Credit Suisse Results Presentation Deck

Group Overview

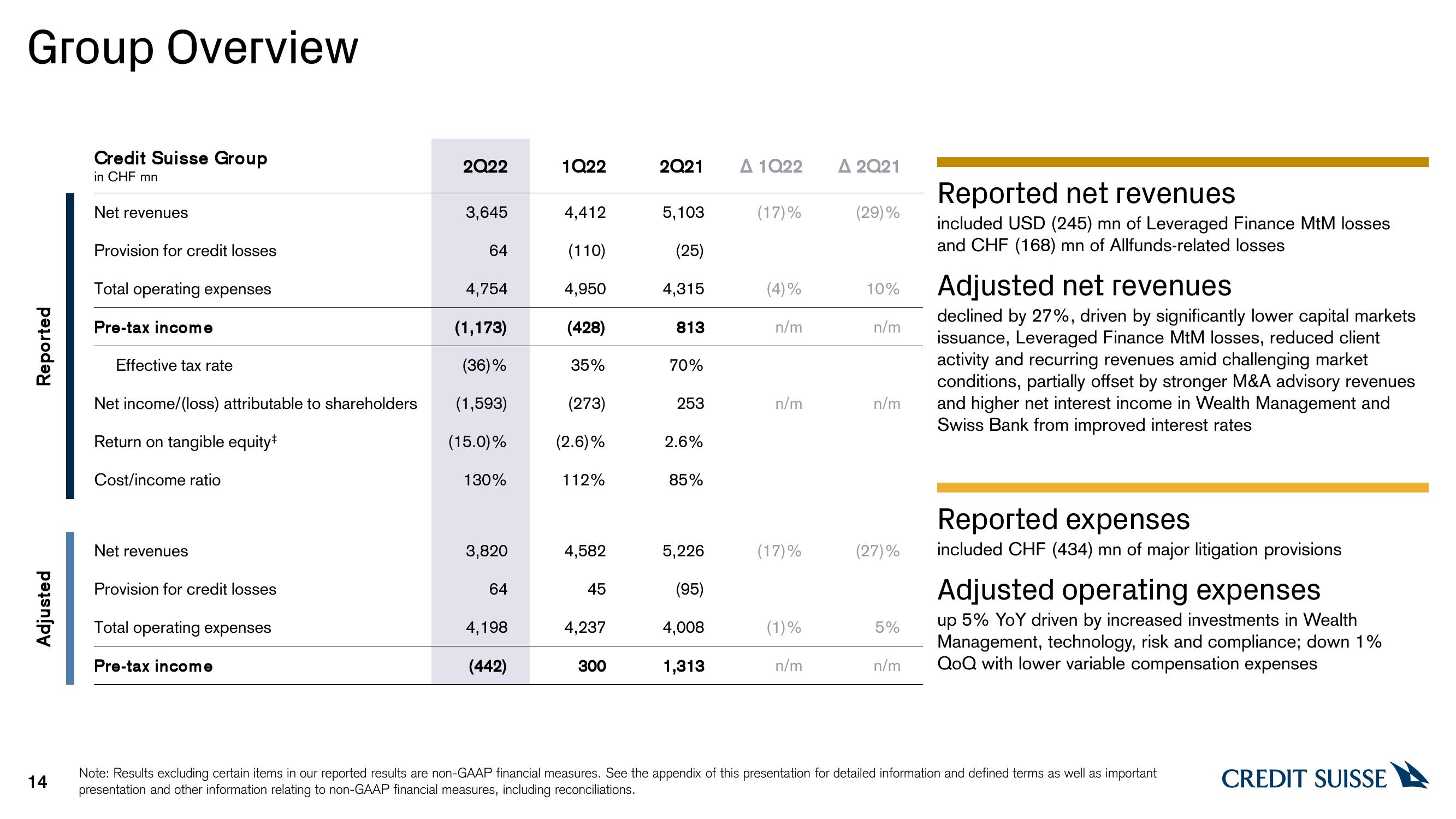

Reported

Adjusted

14

Credit Suisse Group

in CHF mn

Net revenues

Provision for credit losses

Total operating expenses

Pre-tax income

Effective tax rate

Net income/(loss) attributable to shareholders

Return on tangible equity

Cost/income ratio

Net revenues

Provision for credit losses

Total operating expenses

Pre-tax income

2022

3,645

64

4,754

(1,173)

(36)%

(1,593)

(15.0)%

130%

3,820

64

4,198

(442)

1Q22

4,412

(110)

4,950

(428)

35%

(273)

(2.6)%

112%

4,582

45

4,237

300

2Q21

5,103

(25)

4,315

813

70%

253

2.6%

85%

5,226

(95)

4,008

1,313

Δ 1022

(17)%

(4)%

n/m

n/m

(17)%

(1) %

n/m

A 2Q21

(29)%

10%

n/m

n/m

(27)%

5%

n/m

Reported net revenues

included USD (245) mn of Leveraged Finance MtM losses

and CHF (168) mn of Allfunds-related losses

Adjusted net revenues

declined by 27%, driven by significantly lower capital markets

issuance, Leveraged Finance MtM losses, reduced client

activity and recurring revenues amid challenging market

conditions, partially offset by stronger M&A advisory revenues

and higher net interest income in Wealth Management and

Swiss Bank from improved interest rates

Reported expenses

included CHF (434) mn of major litigation provisions

Adjusted operating expenses

up 5% YoY driven by increased investments in Wealth

Management, technology, risk and compliance; down 1%

QoQ with lower variable compensation expenses

Note: Results excluding certain items in our reported results are non-GAAP financial measures. See the appendix of this presentation for detailed information and defined terms as well as important

presentation and other information relating to non-GAAP financial measures, including reconciliations.

CREDIT SUISSEView entire presentation