Lyft Results Presentation Deck

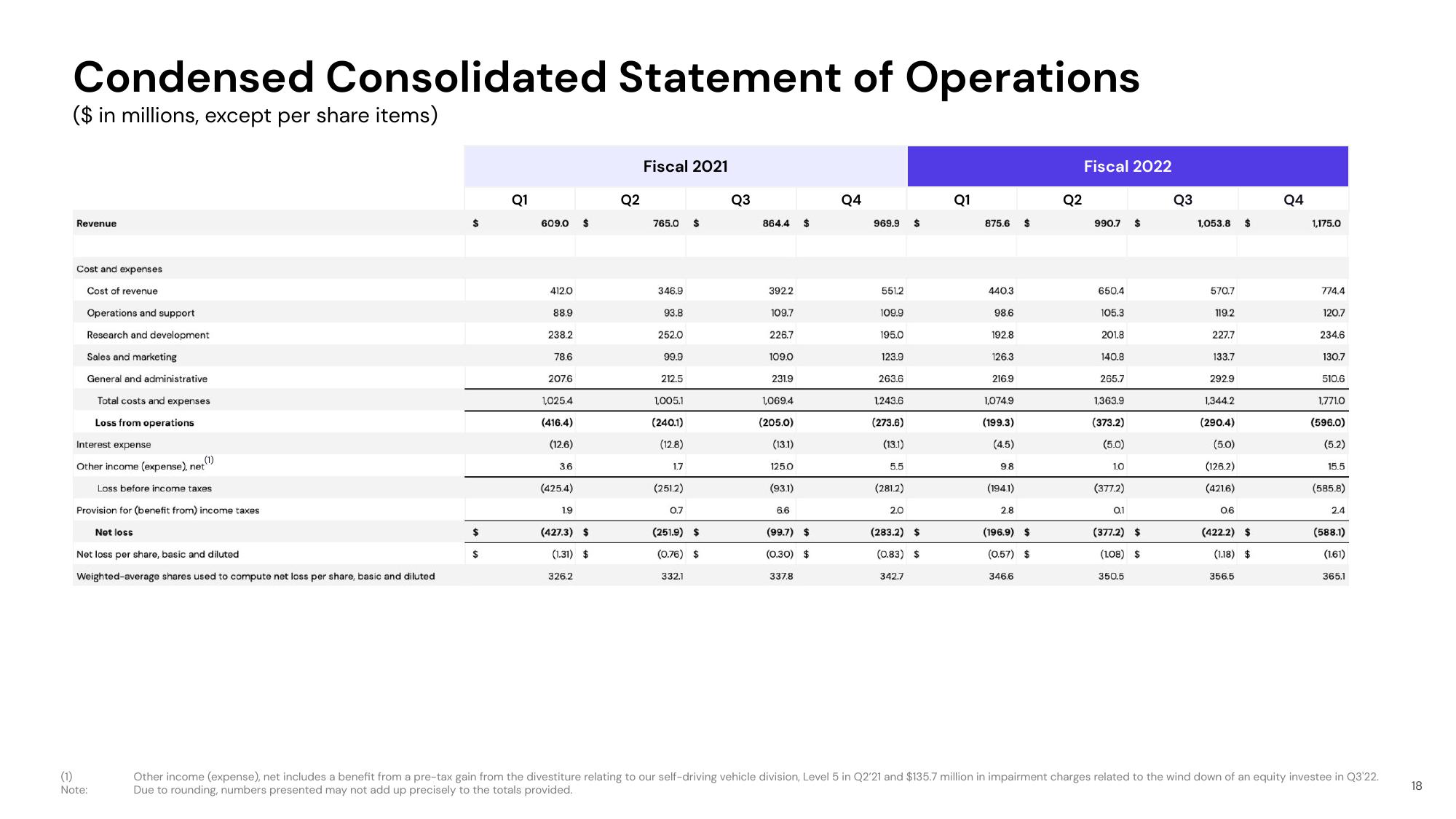

Condensed Consolidated Statement of Operations

($ in millions, except per share items)

Revenue

Cost and expenses

Cost of revenue

Operations and support

Research and development

Sales and marketing

General and administrative

Total costs and expenses

Loss from operations

Interest expense

(1)

Other income (expense), net

Loss before income taxes

Provision for (benefit from) income taxes

Net loss

Net loss per share, basic and diluted

Weighted-average shares used to compute net loss per share, basic and diluted

(1)

Note:

$

$

Q1

609.0

412.0

88.9

238.2

78.6

207.6

1,025.4

(416.4)

(12.6)

3.6

(425.4)

1.9

(427.3) $

(1.31) $

326.2

Q2

Fiscal 2021

765.0 $

346.9

93.8

252.0

99.9

212.5

1,005.1

(240.1)

(12.8)

1.7

(251.2)

0.7

(251.9) $

(0.76) $

332.1

Q3

864.4 $

392.2

109.7

226.7

109.0

231.9

1,069.4

(205.0)

(13.1)

125.0

(93.1)

6.6

(99.7) $

(0.30) $

337.8

Q4

969.9 $

551.2

109.9

195.0

123.9

263.6

1,243.6

(273.6)

(13.1)

5.5

(281.2)

2.0

(283.2) $

(0.83) $

342.7

Q1

875.6

440.3

98.6

192.8

126.3

216.9

1,074.9

(199.3)

(4.5)

9.8

(194.1)

2.8

$

(196.9) $

(0.57) $

346.6

Q2

Fiscal 2022

990.7 $

650.4

105.3

201.8

140.8

265.7

1,363.9

(373.2)

(5.0)

1.0

(377.2)

0.1

(377.2) $

(1.08) $

350.5

Q3

1,053.8

570.7

119.2

227.7

133.7

292.9

1,344.2

(290.4)

(5.0)

(126.2)

(421.6)

0.6

$

(422.2) $

(1.18) $

356.5

Q4

1,175.0

774.4

120.7

234.6

130.7

510.6

1,771.0

(596.0)

(5.2)

15.5

(585.8)

2.4

(588.1)

(1.61)

365.1

Other income (expense), net includes a benefit from a pre-tax gain from the divestiture relating to our self-driving vehicle division, Level 5 in Q2'21 and $135.7 million in impairment charges related to the wind down of an equity investee in Q3'22.

Due to rounding, numbers presented may not add up precisely to the totals provided.

18View entire presentation