Pathward Financial Results Presentation Deck

TAX SEASON UPDATE 2021

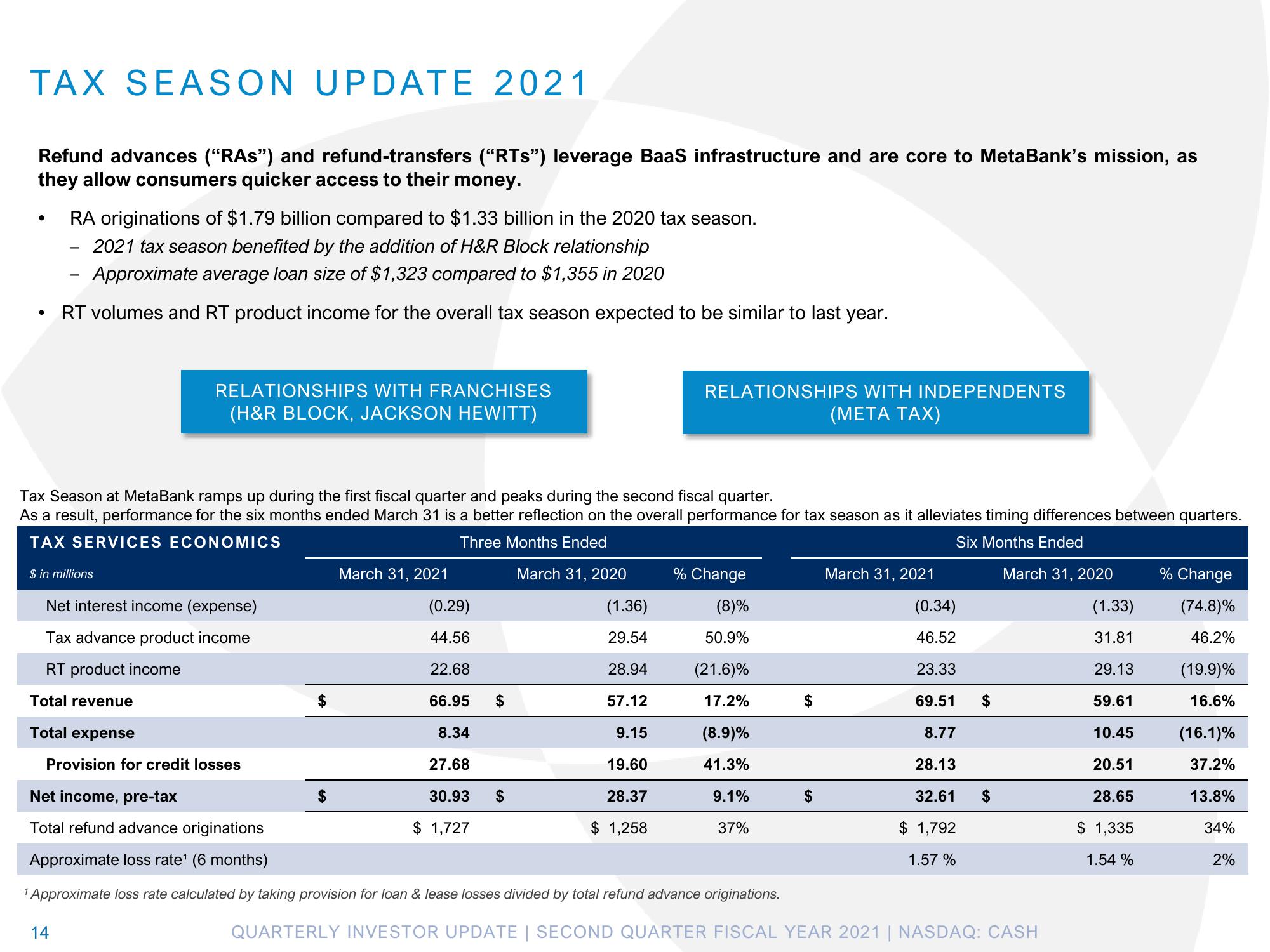

Refund advances ("RAs") and refund-transfers ("RTs") leverage BaaS infrastructure and are core to MetaBank's mission, as

they allow consumers quicker access to their money.

●

RA originations of $1.79 billion compared to $1.33 billion in the 2020 tax season.

2021 tax season benefited by the addition of H&R Block relationship

Approximate average loan size of $1,323 compared to $1,355 in 2020

RT volumes and RT product income for the overall tax season expected to be similar to last year.

$ in millions

Tax Season at MetaBank ramps up during the first fiscal quarter and peaks during the second fiscal quarter.

As a result, performance for the six months ended March 31 is a better reflection on the overall performance for tax season as it alleviates timing differences between quarters.

TAX SERVICES ECONOMICS

Three Months Ended

Six Months Ended

March 31, 2020

RELATIONSHIPS WITH FRANCHISES

(H&R BLOCK, JACKSON HEWITT)

Net interest income (expense)

Tax advance product income

RT product income

Total revenue

Total expense

14

$

March 31, 2021

$

(0.29)

44.56

22.68

66.95

8.34

27.68

30.93

$ 1,727

RELATIONSHIPS WITH INDEPENDENTS

(META TAX)

(1.36)

29.54

28.94

57.12

9.15

19.60

28.37

$ 1,258

$

% Change

(8)%

50.9%

Provision for credit losses

Net income, pre-tax

Total refund advance originations

Approximate loss rate¹ (6 months)

1 Approximate loss rate calculated by taking provision for loan & lease losses divided by total refund advance originations.

(21.6)%

17.2%

(8.9)%

41.3%

9.1%

37%

$

$

March 31, 2021

(0.34)

46.52

23.33

69.51

8.77

28.13

32.61

$ 1,792

1.57 %

$

$

March 31, 2020

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH

(1.33)

31.81

29.13

59.61

10.45

20.51

28.65

$ 1,335

1.54 %

% Change

(74.8)%

46.2%

(19.9)%

16.6%

(16.1)%

37.2%

13.8%

34%

2%View entire presentation