Oatly Results Presentation Deck

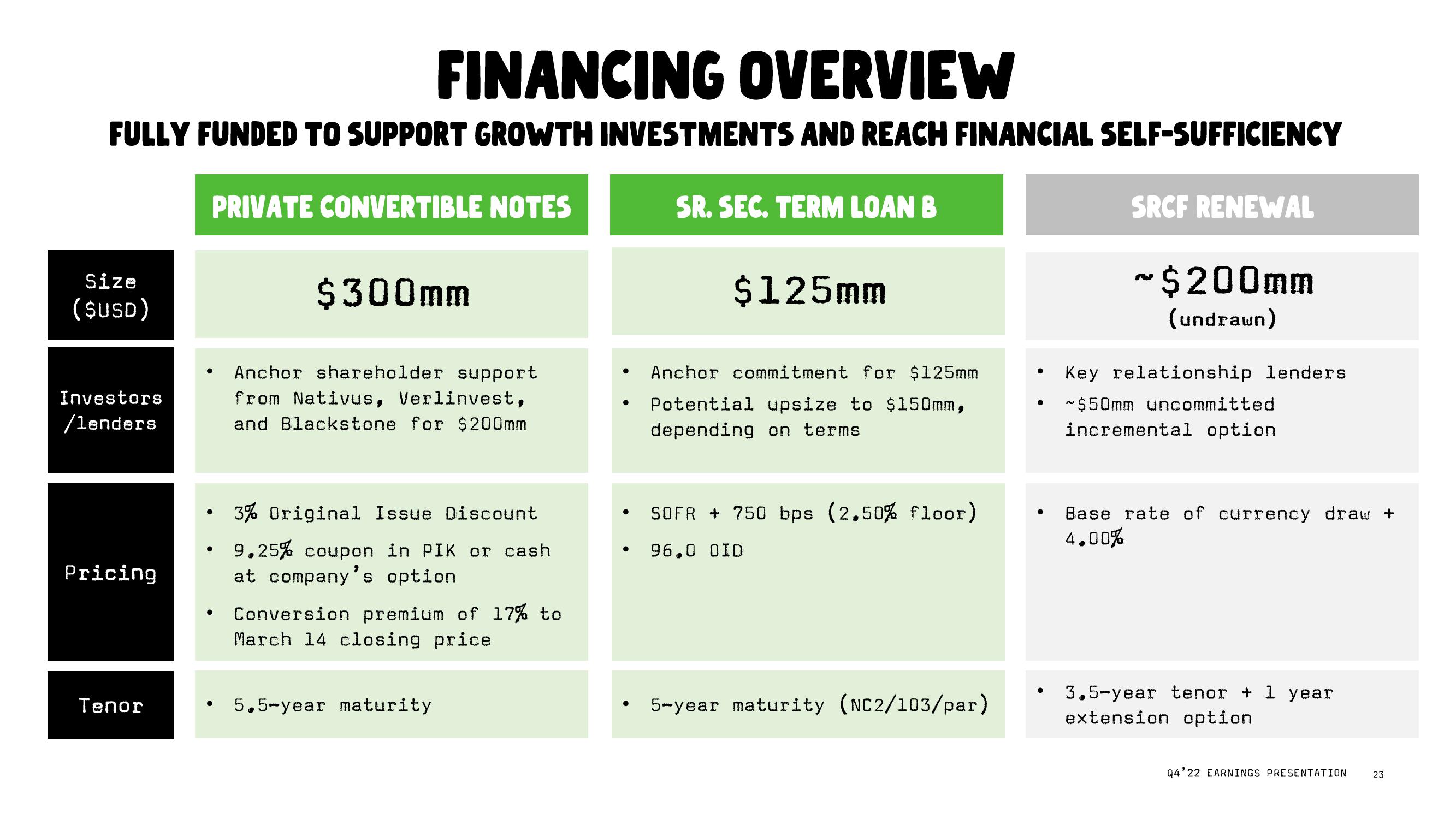

FINANCING OVERVIEW

FULLY FUNDED TO SUPPORT GROWTH INVESTMENTS AND REACH FINANCIAL SELF-SUFFICIENCY

Size

($USD)

Investors

/lenders

Pricing

Tenor

PRIVATE CONVERTIBLE NOTES

●

$300mm

Anchor shareholder support

from Nativus, Verlinvest,

and Blackstone for $200mm

3% Original Issue Discount

9.25% coupon in PIK or cash

at company's option

Conversion premium of 17% to

March 14 closing price

5.5-year maturity

●

●

SR. SEC. TERM LOAN B

●

$125mm

Anchor commitment for $125mm

Potential upsize to $150mm,

depending on terms

SOFR + 750 bps (2.50% floor)

• 96.0 OID

5-year maturity (NC2/103/par)

●

●

●

SRCF RENEWAL

~$200mm

(undrawn)

Key relationship lenders

~$50mm uncommitted

incremental option

Base rate of currency draw +

4.00%

3.5-year tenor + 1 year

extension option

Q4'22 EARNINGS PRESENTATION

23View entire presentation