Baird Investment Banking Pitch Book

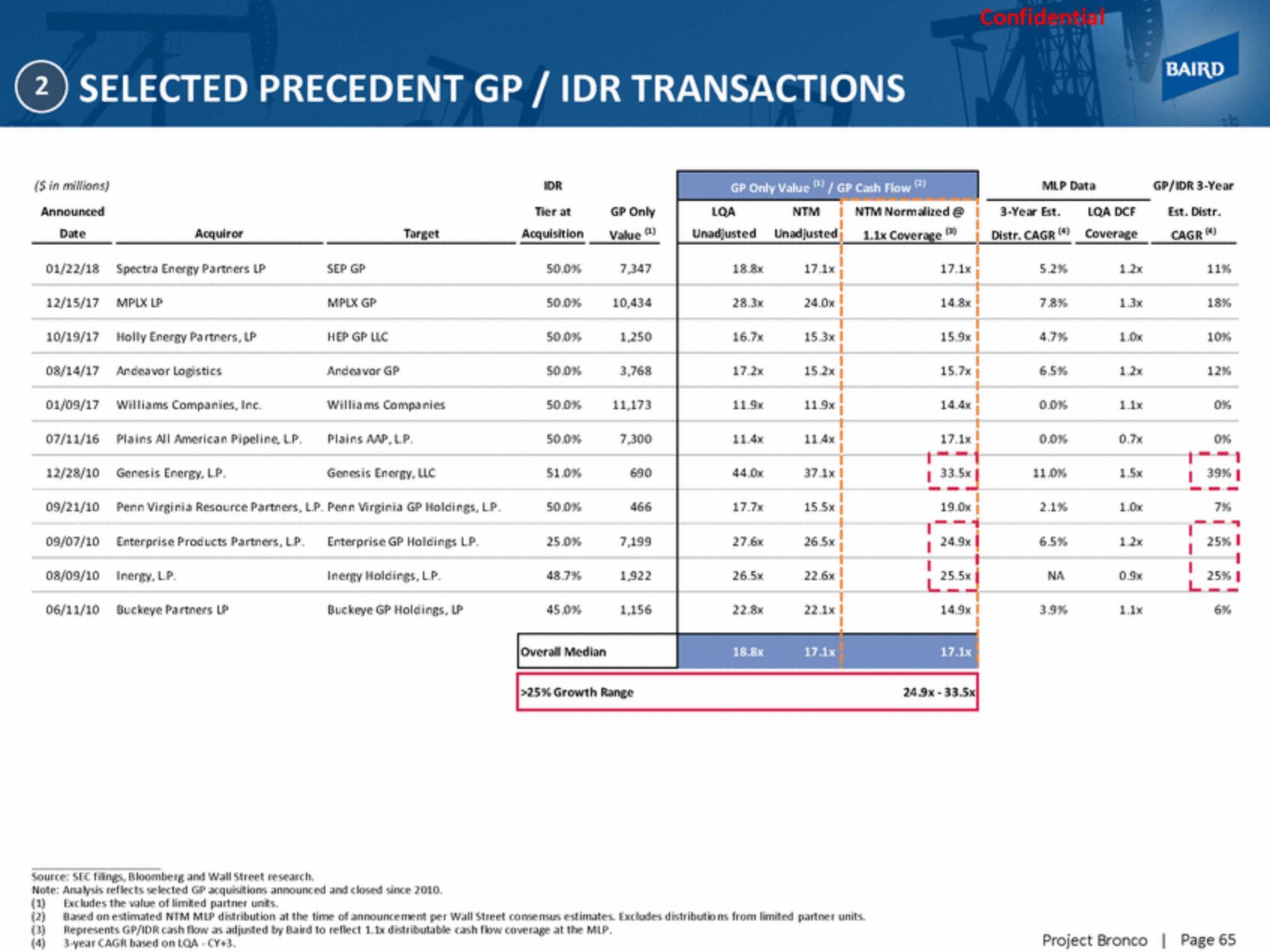

2 SELECTED PRECEDENT GP/IDR TRANSACTIONS

($ in millions)

Announced

Date

Acquiror

01/22/18 Spectra Energy Partners LP

12/15/17 MPLX LP

10/19/17 Holly Energy Partners, LP

08/14/17 Andeavor Logistics

01/09/17 Williams Companies, Inc.

07/11/16 Plains All American Pipeline, LP.

(1)

(2)

(3)

(4)

SEP GP

MPLX GP

HEP GP LLC

Andeavor GP

Target

Williams Companies

Plains AAP, L.P.

12/28/10 Genesis Energy, LP.

Genesis Energy, LLC

09/21/10 Penn Virginia Resource Partners, L.P. Penn Virginia GP Holdings, LP.

09/07/10 Enterprise Products Partners, L.P.

08/09/10 Inergy, L.P.

06/11/10 Buckeye Partners LP

Enterprise GP Holdings LP.

Inergy Holdings, L.P.

Buckeye GP Holdings, LP

Source: SEC filings, Bloomberg and Wall Street research.

Note: Analysis reflects selected GP acquisitions announced and closed since 2010.

Excludes the value of limited partner units.

IDR

Tier at

Acquisition

50.0%

50.0%

50.0%

50.0%

50.0%

50.0%

51.0%

50.0%

25.0%

48.7%

45.0%

Overall Median

GP Only

Value (¹)

7,347

10,434

1,250

3,768

11,173

7,300

690

466

7,199

1,922

1,156

>25% Growth Range

GP Only Value (¹) / GP Cash Flow (2)

LQA

NTM

Unadjusted Unadjusted

18.8x

28.3x

16.7x

17.2x

11.9x

11.4x

44,0x

17.7x

27.6x

26.5×

22.8x

18.8x

17.1x

24.0x

15.3x1

15.2x1

11.9x

11.4x

37.1x1

155x

265x

22.6x

22.1x1

17.1x

NTM Normalized @

1.1x Coverage

Based on estimated NTM MLP distribution at the time of announcement per Wall Street consensus estimates. Excludes distributions from limited partner units.

Represents GP/IDR cash flow as adjusted by Baird to reflect 1.1x distributable cash flow coverage at the MLP.

3-year CAGR based on LQA-CY+3.

17.1x

I

14.8x

15.9x

15.7x

14.4x

17.1x

I 33.5x

19.0xi

24.9x

25.5x |

14.9x

17.1x

Confidential

24.9x-33.5x

MLP Data

3-Year Est.

LQA DCF

Distr. CAGR (4) Coverage

5.2%

7.8%

4.7%

6.5%

0.0%

0.0%

11.0%

2.1%

6.5%

NA

3.9%

1.2x

1.3x

1.0x

1.2x

1.1x

0.7x

1.5x

1.0x

1.2x

0.9x

1.1x

BAIRD

GP/IDR 3-Year

Est. Distr.

CAGR (4)

11%

I

18%

10%

12%

0%

0%

| 39% I

7%

25% I

25% I

6%

Project Bronco | Page 65View entire presentation