Third Point Management Activist Presentation Deck

SNACKS

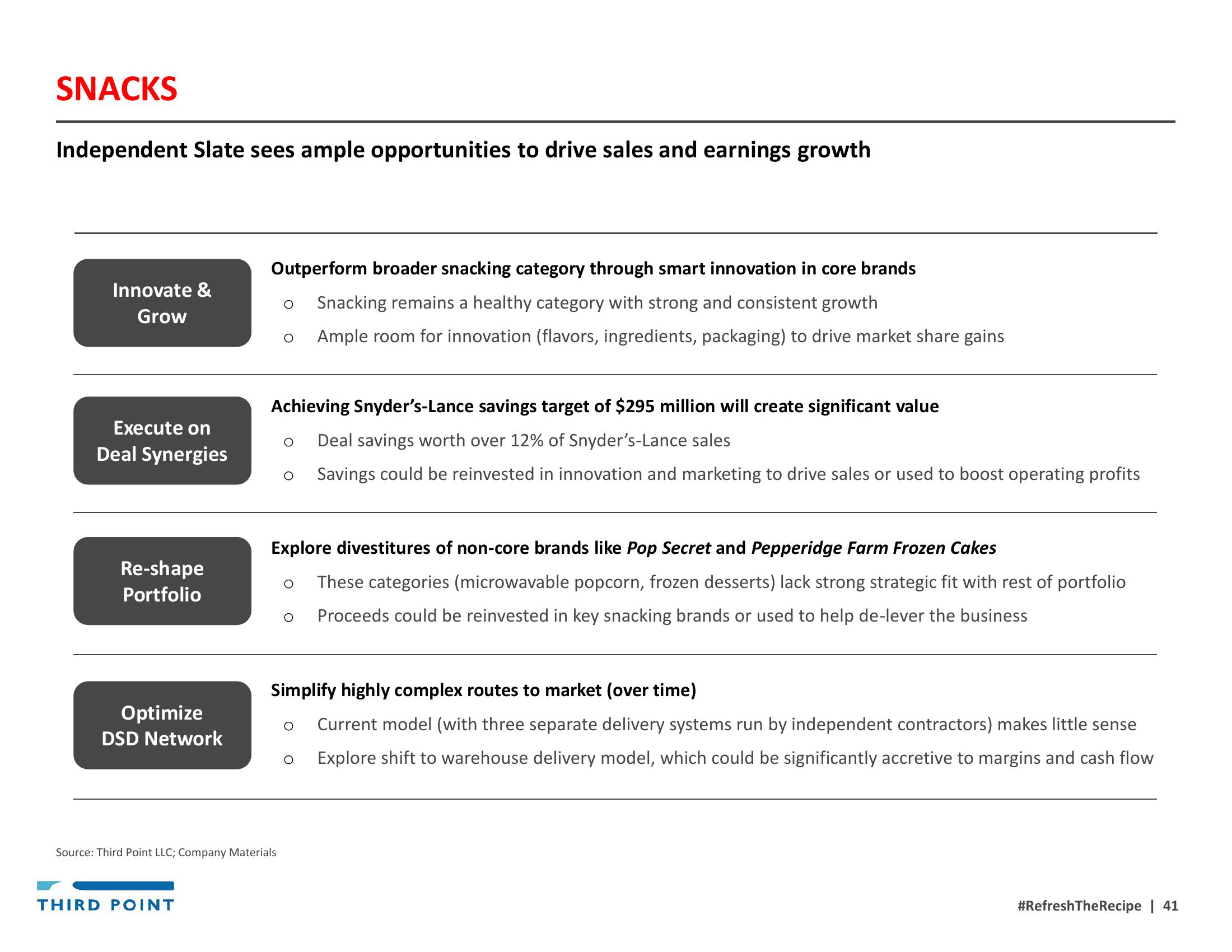

Independent Slate sees ample opportunities to drive sales and earnings growth

Innovate &

Grow

Execute on

Deal Synergies

Re-shape

Portfolio

Optimize

DSD Network

Outperform broader snacking category through smart innovation in core brands

O Snacking remains a healthy category with strong and consistent growth

Ample room for innovation (flavors, ingredients, packaging) to drive market share gains

THIRD POINT

O

Achieving Snyder's-Lance savings target of $295 million will create significant value

O Deal savings worth over 12% of Snyder's-Lance sales

O Savings could be reinvested in innovation and marketing to drive sales or used to boost operating profits

Explore divestitures of non-core brands like Pop Secret and Pepperidge Farm Frozen Cakes

These categories (microwavable popcorn, frozen desserts) lack strong strategic fit with rest of portfolio

O Proceeds could be reinvested in key snacking brands or used to help de-lever the business

Source: Third Point LLC; Company Materials

O

Simplify highly complex routes to market (over time)

O Current model (with three separate delivery systems run by independent contractors) makes little sense

O Explore shift to warehouse delivery model, which could be significantly accretive to margins and cash flow

#RefreshTheRecipe | 41View entire presentation