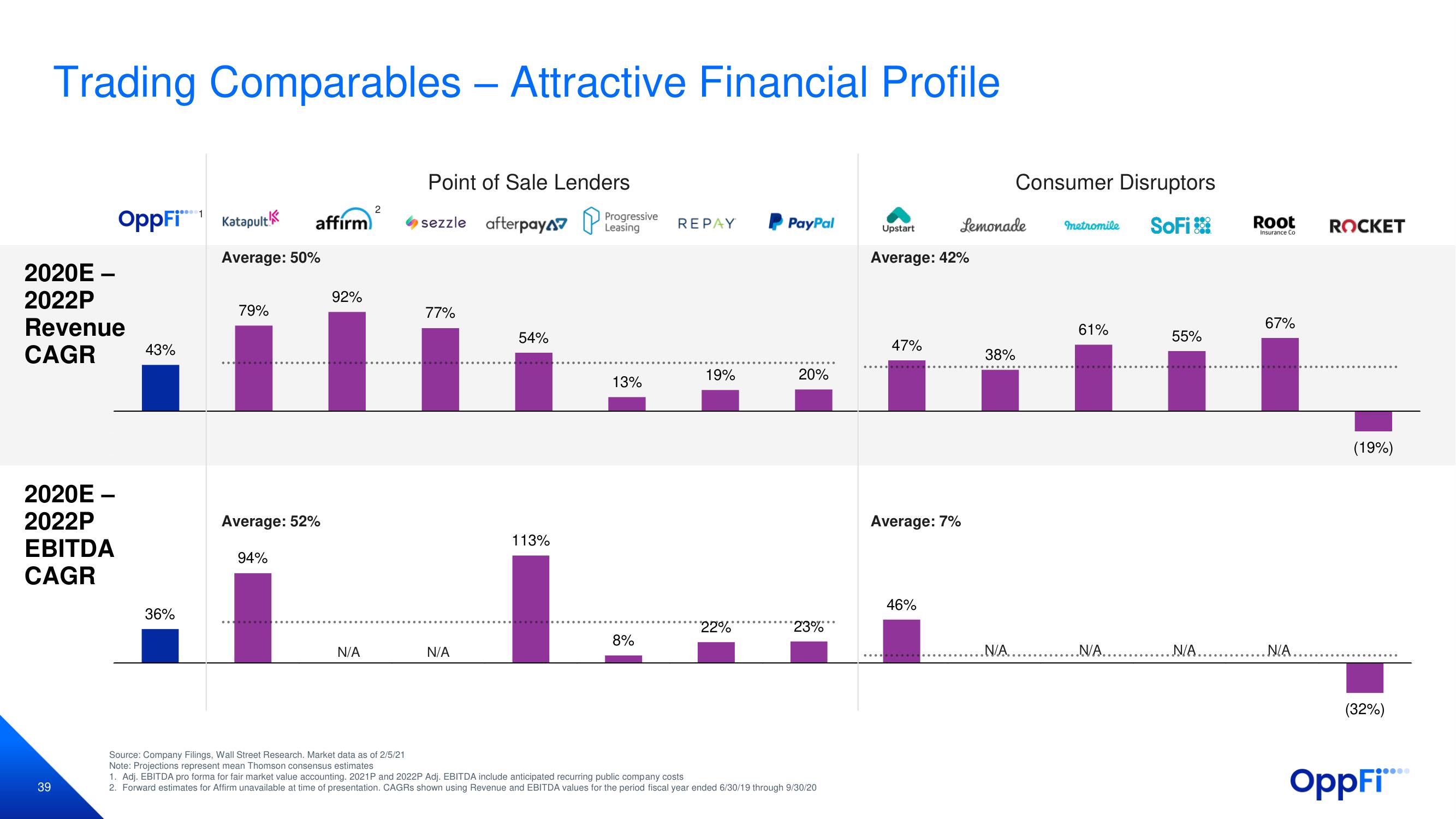

Trading Comparables - Attractive Financial Profile

2020E -

2022P

Revenue

CAGR

2020E -

2022P

EBITDA

CAGR

39

OppFi Katapult!

43%

36%

⁰⁰⁰01

affirm

Average: 50%

79%

Average: 52%

94%

92%

N/A

2

Point of Sale Lenders

sezzle afterpay

77%

N/A

54%

113%

Progressive

Leasing

13%

8%

REPAY

19%

22%*

PayPal

20%

23%

Source: Company Filings, Wall Street Research. Market data as of 2/5/21

Note: Projections represent mean Thomson consensus estimates

1. Adj. EBITDA pro forma for fair market value accounting. 2021P and 2022P Adj. EBITDA include anticipated recurring public company costs

2. Forward estimates for Affirm unavailable at time of presentation. CAGRs shown using Revenue and EBITDA values for the period fiscal year ended 6/30/19 through 9/30/20

Upstart

Average: 42%

47%

Average: 7%

46%

Lemonade

Consumer Disruptors

SoFi

38%

metromile

61%

.N/A........ ..N/A...

55%

Root

Insurance Co

67%

N/A......... .N/A

ROCKET

(19%)

(32%)

OppFi****View entire presentation