Investor Presentation

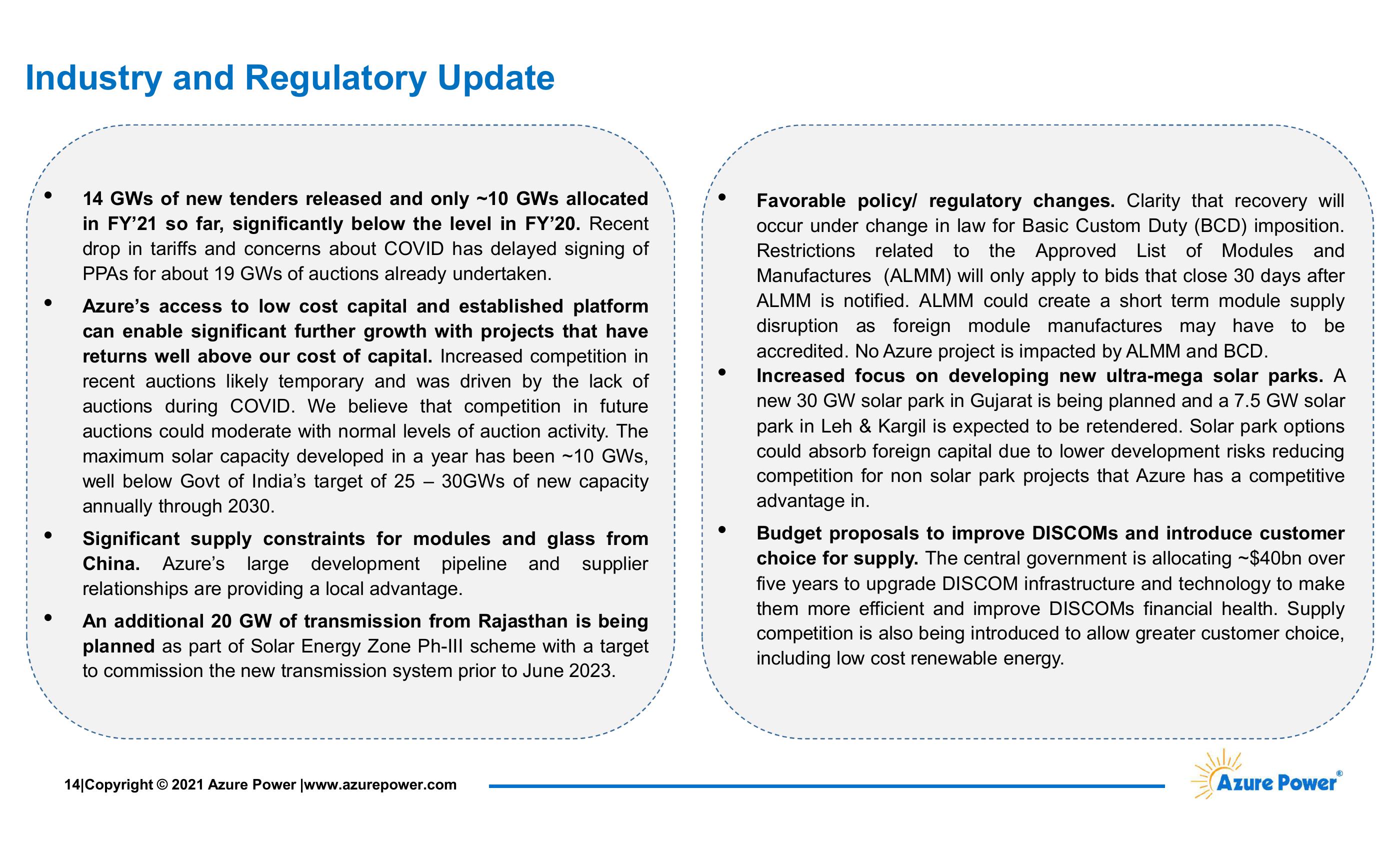

Industry and Regulatory Update

14 GWs of new tenders released and only ~10 GWs allocated

in FY'21 so far, significantly below the level in FY’20. Recent

drop in tariffs and concerns about COVID has delayed signing of

PPAs for about 19 GWs of auctions already undertaken.

Azure's access to low cost capital and established platform

can enable significant further growth with projects that have

returns well above our cost of capital. Increased competition in

recent auctions likely temporary and was driven by the lack of

auctions during COVID. We believe that competition in future

auctions could moderate with normal levels of auction activity. The

maximum solar capacity developed in a year has been ~10 GWs,

well below Govt of India's target of 25 30GWs of new capacity

annually through 2030.

-

Significant supply constraints for modules and glass from

China. Azure's large development pipeline and supplier

relationships are providing a local advantage.

An additional 20 GW of transmission from Rajasthan is being

planned as part of Solar Energy Zone Ph-III scheme with a target

to commission the new transmission system prior to June 2023.

Favorable policy/ regulatory changes. Clarity that recovery will

occur under change in law for Basic Custom Duty (BCD) imposition.

Restrictions related to the Approved List of Modules and

Manufactures (ALMM) will only apply to bids that close 30 days after

ALMM is notified. ALMM could create a short term module supply

disruption as foreign module manufactures may have to be

accredited. No Azure project is impacted by ALMM and BCD.

Increased focus on developing new ultra-mega solar parks. A

new 30 GW solar park in Gujarat is being planned and a 7.5 GW solar

park in Leh & Kargil is expected to be retendered. Solar park options

could absorb foreign capital due to lower development risks reducing

competition for non solar park projects that Azure has a competitive

advantage in.

Budget proposals to improve DISCOMs and introduce customer

choice for supply. The central government is allocating $40bn over

five years to upgrade DISCOM infrastructure and technology to make

them more efficient and improve DISCOMS financial health. Supply

competition is also being introduced to allow greater customer choice,

including low cost renewable energy.

14|Copyright © 2021 Azure Power |www.azurepower.com

Azure Power®ⓇView entire presentation