FlexJet SPAC Presentation Deck

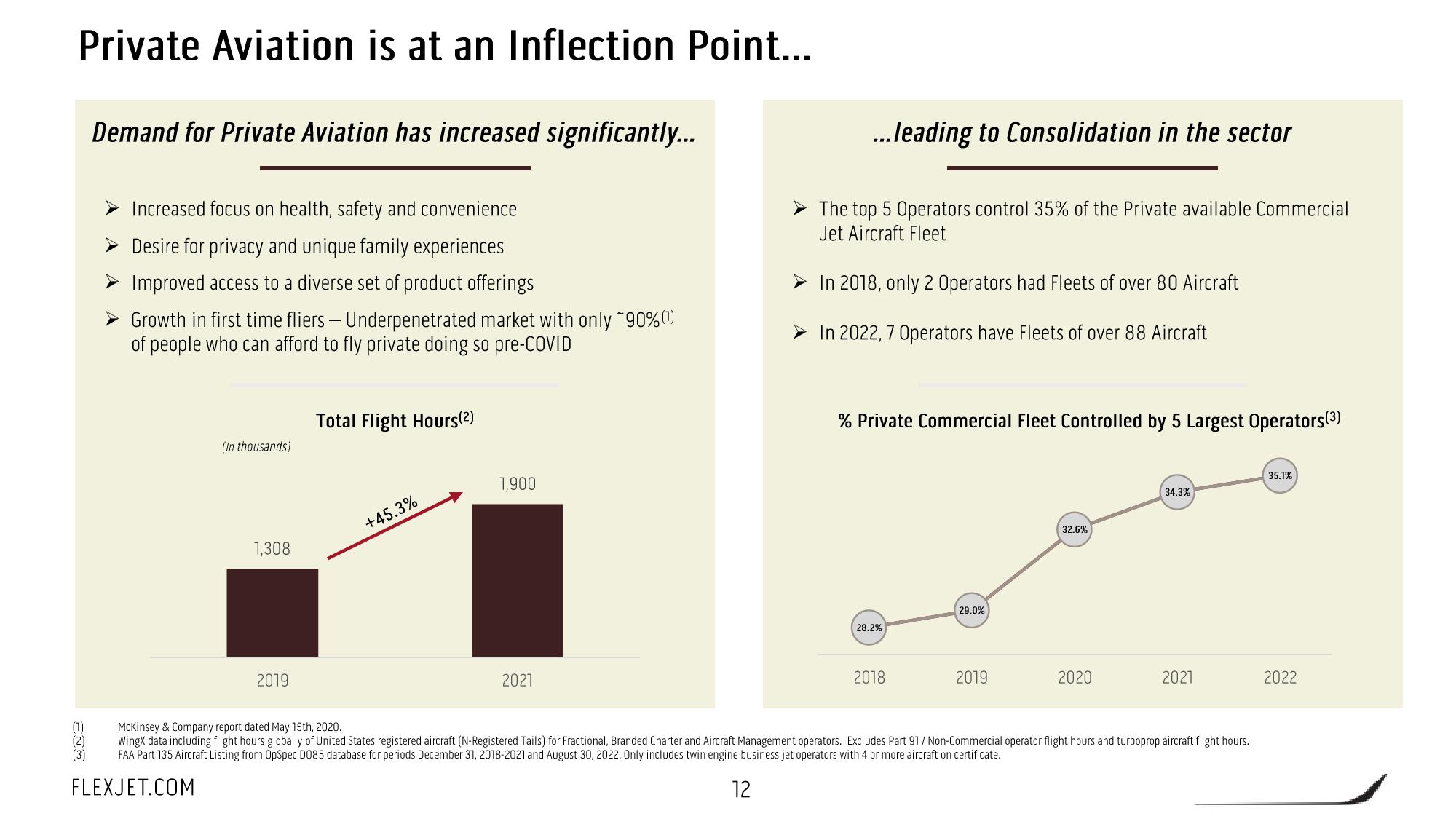

Private Aviation is at an Inflection Point...

Demand for Private Aviation has increased significantly...

(1)

(2)

(3)

Increased focus on health, safety and convenience

Desire for privacy and unique family experiences

Improved access to a diverse set of product offerings

Growth in first time fliers - Underpenetrated market with only ~90% (¹)

of people who can afford to fly private doing so pre-COVID

(In thousands)

1,308

2019

Total Flight Hours(2)

+45.3%

1,900

2021

...leading to Consolidation in the sector

The top 5 Operators control 35% of the Private available Commercial

Jet Aircraft Fleet

In 2018, only 2 Operators had Fleets of over 80 Aircraft

In 2022, 7 Operators have Fleets of over 88 Aircraft

% Private Commercial Fleet Controlled by 5 Largest Operators(³)

28.2%

2018

29.0%

2019

32.6%

2020

34.3%

2021

McKinsey & Company report dated May 15th, 2020.

Wingx data including flight hours globally of United States registered aircraft (N-Registered Tails) for Fractional, Branded Charter and Aircraft Management operators. Excludes Part 91/ Non-Commercial operator flight hours and turboprop aircraft flight hours.

FAA Part 135 Aircraft Listing from OpSpec D085 database for periods December 31, 2018-2021 and August 30, 2022. Only includes twin engine business jet operators with 4 or more aircraft on certificate.

FLEXJET.COM

12

35.1%

2022View entire presentation