Ready Capital Investor Presentation Deck

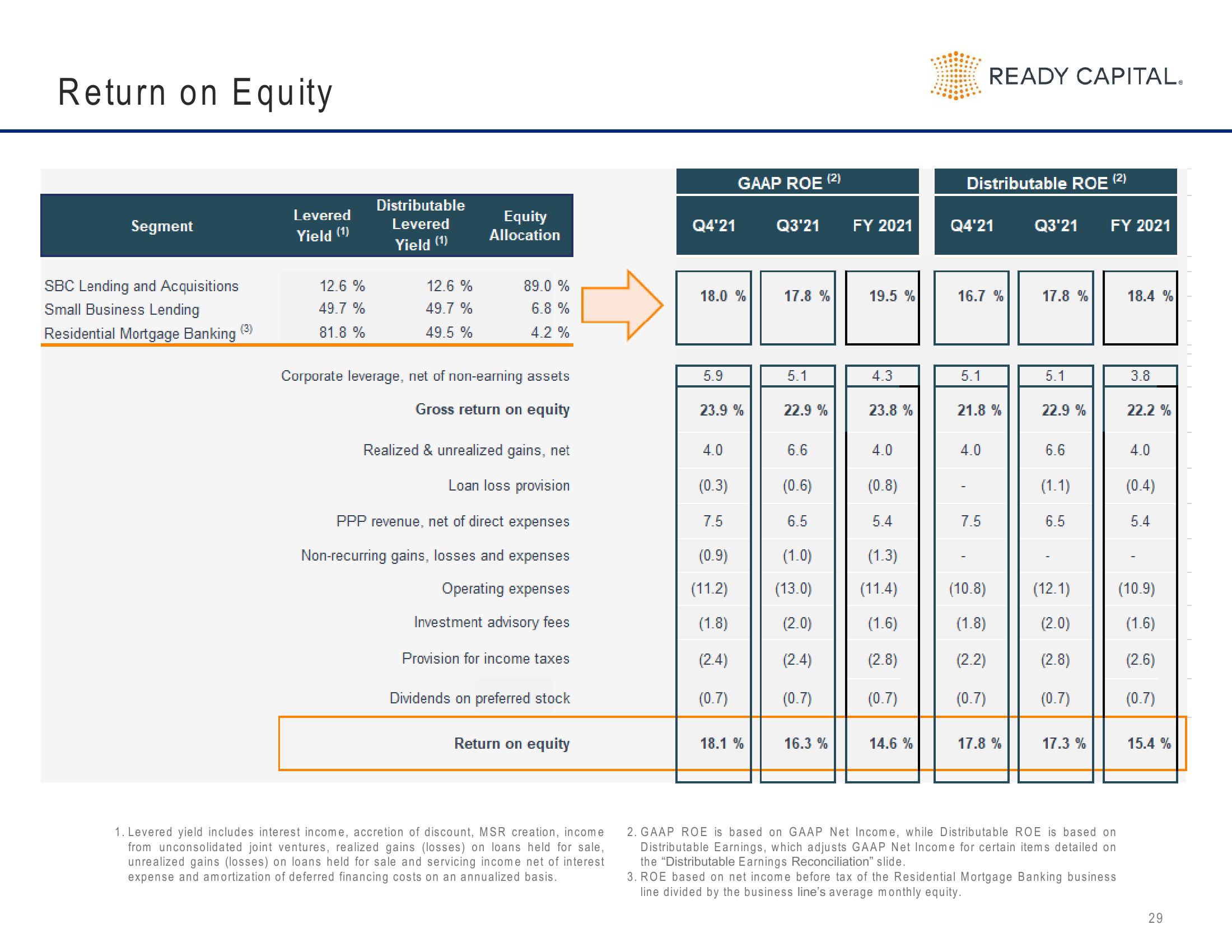

Return on Equity

Segment

SBC Lending and Acquisitions

Small Business Lending

Residential Mortgage Banking (3)

Levered

Yield (1)

12.6 %

49.7 %

81.8 %

Distributable

Levered

Yield (1)

12.6 %

49.7 %

49.5 %

Equity

Allocation

89.0 %

6.8 %

4.2 %

Corporate leverage, net of non-earning assets

Gross return on equity

Realized & unrealized gains, net

Loan loss provision

PPP revenue, net of direct expenses

Non-recurring gains, losses and expenses

Operating expenses

Investment advisory fees

Provision for income taxes

Dividends on preferred stock

Return on equity

1. Levered yield includes interest income, accretion of discount, MSR creation, income

from unconsolidated joint ventures, realized gains (losses) on loans held for sale,

unrealized gains (losses) on loans held for sale and servicing income net of interest

expense and amortization of deferred financing costs on an annualized basis.

Q4'21

18.0 %

5.9

GAAP ROE

23.9 %

4.0

(0.3)

7.5

(0.9)

(11.2)

(1.8)

(2.4)

(0.7)

18.1 %

Q3'21

17.8 %

5.1

(2)

22.9 %

6.6

(0.6)

6.5

(1.0)

(13.0)

(2.0)

(2.4)

(0.7)

16.3 %

FY 2021

19.5 %

4.3

23.8 %

4.0

(0.8)

5.4

(1.3)

(11.4)

(1.6)

(2.8)

(0.7)

14.6 %

Distributable ROE (2)

Q4'21

16.7 %

5.1

READY CAPITAL.

21.8 %

4.0

7.5

(10.8)

(1.8)

(2.2)

(0.7)

17.8 %

Q3'21

17.8 %

5.1

22.9 %

6.6

(1.1)

6.5

(12.1)

(2.0)

(2.8)

(0.7)

17.3 %

FY 2021

18.4 %

2. GAAP ROE is based on GAAP Net Income, while Distributable ROE is based on

Distributable Earnings, which adjusts GAAP Net Income for certain items detailed on

the "Distributable Earnings Reconciliation" slide.

3. ROE based on net income before tax of the Residential Mortgage Banking business

line divided by the business line's average monthly equity.

3.8

22.2 %

4.0

(0.4)

5.4

(10.9)

(1.6)

(2.6)

(0.7)

15.4 %

29View entire presentation