Vivid Seats SPAC Presentation Deck

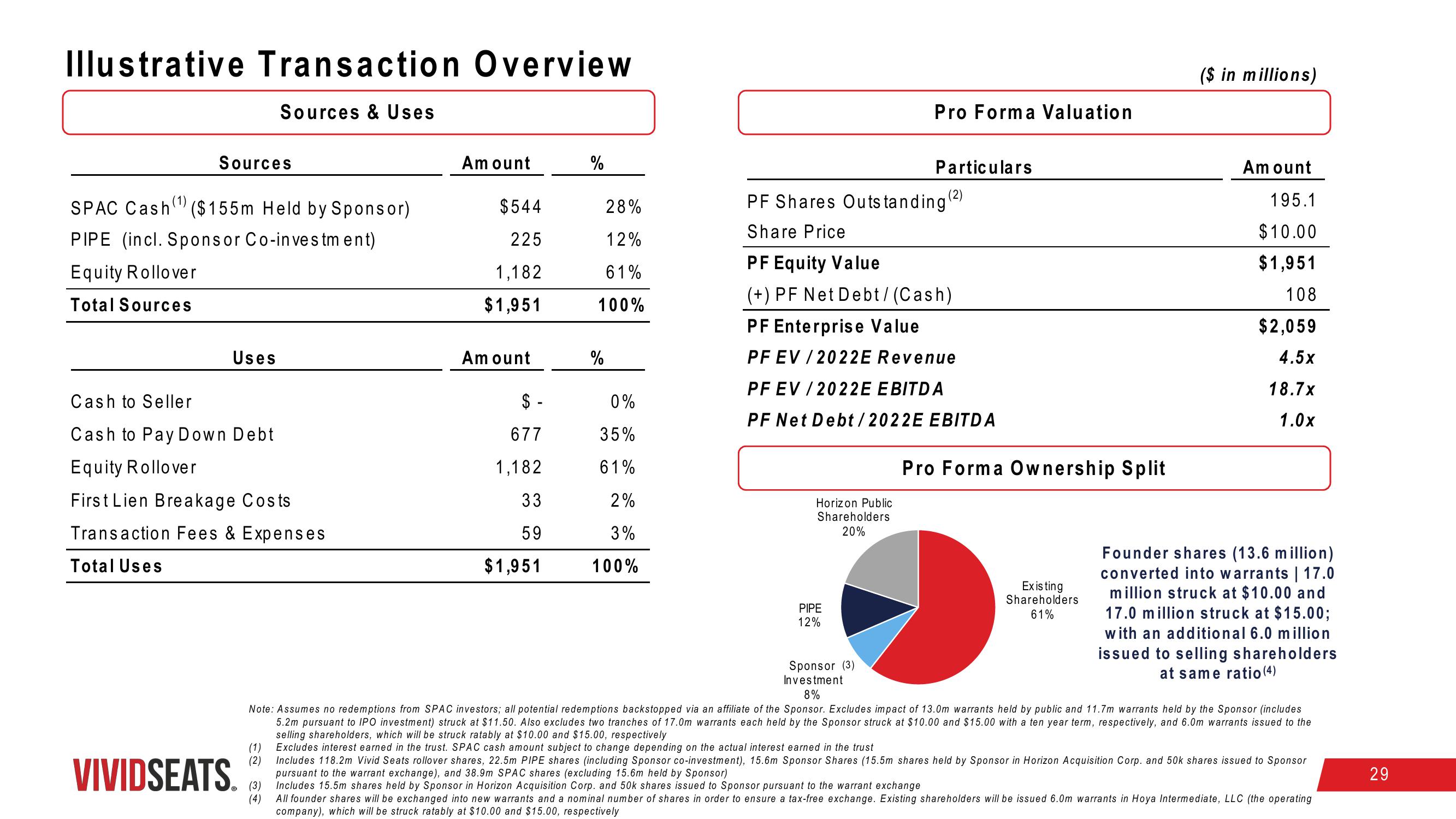

Illustrative Transaction Overview

Sources

SPAC Cash ($155m Held by Sponsor)

PIPE (incl. Sponsor Co-investment)

Equity Rollover

Total Sources

Uses

Sources & Uses

Cash to Seller

Cash to Pay Down Debt

Equity Rollover

First Lien Breakage Costs

Transaction Fees & Expenses

Total Uses

VIVIDSEATS.

(1)

(2)

(3)

(4)

Amount

$544

225

1,182

$1,951

Amount

$-

677

1,182

33

59

$1,951

%

28%

12%

61%

100%

%

0%

35%

61%

2%

3%

100%

Horizon Public

Shareholders

20%

PF Shares Outstanding (²)

Share Price

PF Equity Value

(+) PF Net Debt / (Cash)

PF Enterprise Value

PFEV/2022E Revenue

PF EV /2022E EBITDA

PF Net Debt/2022E EBITDA

PIPE

12%

Pro Forma Valuation

Sponsor (3)

Investment

8%

Particulars

Pro Forma Ownership Split

Existing

Shareholders

61%

($ in millions)

Amount

195.1

$10.00

$1,951

108

$2,059

4.5x

18.7x

1.0x

Note: Assumes no redemptions from SPAC investors; all potential redemptions backstopped via an affiliate of the Sponsor. Excludes impact of 13.0m warrants held by public and 11.7m warrants held by the Sponsor (includes

5.2m pursuant to IPO investment) struck at $11.50. Also excludes two tranches of 17.0m warrants each held by the Sponsor struck at $10.00 and $15.00 with a ten year term, respectively, and 6.0m warrants issued to the

selling shareholders, which will be struck ratably at $10.00 and $15.00, respectively

Excludes interest earned in the trust. SPAC cash amount subject to change depending on the actual interest earned in the trust

Includes 118.2m Vivid Seats rollover shares, 22.5m PIPE shares (including Sponsor co-investment), 15.6m Sponsor Shares (15.5m shares held by Sponsor in Horizon Acquisition Corp. and 50k shares issued to Sponsor

pursuant to the warrant exchange), and 38.9m SPAC shares (excluding 15.6m held by Sponsor)

Includes 15.5m shares held by Sponsor in Horizon Acquisition Corp. and 50k shares issued to Sponsor pursuant to the warrant exchange

All founder shares will be exchanged into new warrants and a nominal number of shares in order to ensure a tax-free exchange. Existing shareholders will be issued 6.0m warrants in Hoya Intermediate, LLC (the operating

company), which will be struck ratably at $10.00 and $15.00, respectively

Founder shares (13.6 million)

converted into warrants | 17.0

million struck at $10.00 and

17.0 million struck at $15.00;

with an additional 6.0 million

issued to selling shareholders

at same ratio (4)

29View entire presentation