Goldman Sachs Investment Banking Pitch Book

Goldman

Sachs

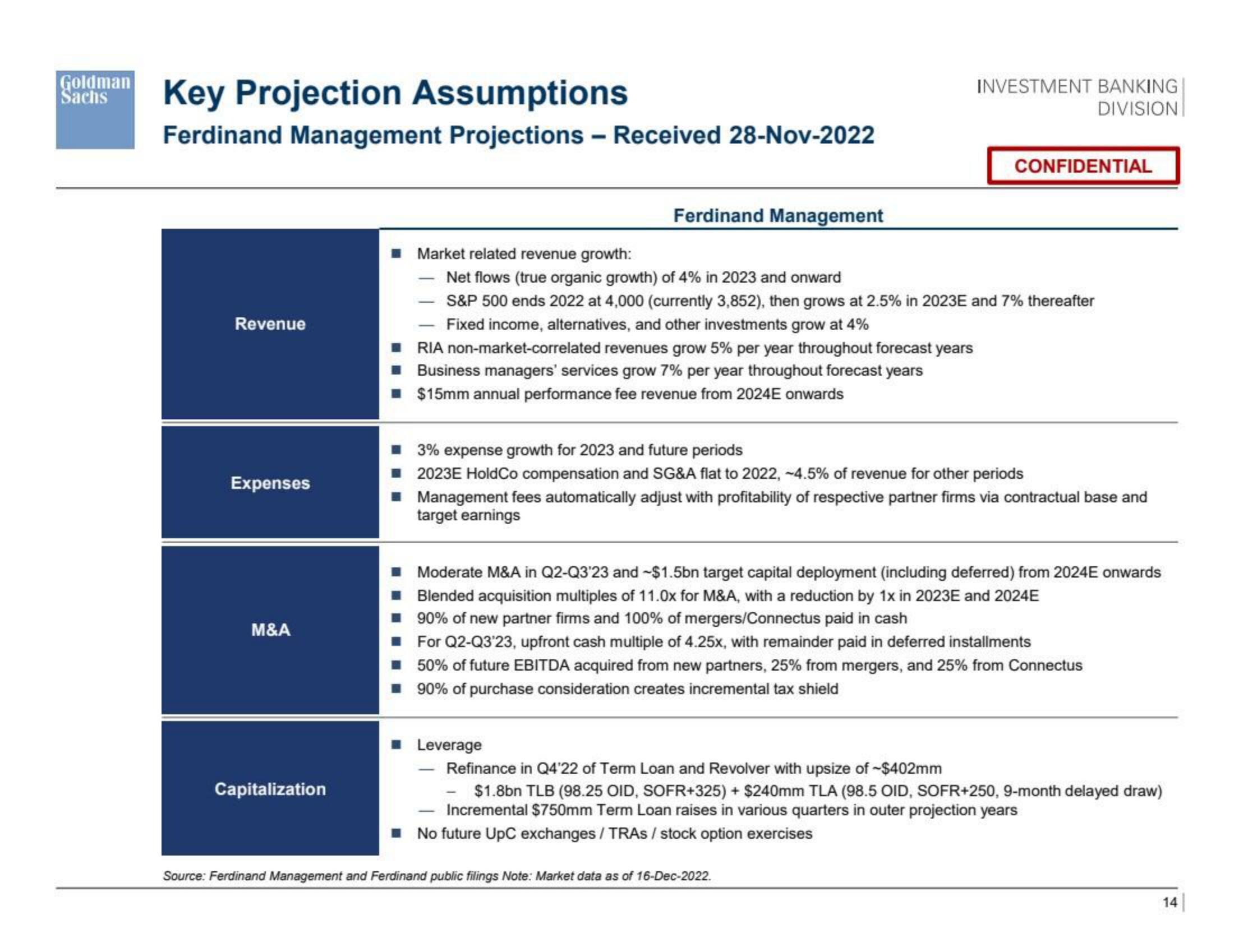

Key Projection Assumptions

Ferdinand Management Projections - Received 28-Nov-2022

Revenue

Expenses

M&A

Capitalization

■ Market related revenue growth:

Ferdinand Management

INVESTMENT BANKING

DIVISION

Net flows (true organic growth) of 4% in 2023 and onward

S&P 500 ends 2022 at 4,000 (currently 3,852), then grows at 2.5% in 2023E and 7% thereafter

Fixed income, alternatives, and other investments grow at 4%

■ RIA non-market-correlated revenues grow 5% per year throughout forecast years

■ Business managers' services grow 7% per year throughout forecast years

■ $15mm annual performance fee revenue from 2024E onwards

Leverage

CONFIDENTIAL

■ 3% expense growth for 2023 and future periods

■2023E HoldCo compensation and SG&A flat to 2022, -4.5% of revenue for other periods

Management fees automatically adjust with profitability of respective partner firms via contractual base and

target earnings

■ Moderate M&A in Q2-Q3'23 and -$1.5bn target capital deployment (including deferred) from 2024E onwards

Blended acquisition multiples of 11.0x for M&A, with a reduction by 1x in 2023E and 2024E

■90% of new partner firms and 100% of mergers/Connectus paid in cash

■ For Q2-Q3'23, upfront cash multiple of 4.25x, with remainder paid in deferred installments

50% of future EBITDA acquired from new partners, 25% from mergers, and 25% from Connectus

■ 90% of purchase consideration creates incremental tax shield

Source: Ferdinand Management and Ferdinand public filings Note: Market data as of 16-Dec-2022.

Refinance in Q4'22 of Term Loan and Revolver with upsize of ~$402mm

- $1.8bn TLB (98.25 OID, SOFR+325) + $240mm TLA (98.5 OID, SOFR+250, 9-month delayed draw)

Incremental $750mm Term Loan raises in various quarters in outer projection years

No future UPC exchanges/ TRAS / stock option exercises

14View entire presentation