Porch SPAC Presentation Deck

(2)

(3)

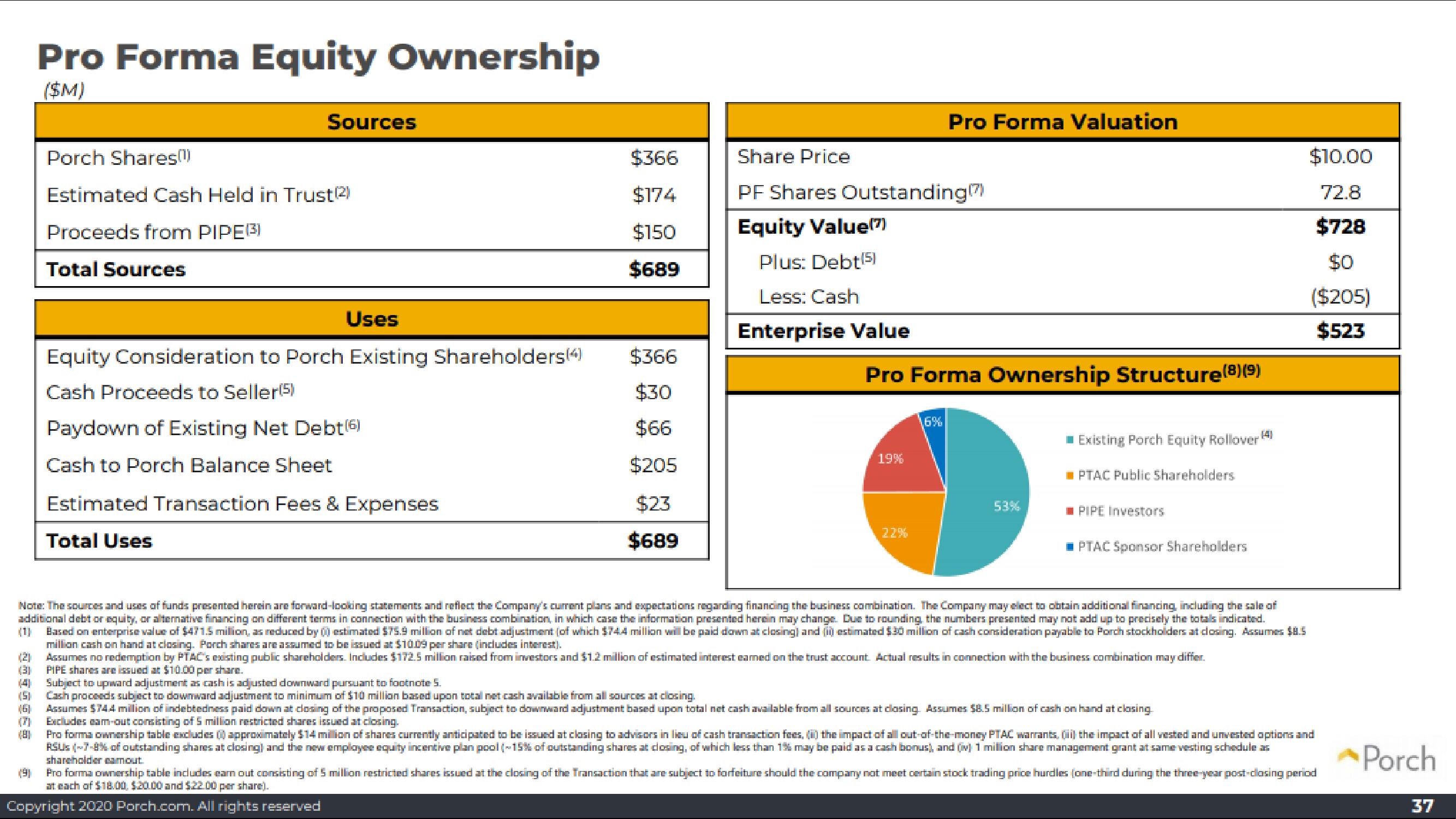

Pro Forma Equity Ownership

($M)

(4)

(5)

(6)

(0)

(8)

Sources

Porch Shares(¹)

Estimated Cash Held in Trust (2)

Proceeds from PIPE (3)

Total Sources

Uses

Equity Consideration to Porch Existing Shareholders(4)

Cash Proceeds to Seller(5)

Paydown of Existing Net Debt (6)

Cash to Porch Balance Sheet

Estimated Transaction Fees & Expenses

Total Uses

$366

$174

$150

$689

$366

$30

$66

$205

$23

$689

Share Price

PF Shares Outstanding(7)

Equity Value(7)

Plus: Debt(5)

Less: Cash

Enterprise Value

Pro Forma Ownership Structure (8) (9)

19%

Pro Forma Valuation

22%

16%

53%

Note: The sources and uses of funds presented herein are forward-looking statements and reflect the Company's current plans and expectations regarding financing the business combination. The Company may elect to obtain additional financing, including the sale of

additional debt or equity, or alternative financing on different terms in connection with the business combination, in which case the information presented herein may change. Due to rounding, the numbers presented may not add up to precisely the totals indicated.

Based on enterprise value of $471.5 million, as reduced by 0) estimated $75.9 million of net debt adjustment (of which $74.4 million will be paid down at closing) and (i) estimated $30 million of cash consideration payable to Porch stockholders at closing. Assumes $8.5

million cash on hand at closing. Porch shares are assumed to be issued at $10.09 per share (includes interest).

Assumes no redemption by PTAC's existing public shareholders. Includes $172.5 million raised from investors and $1.2 million of estimated interest eamed on the trust account. Actual results in connection with the business combination may differ.

PIPE shares are issued at $10.00 per share.

Subject to upward adjustment as cash is adjusted downward pursuant to footnote 5.

Existing Porch Equity Rollover (4)

PTAC Public Shareholders

■ PIPE Investors

■ PTAC Sponsor Shareholders

$10.00

72.8

$728

$0

($205)

$523

Cash proceeds subject to downward adjustment to minimum of $10 million based upon total net cash available from all sources at closing.

Assumes $74.4 million of indebtedness paid down at closing of the proposed Transaction, subject to downward adjustment based upon total net cash available from all sources at closing. Assumes $8.5 million of cash on hand at closing

Excludes eam-out consisting of 5 million restricted shares issued at closing.

Pro forma ownership table excludes (approximately $14 million of shares currently anticipated to be issued at closing to advisors in lieu of cash transaction fees, (i) the impact of all out-of-the-money PTAC warrants, (ii) the impact of all vested and unvested options and

RSUS (-7-8% of outstanding shares at closing) and the new employee equity incentive plan pool (~15% of outstanding shares at closing, of which less than 1% may be paid as a cash bonus), and (iv) 1 million share management grant at same vesting schedule as

shareholder camout.

Pro forma ownership table includes eam out consisting of 5 million restricted shares issued at the closing of the Transaction that are subject to forfeiture should the company not meet certain stock trading price hurdles (one-third during the three-year post-closing period

at each of $18.00, $20.00 and $22.00 per share).

Copyright 2020 Porch.com. All rights reserved

Porch

37View entire presentation