Avantor Investor Day Presentation Deck

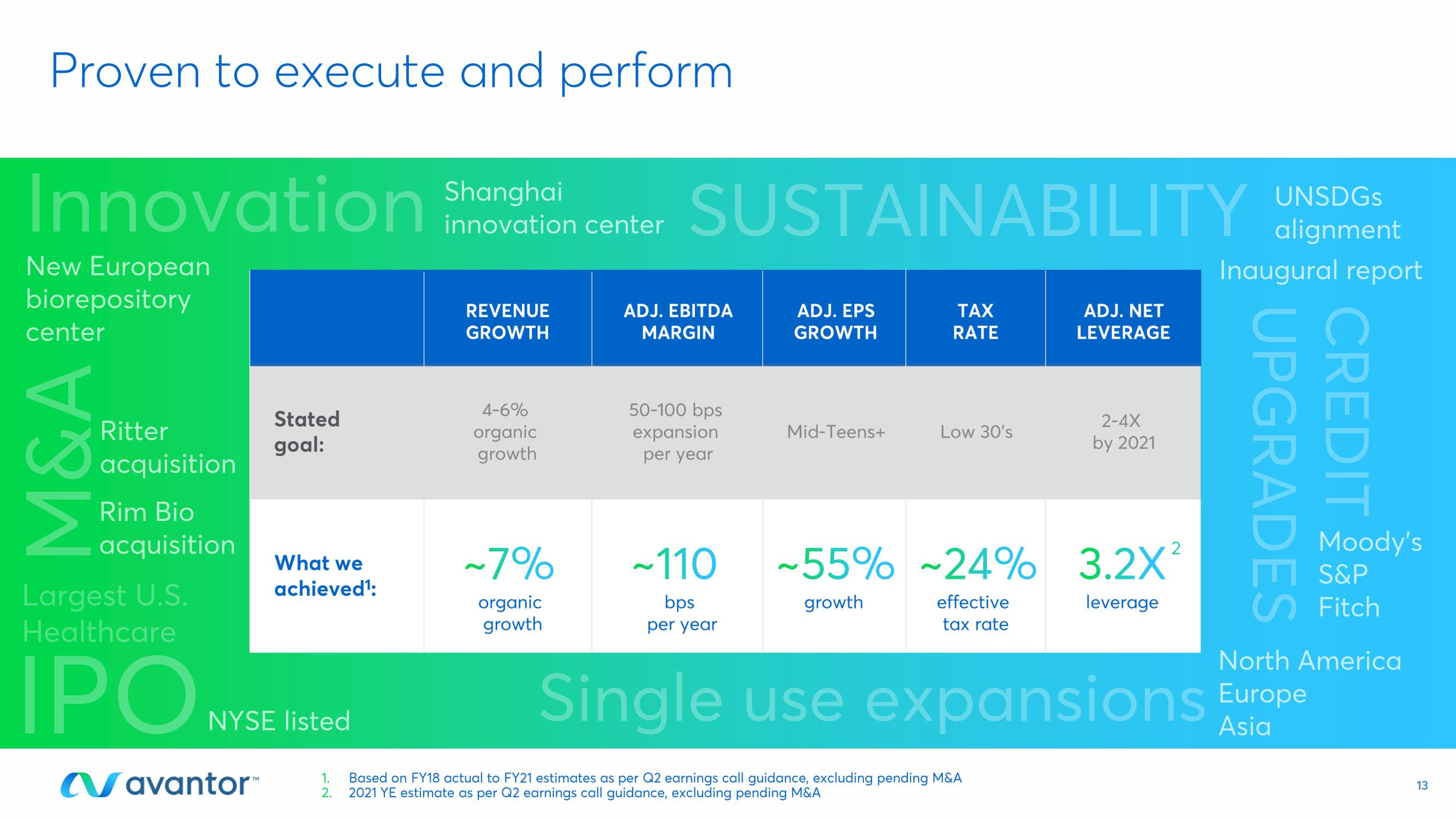

Proven to execute and perform

Innovation Shanghai

New European

biorepository

center

M&A

Ritter

acquisition

Rim Bio

acquisition

Largest U.S.

Healthcare

IPO

Stated

goal:

Navantor™

What we

achieved¹:

NYSE listed

innovation center

REVENUE

GROWTH

4-6%

organic

growth

~7%

organic

growth

SUSTAINABILITY UNSDGS

alignment

Inaugural report

S

ADJ. EBITDA

MARGIN

50-100 bps

expansion

per year

~110

bps

per year

ADJ. EPS

GROWTH

Mid-Teens+

TAX

RATE

Low 30's

ADJ. NET

LEVERAGE

2-4X

by 2021

~55% -24% 3.2X²

growth

leverage

effective

tax rate

1.

Based on FY18 actual to FY21 estimates as per Q2 earnings call guidance, excluding pending M&A

2. 2021 YE estimate as per Q2 earnings call guidance, excluding pending M&A

CREDIT

UPGRADES

Single use expansions Europe

Asia

Moody's

S&P

Fitch

North America

13View entire presentation